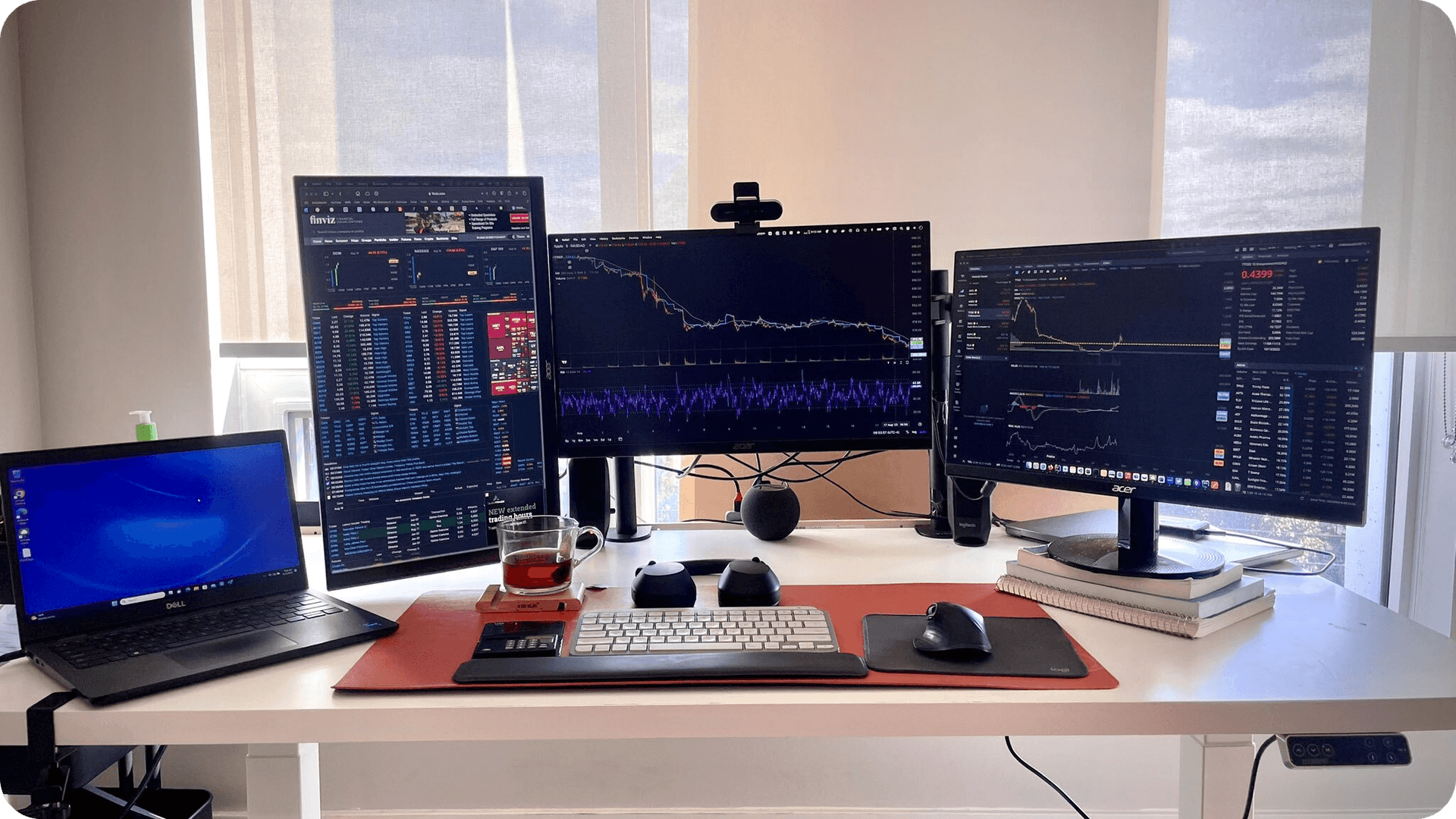

Ardi graduated from the University of British Columbia (Canada) with a concentration in accounting and finance. He is a best-seller author and accomplished trader who serves as the CEO of Trading Terminal. Ardi's accomplishments showcase a combination of academic excellence, trading prowess, and entrepreneurial leadership, making him a prominent figure in the financial world.

Argentina now has a new president: Javier Milei has won Argentina’s presidential election with some ease. Javier is a right-leaning candidate who believes government bureaucracy should be eliminated and...

Discover why bonds are catching attention as signs point to a slowing economy. Read insights on initial jobless claims, oil price signals, and the stability of long-term bond yields. Read more here.

This week, we delve into the crucial role of interest rates in shaping market dynamics. Explore the impact of cooling inflation on rates and how it influences equities and risk assets.

Discover the hidden signals in the Senior Lending Officers Opinion Survey (SLOOS) as Ardi breaks down the crucial insights that this often-overlooked survey provides and proposes a strategic trade for the coming months.

Discover the best trading psychology books for 2024, covering emotions, discipline, and self-awareness to improve trading skills and decision-making. Suitable for traders of all levels, these books provide valuable insights to master the mental game of trading.

Explore the factors behind the recent bond market turmoil and discover the key indicators signaling a potential recession. Dive into the Sahm Rule, a reliable tool to understand economic slowdowns. Learn when bonds might be your go-to asset in uncertain times.

Explore the best books for day trading, covering crucial topics like risk management, technical analysis, trading psychology, and strategies. Unlock the insights of successful traders and equip yourself with the knowledge to thrive in the world of day trading.

Explore the latest insights into the market's puzzling performance as we dive into an earnings season that has left many unimpressed.

Financials are a very important part of every earnings season. They often showcase the strength of the consumer, loan generation, and overall activity in the economy. The problem however is that the banks in the past 6 months have been uninvestable and I am here to explain why.

The market often takes the road that leads to the greatest pain. It looks to cause the most amount of pain for investors. The reason for it is simple, when everyone is short, a few percentage points on the long side, force the hand of the shorts and lead to a short squeeze.

The stocks continue to be weak. While some reason for this is seasonality, another reason that could be a catalyst is the fact that rates have gone up by a lot over the past month and a half.

All eyes are on the small caps. They are barely hanging on to their 2019 support and the question on everyone's mind is whether or not can they hang on and bounce higher.

When it comes to day trading communities, BearBull Traders, Warrior Trading, and Investors Underground stand out as leading platforms, each with its own unique strengths.

3 reasons on why fed focuses on 2% inflation, and why they won’t stop until price stability is achieved.

Why you should aim to earn at least 10.5% to consider it a good year.