Hello traders,

I am writing this on Thursday evening, preparing for bank earnings. Financials are a very important part of every earnings season. They often showcase the strength of the consumer, loan generation, and overall activity in the economy. The problem however is that the banks in the past 6 months have been uninvestable and I am here to explain why.

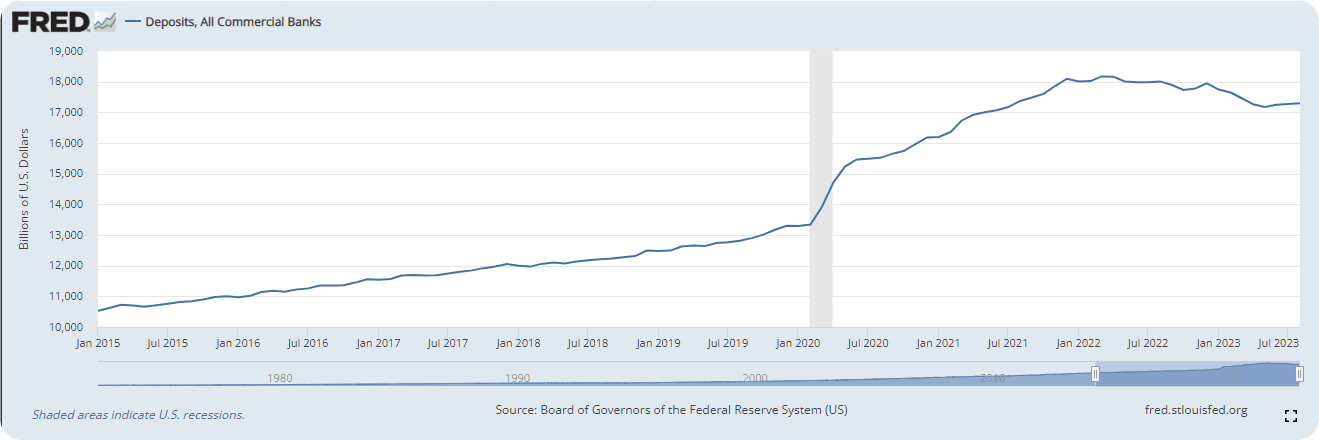

Massive Influx of Deposits in 2020

Over the 2020 pandemic, the system injected tons of cash through PPP loan checks, inflation support, and federal aid. All of this money found itself in the banking system as shown in the chart below. They were deposited into customers' accounts in the banking system.

Deposits Are the Bank’s Liabilities and They Need to Be Matched with Assets

What's important is that the customer deposits are bank liabilities, so in order to match that with assets, they were forced to buy treasuries (assets) or generate new loans. Since we were in the middle of the pandemic and there were not a lot of opportunities to generate new loans, the banks were forced to buy treasuries at 1-2% coupon rates.

Treasuries were offering such low yields that now, with the rise of yields, most banks' portfolios are now down 50~60% on those loans. Granted these are unrealized losses, but they still find themselves inside the income statement.

They now need to sell these securities at a loss, because customers are withdrawing their deposits and moving them to money markets! This vicious cycle has made banks uninvestable for the past 6 months.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.