Yields Are Driving the Market

Hello traders,

Often we want to know what moves the market. Is it the flows, is it earnings, or future expectations of the economy?

I have shared before that in the long term, over 80% of movement in the stock prices can be explained by two main variables: rates, and earnings.

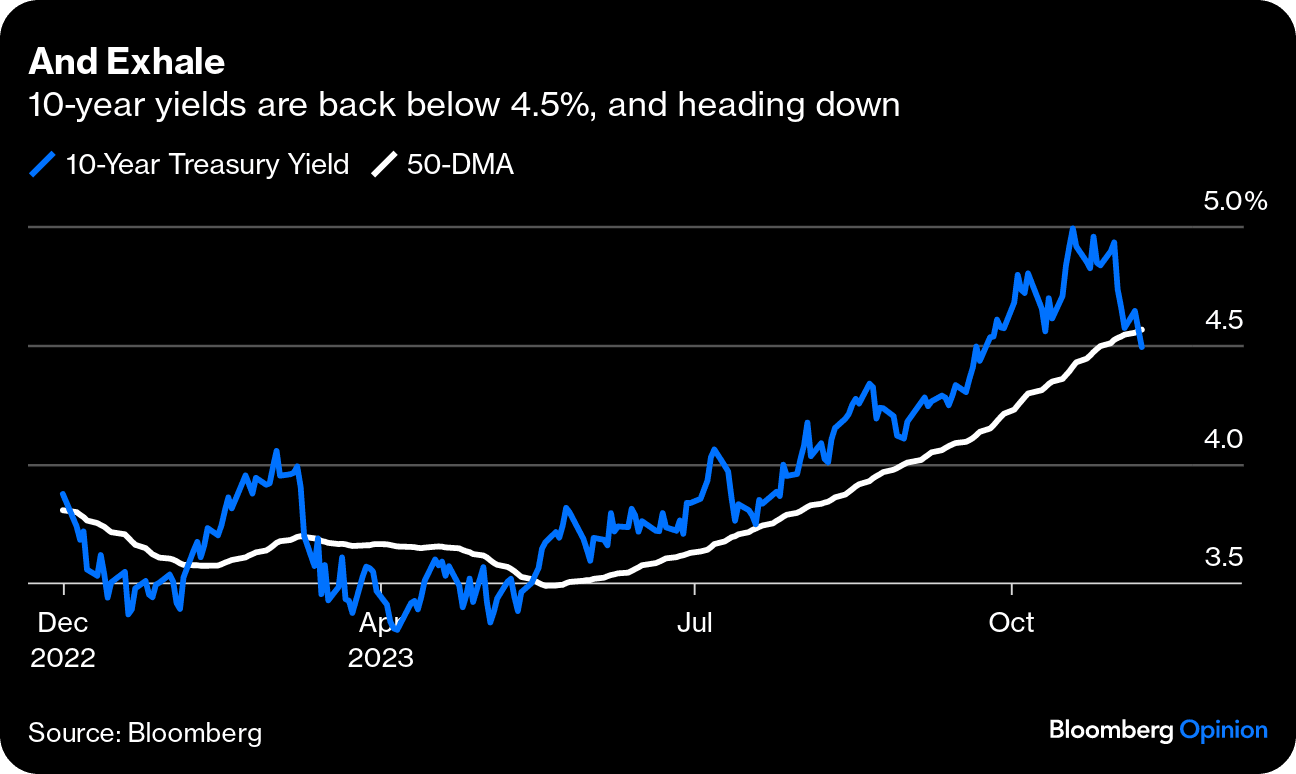

This week, it is all about rates. As inflation is cooling down, the rates are also dropping signaling the real rates might be getting too restrictive. This shows itself in the 10-year yields right now trading below 4.45% in a while! When rates fall, this acts as a tailwind for equities and the majority of the risk assets.

As I have said before, I believe three weeks ago the best trade in the market was betting on the 2-year notes which at the time were yielding over 5.25% using options on the interest rates via the products that CME offers.

Those option contracts are up over 20% so far. Carry trade is also another setup of opportunities especially for traders who are looking to trade the currency markets.

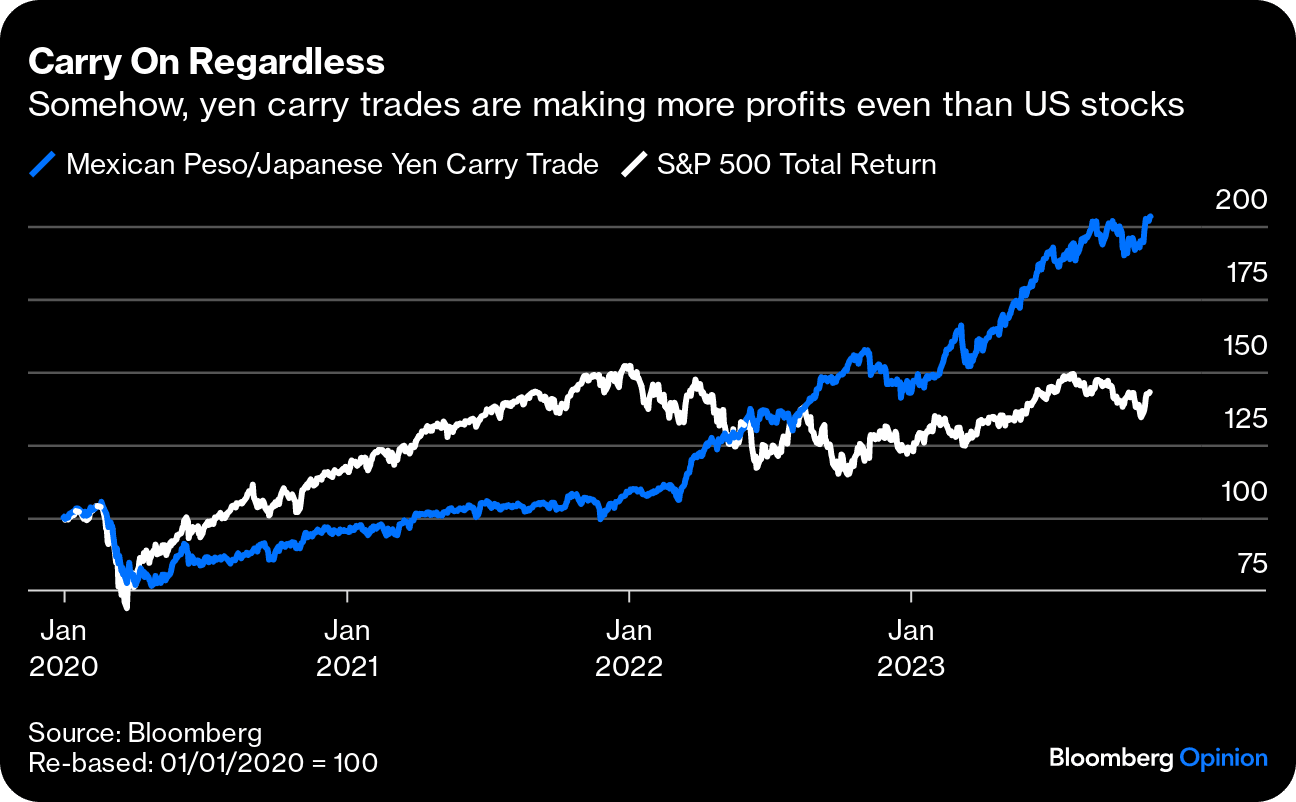

The setup is simple, go long the currency of the country with higher rates, and borrow in the currency of the country that charges less interest.

You can take advantage of this interest rate differential in a setup called “Carry Trade.” This is a really powerful setup that every trader should add to their trading arsenal.

Just look at the performance of long Mexican peso and short Japanese Yen! You may have beat the S&P 500 by a wide margin!

With rates coming down, however, the USD/CAD carry trade that I was doing is coming to an end and I took that position off my books.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.