2025 Outlook: Historical Cycles and the Case for a Sustained Bull Market

The stock market is often likened to a pendulum—swinging between optimism and fear, bull markets and bear markets, expansion and contraction. But there has been one constant in the tides of history: resilience. As I've explained in my prior pieces about the market comebacks in 2023 and 2024, history somehow shows a way to paint in patterns that helps us anticipate what lies ahead. With this foundation, I still remain confident that 2025 will continue the bullish momentum we’ve witnessed over the past two years.

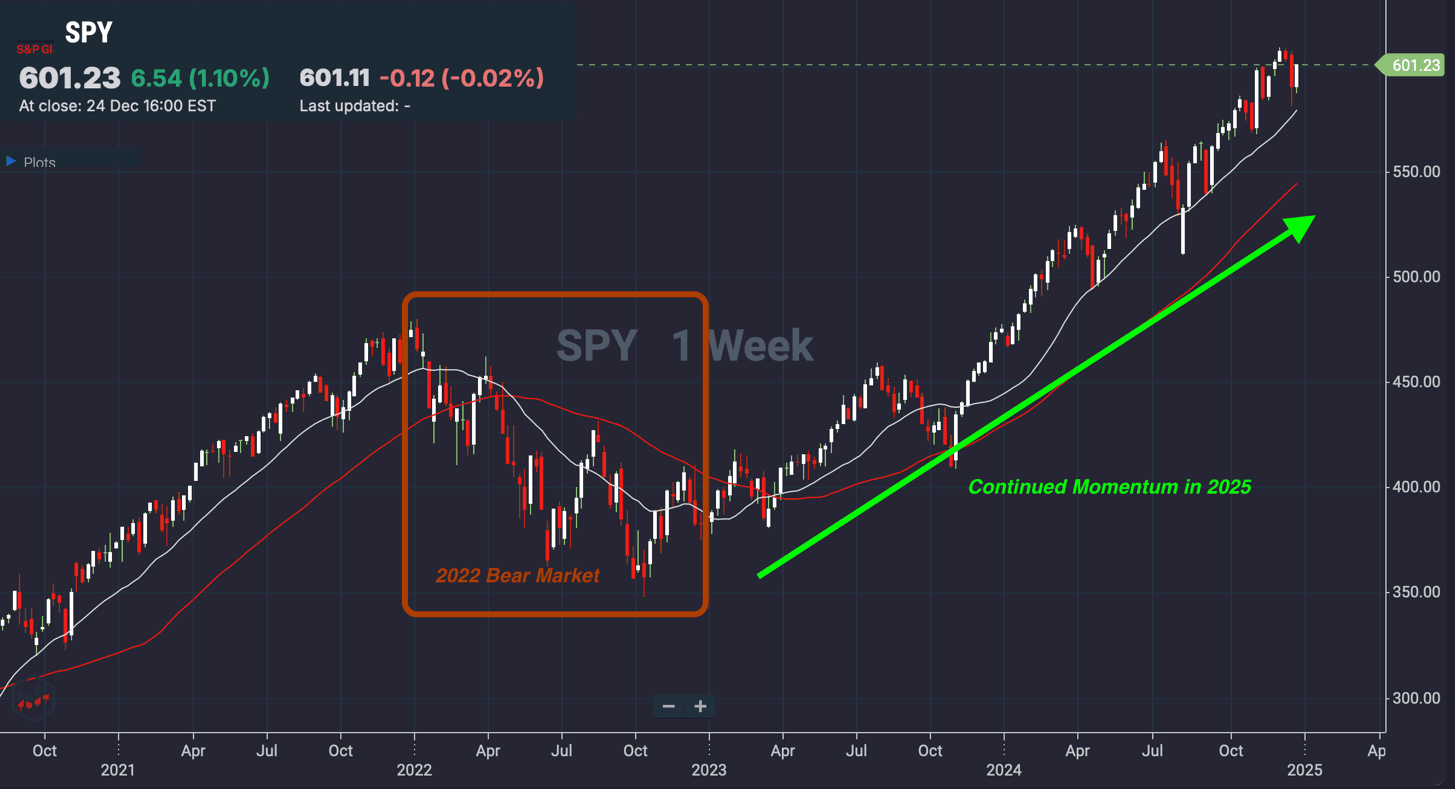

Coming off the turbulence of 2022, which was characterized by inflation, aggressive rate hikes, and geopolitical uncertainty, 2023's rebound positioned 2024, which I said would be another strong year for stocks. The market's long-term trajectory, coupled with historical understanding of post-bear market recoveries, suggested just that. Now, with 2025 in sight, history remains my guide with current catalysts that shape the favorable outlook.

The Power of Historical Cycles

The best lessons from history are the realization that markets go in cycles. There is a growth and optimism, a phase of uncertainty – mostly consolidating, and a decline phase marked by downturns and corrections. While their exact timing cannot be forecast with precision, over long periods their patterns are amazingly consistent. At this moment, I believe we are in optimism phase, and history shows that optimism or inclining phase stays longer than declining phase. Let's examine three major patterns that indicate 2025 will continue its optimism phase and what will shape up to be: the post-bear market rebound, the dynamics of post-inflation bull markets, and the inter relations between election cycles and market performance. Understanding these can provide valuable insights for the year ahead.

The Post-Bear Rule

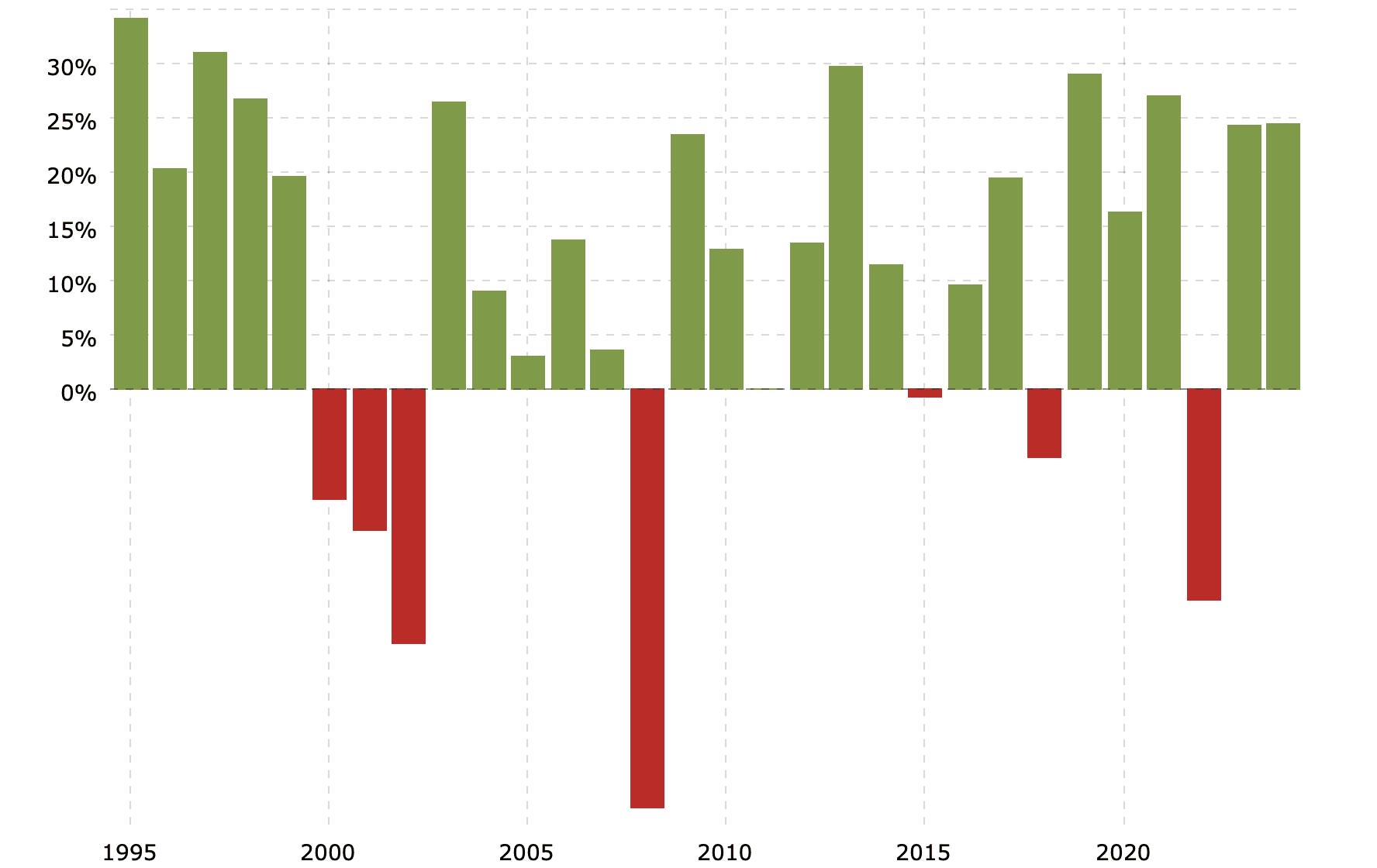

Historically, after a major bear market, the subsequent three years are usually good for equities. This has been repeated over and over again for decades: since the Great Depression, to the bursting of the dot-com bubble, to the 2008 financial crisis.

For example, as you will see from the charts above, following the 2008 financial crisis, the market bounced back sharply in 2009 and kept moving upward through 2011. In the same fashion, after the bursting of the tech bubble at the beginning of the 2000s, by 2003 the recovery began to pick up speed and extended until 2006. By applying this rule in the market at hand, 2022 was an inflation-obsessed, monetary tightening-oriented bear market year succeeded by the beginning of such recovery in 2023 due to easing inflation and resilient corporate earnings. As 2024 builds on that foundation, historical evidence has shown that the third year will return positive stock market performance, 2025 in this case, as the investor confidence strengthens.

Post-Inflation Bull Markets

Another historical trend in favor of a bullish outlook for 2025 involves how the market has performed during periods of high inflation. While painful in the near term, inflationary spikes have usually been followed by some pretty strong bull markets when that inflation starts to calm down. Take the 1980s, for example. Inflation reached double digits by the late 1970s, which was responded to aggressively by the Federal Reserve. By the early 1980s, when inflation had been tamed, the stock market began a multi-year bull run that extended into the late 1980s. In 1990, when the inflation was 6%, it came down to 3% the following year and continued to fall. The S&P 500 also recovered from -6.5% return from 1990 and generated positive returns for three years.

We've seen this very same thing happen today. The rate of inflation did peak in 2022, but fall in 2023 and continuing into 2024 - actually moderated via the operation of Federal Reserve interest rates. If it can hold there or go further on a downtrend, perhaps even as early as 2025, it will give the stock market the tailwind that occurred in past post-inflationary cycles.

Election Cycles and Market Performance

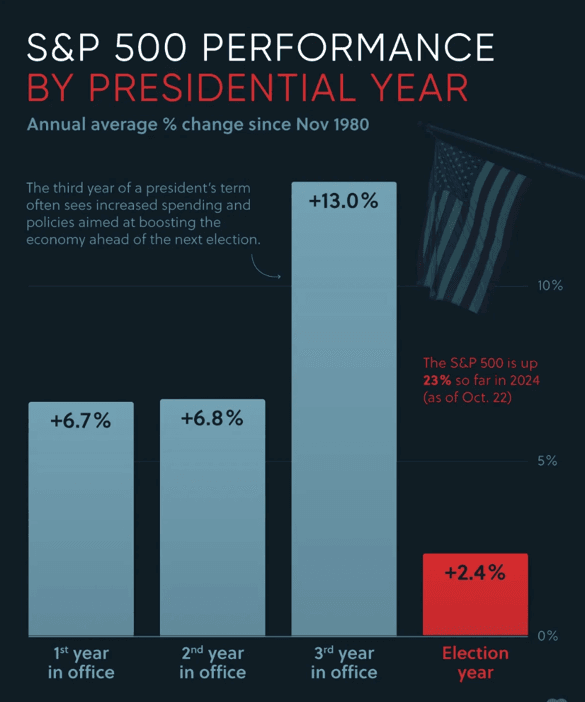

Another historical pattern to note is the U.S. presidential election cycle: markets tend to perform well during the third year of a presidency, such as in 2023, and maintain strength in the fourth year, albeit at a slower pace, as policymakers focus on economic growth ahead of elections. The year 2024 is an exceptional year that surpasses historical returns in the election year, and I expect the momentum to continue.

In general, the year following an election - in this case, 2025 - should be a period of clarity on fiscal and regulatory policies that could lower investor uncertainty. Historically, such periods of policy stability, combined with reduced political noise, have been followed by favorable market performance. Based on precedents, one can well guess that the year 2025 might prove similar in that respect, provided the political environment remains friendly and growth-oriented policies prevail.

Catalysts Supporting Factors for 2025

While history may paint a strong case for optimism, there is a need to consider some catalysts that shape today's market, and might eventually help drive strong stock market performance in 2025.

Resilient Corporate Earnings

One of the most promising signs for 2025 is the corporate earnings strength. So far, though beset with inflation, disrupted supply chains, and surging rates, many firms have shown resilience through their cost efficiency, price increases, and technology investments. By 2025, these would have already paid off and accelerated into earnings growth in key sectors such as technology, healthcare, and consumer discretionary.

Technological Innovation as a Catalyst

As I’ve written in prior pieces, technology is a major force driving the market forward. The rise of artificial intelligence (AI), cloud computing, and digital transformation continues to reshape industries, creating new revenue streams and improving productivity. Companies that successfully harness these innovations are likely to deliver outsized returns in 2025. For example; AI adoption in healthcare and manufacturing is driving cost savings and efficiency gains. The semiconductor industry is seeing renewed growth as demand for advanced chips surges. Historically, the technology sector has led during bull markets, and 2025 should be no different.

Global Economic and Political Stability

Global leaders seem determined to seek peace treaties in both Ukraine and the Middle East. President-elect Donald J. Trump has pledged during his campaign to contribute to ending the war in Ukraine and to stabilize the Middle East. If these succeed, hand in hand with other global leaders, it could be a major stimulus to increased global economic stability.

Peace in these regions would likely decrease geopolitical risks, stabilize energy markets, and allow high conditions for trade and investment. With the global economy still in recovery from a few turbulent years, peace could accelerate such progress. Emerging markets, with favorable demographics and increasing foreign investment, would benefit further from a stable geopolitical environment. For U.S. multinationals, this could mean higher revenues, improved profitability, and, therefore, a promising outlook for 2025 and beyond.

Risks to Watch in 2025

While I am optimistic about the opportunities that 2025 presents, no market outlook is complete without acknowledging some of the potential risks. Rarely does the stock market move in a straight line, and I believe next year will be no different. Some of the key risks I'm keeping an eye on are:

Geopolitical Uncertainty

Geopolitical tensions have always been a wild card for the global economy and markets, and 2025 is no exception. The ongoing war in Ukraine, or potential flashpoints in the Middle East or Asia, could disrupt supply chains, increase energy prices, and unsettle investor confidence.

Trade relations, especially between the U.S. and China, may also be subject to renewed strains that could weigh on global growth. While such risks are inherently unpredictable, they put into focus the importance of a diversified portfolio and proactive risk management. It will be important to remain flexible and monitor developments closely.

Valuation Issues

Following stellar market gains in 2023 and 2024, some sectors may be entering 2025 with valuations that appear overstretched. This could be especially true for high-growth sectors like technology, where investors’ enthusiasm often leads to elevated price-to-earnings ratios. If corporate earnings growth in these sectors fails to meet lofty expectations, the result could be sharp corrections.

These valuation pressures can cause turbulence that tries the patience of investors. Yet at the same time, they remind one to look at fundamentals, maintain the long-term perspective, and be disciplined in rebalancing portfolios.

Monetary Policy Surprises

While the Federal Reserve is likely to maintain stable interest rate conditions in 2025, one would not want to rule out surprises. For instance, if supply-side shocks cause a reacceleration of inflation or economic activity proves stronger than expected, the Fed may be forced to pivot back to tightening. An unexpected rate hike or more hawkish guidance could create headwinds for both equities market, dampening economic growth while financial conditions are being tightened.

On the other hand, this too-accommodative posture is going to inflate asset bubbles and thereby create risks down the road. Monitoring macroeconomic data and Fed communication will be crucial in making one's way through such uncertainty.

2025 Sectors to Watch

With the broader market looks like it’s on growth phase, several sectors are positioned to outperform, driven by transformative trends and shifting consumer behavior. Here's a closer look at some of the top sectors to watch in 2025:

Technology

The technology sector keeps its position at the very vanguard of market innovation and disruption. Breakthroughs in AI, cloud computing, quantum computing, and semiconductors are changing whole industries and fueling demand for state-of-the-art solutions. Data centers integral to AI and cloud infrastructure will also see their demand rise through increased global digitization. Since the technology companies lead from the front in automation, robotics, and machine learning, the sector is expected to grow a great deal in 2025.

Consumer Discretionary

The consumer discretionary sector will have all the reasons to shine on improving economic conditions and rising consumer confidence that would drive spending. The travel, hospitality, and entertainment industries have ample opportunities to see strong earnings growth year-over-year. I believe Retail would also emerge stronger as well as people spend more on experiences and higher-end products.

Blockchain and Cryptocurrency

Blockchain and cryptocurrencies have a possibility to continue its momentum in 2025, amid hopes that the new US administration will be extremely Bitcoin-friendly. This growth may be further shaped if Bitcoin is supported by the policymakers. New usages of blockchains in financial infrastructure, supply chain management, game industry, and options for digitized identity could open different avenues in 2025. The more the institutional adoption of cryptocurrencies increases and regulations bring clarity, the better this sector will thrive under favorable policy conditions.

Final Thoughts: Continued Growth in 2025 with Cautious Risk Management

Looking ahead to 2025, I see a market shaped by the perfect blend of historical patterns and current catalysts. The stock market performance in 2023 and 2024 has built a solid base for momentum to 2025, with things like stable inflation, breakthrough technological innovation, and improving geopolitical conditions serving as tailwinds. These drivers create a compelling backdrop for what could be another strong year. That said, no market outlook comes without its uncertainties. While history may be a great teacher, risks are just part of the equation.

The long-term direction of the market, as underpinned by innovation, adaptability, and resilience, is clear; disciplined risk management remains paramount. It will be very important to stay diversified and focused on high-quality investments in order to weather potential volatility and seize emerging opportunities. As I always say, "The game is the same." History may not repeat itself exactly, but lessons from it guide us through. If past patterns persist, then 2025 may turn out to be another year of a positive stock market return.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

More from Femi Agboola, CFA

December 28, 2024

December 28, 20242025 Outlook: Historical Cycles and the Case for a Sustained Bull Market

December 28, 2023

December 28, 2023Why I’m Bullish on the Stock Market in 2024: A Historical Perspective

May 31, 2023

May 31, 2023NVIDIA: Leading the AI Pack for Investment

May 5, 2023

May 5, 2023