Why Small Caps Are Not Investable

Hello traders,

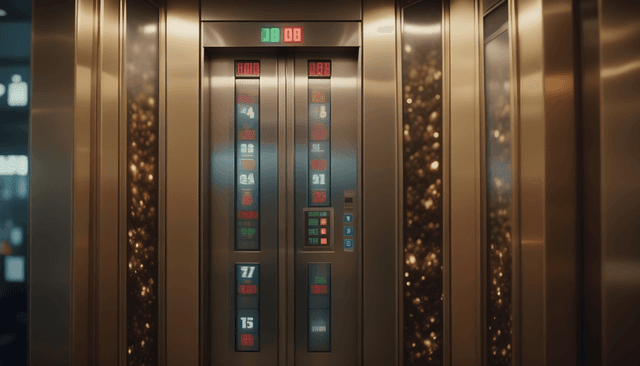

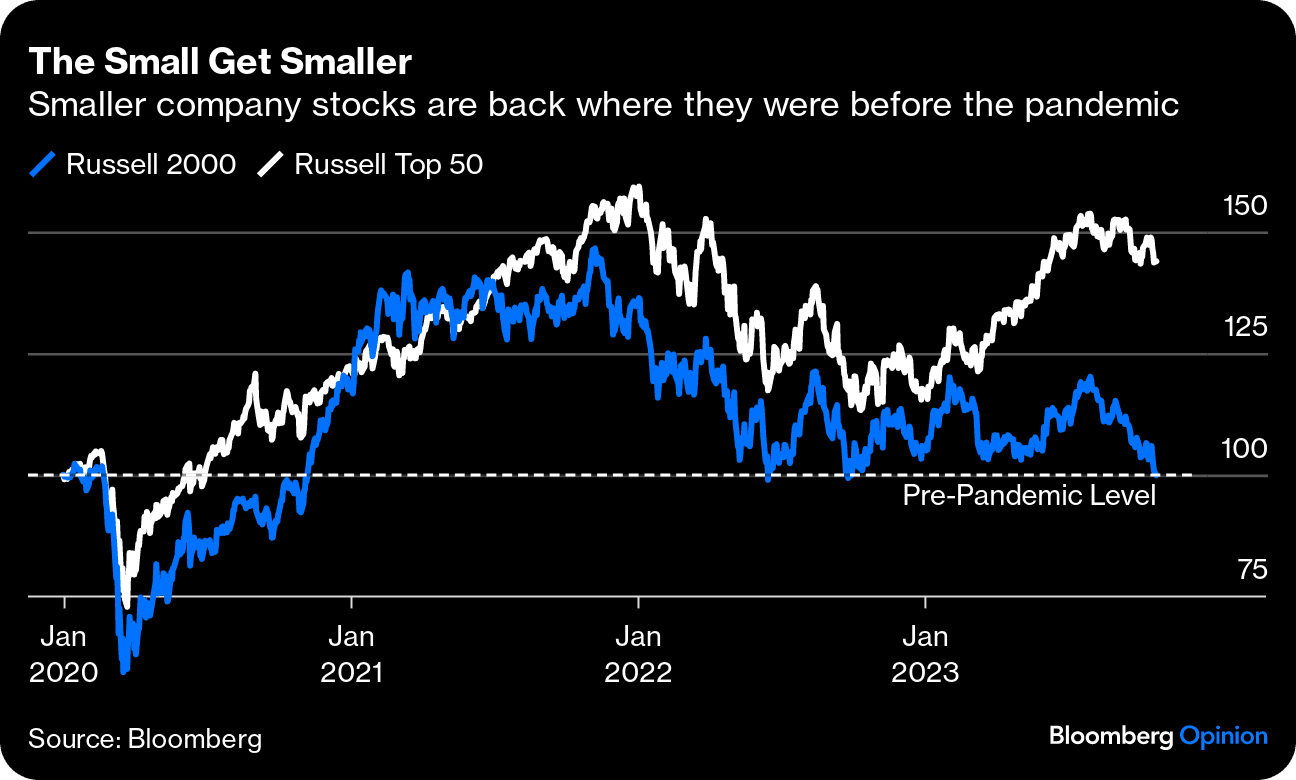

All eyes are on the small caps. They are barely hanging on to their 2019 support and the question on everyone's mind is whether or not can they hang on and bounce higher. While I leave discussing that with the technical traders, I want to spend some time discussing why small caps have underperformed so much over the last few years.

1. Size Matters

The underperformance is coming mostly from the bottom half of the companies. These are companies that lack earnings and have a heavy burden of debt that has led their investors to dump them for better opportunities in the market.

The chart above shows the Russell top 50, companies with lower debt, have done better as compared to Russell 2000. Also, it is important to know when companies have to refinance which leads us to reason number 2.

2. Bad terms for smaller guys

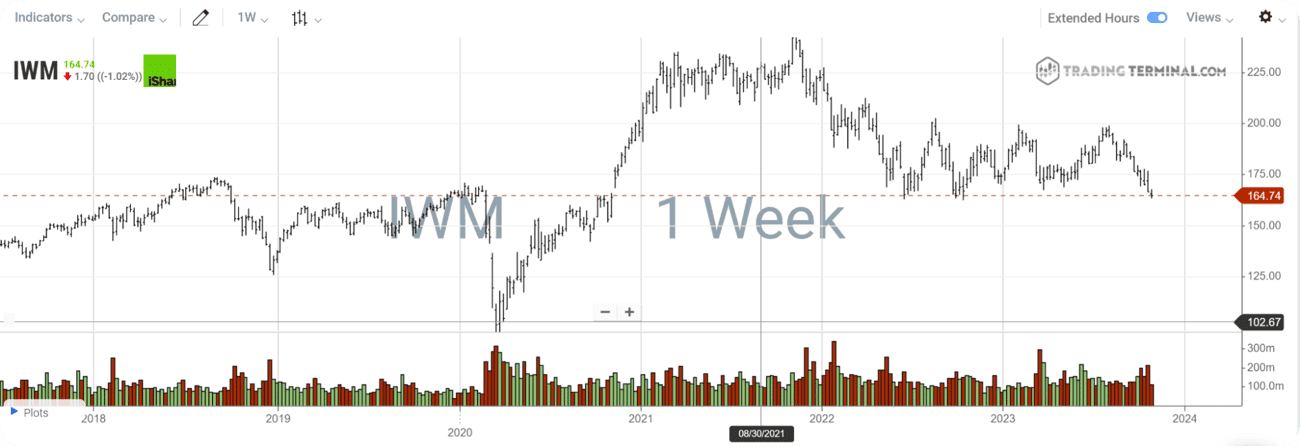

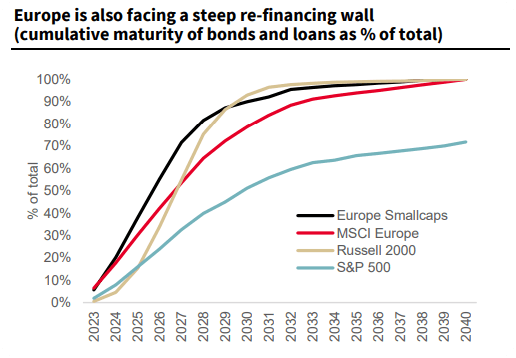

Big companies like Apple and Amazon often have a much easier time refinancing their debt and get debts that are maturing in 20 or 30 years. After all, it is much easier to imagine a world where Apple is still around 30 years from now, than a world where AMC is around. This has led bigger companies to take 20 to 30 years loans in 2021, when rates were really low, and leave smaller companies with floating loans and loans with shorter maturity. The chart below shows that 50% of small-cap companies have to refinance over the next three years, while the number is only 30% for the S&P 500!

This means many companies will go bankrupt if the rates are not lower over the next few years.

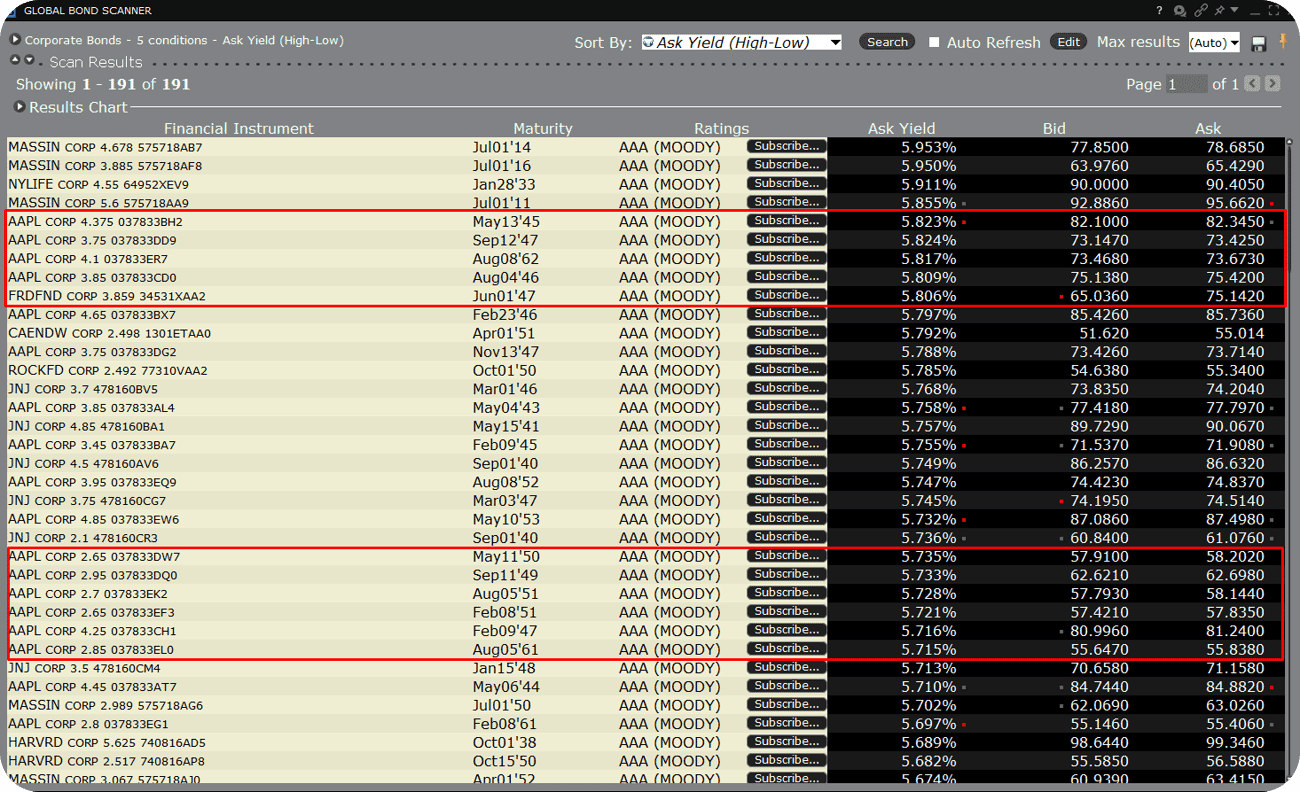

The chart below is from Interactive Brokers, a well-known broker providing tools to discover a wide selection of bonds for retail traders to buy and trade. I have been trading bonds since 2020 in my previous job and trading credit via IB is as easy as using Bloomberg Terminal.

It shows how the average cost of debt for Apple is just 3%, while they are collecting over 5% on their idle cash! The maturity of their debt goes as far as 2061! That is almost 40 years from now!

If you're considering opening an account with IBKR in the United States, please use this link.

For those in Canada, the link for account opening is this.

3. Money is Becoming Scarce

Lastly, the reason for this underperformance is banks do not lend to smaller companies with tighter financial conditions. The chart below shows loan officers are much more cautious about lending to smaller companies.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.