Are you a Failure as a Trader? How Can You Tell?

Why You Should Aim to Earn at Least 10.5% in 2023 to Consider it a Good Year

Being a CEO of a fintech company, as well as being part of one of the largest retail trading communities in the world; Number one question I hear from retail traders are something in these lines:

"Can I make X amount of money trading every week?"

Or

"I made X amount this year, is this good?"

How can you answer questions like these? What is considered good, and what is considered bad? What is an acceptable return? Should you compare your result to the bond market? to the S&P 500? to Nasdaq 100? to your neighbor?

In everything we do in life, we are looking for benchmarks and hurdle rates to define if we are successful or not. When it comes to investing and trading, benchmarking is very important. There are actual chapters in finance textbooks on how to create benchmarks. If you are a professional fund manager, your job might depend on it.

If you are a retail trader, you are exchanging your time and attention, to actively trade as opposed to a passive Index portfolio or leaving your money in the checking account. Therefore, you must get compensated for that extra time and energy.

In this article I will try to give you a clear guide on how to set a benchmark for yourself. True hurdle rate, must have two characteristics:

- It should change every year depending on the market conditions

- It should be independent of your account size

First, let’s define what a benchmark or hurdle rate is.

What is a Hurdle Rate?

Hurdle rate is what you are comparing your result to. If you are a large cap fund manager, then your benchmark is mostly S&P 500 and hence your hurdle rate would be whatever return S&P 500 gets. If you are a fund manager that focuses on technology in the U.S, then probably your benchmark is Nasdaq 100. Each fund manager has a mandate which they must follow.

Think of mandate as a set of rules on what a manager can, and cannot do. If you are an American based innovation fund, then you probably cannot buy Chinese consumer staple stocks. Your mandate simply does not allow you to do this.

The good thing about managing your own money is that your mandate is to yourself. You don't have to respond to anyone else except for yourself and maybe your spouse. But that does not mean that you don't need benchmark and hurdle rate. You still need something to compare your result to.

How to Find the Right Benchmark

What is the optimal amount of return, you should get to compensate for the time and energy you are putting to actively trade and follow the market.

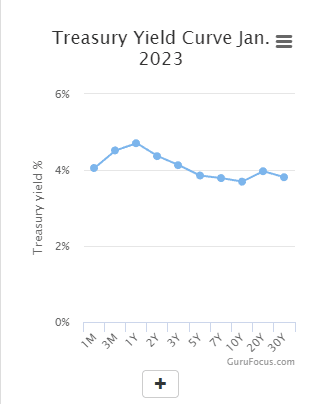

To answer this question, we must first start with risk free rate. This rate would give you a return which is “risk free” backed by the U.S. government and the faith in their taxpayers. Currently, the 1- year U.S. note is 4.7%. This means that if you invest in a one-year note, you can achieve 4.7% return risk free.

Yield curve as of January 3, 2023

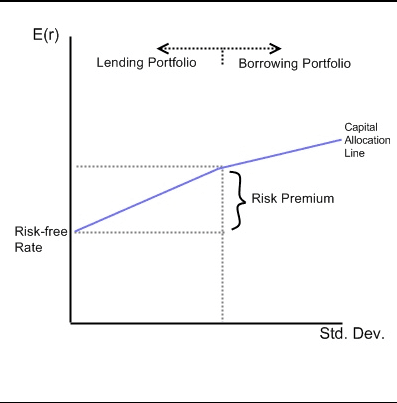

But is that a good benchmark? No, because you are willing to take a risk. The additional risk you are willing to take is called the “risk premium.” This is the minimum amount of return you must capture for the additional unit of risk you are taking in the equity market.

The capital market theory discusses this in huge detail but for now, the chart below should give you a good idea on the return and risk trade off.

Capital Allocation Line: Additional return for taking additional risk (standard deviation)

What is a good proxy for risk premium?

Based on various corporate finance theories, I believe BBB bonds are a good proxy for risk premiums. Triple B bonds are the lowest investment grade bonds that act as mezzanine between equity like bonds (junk and risky) and investment grade bonds, hence a good proxy for risk premium.

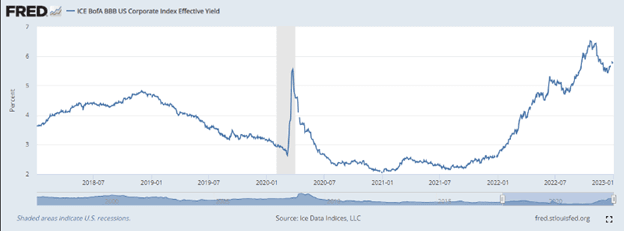

Currently BBB yield to maturity is 5.77%. That means for an investment grade bond, you are getting paid 5.8%.

BBB US Corporate Yield

Now to benchmarking and hurdle rates:

Corporate finance theory states that equity is riskier than both the risk-free rate and bonds. The reason for risk free is obvious, there is no default risk. And why is equity riskier than bonds? because bond holders have access to company's assets in times of default, but equity holders don't.

2023 Hurdle Rate: 10.5%

So, if you are trading this year, you should aim for at least 10.5% return. That is 5.8% BBB bond yield + 4.7% one-year risk free rate. Anything above that means you have outperformed and anything below that means, maybe you should reconsider trading, and use your time for something better like spending time with your family or learning a new skill.

It is also important to look at your returns and see where your returns are coming from. Is it coming from leverage? Is it coming from tilting towards different sectors, is it from sitting on cash and timing the market etc etc. This is a complex topic, and could be another article, but I hope everyone is taking the time to go over their returns and set clear benchmarks for 2023.

Happy new year and to a green 2023!

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.