Femi Agboola, CFAMay 31, 2023

Femi Agboola, CFAMay 31, 2023

Artificial intelligence (AI) has been the most sought-after technology in recent years, with an ever-increasing number of companies investing in AI research and development; and riding the AI wave to boost their stock performance. In this highly competitive space, several companies stand out as the ultimate investment opportunity – companies such as Microsoft (MSFT), Alphabet (GOOG), and C3.ai (AI). However, given several factors highlighted below, I believe NVIDIA Corporation is likely to outperform the rest over the long term despite the bears’ view on its valuation. In this opinion piece, I delve into why NVIDIA will keep leading the way, considering factors such as market leadership, product innovation, financial performance, and future growth potential.

First, it’s important to mention the recent NVIDIA’s earnings report and its stock performance afterward. NVIDIA smashed wall street estimates and provided stronger than expected sales forecast that helped drove its stock price up by ~25% in extended trading. While the valuation currently looks too high for bears, the bulls believe its sales growth momentum align with its price. In as much as NVIDIA keeps its growth strategy, I expect the stock price to continue appreciate in the near term. Oh, by the way, NVIDIA briefly joined the one Trillion USD market cap club during the trading hour on May 30, 2023 – will be a permanent member sooner or later.

NVIDIA Corporation (NVDA) is increasingly becoming the top choice for investment among artificial intelligence (AI) related companies, thanks to its commanding position in the AI market, immense growth potential in generative AI applications, and its earnings growth prospects.

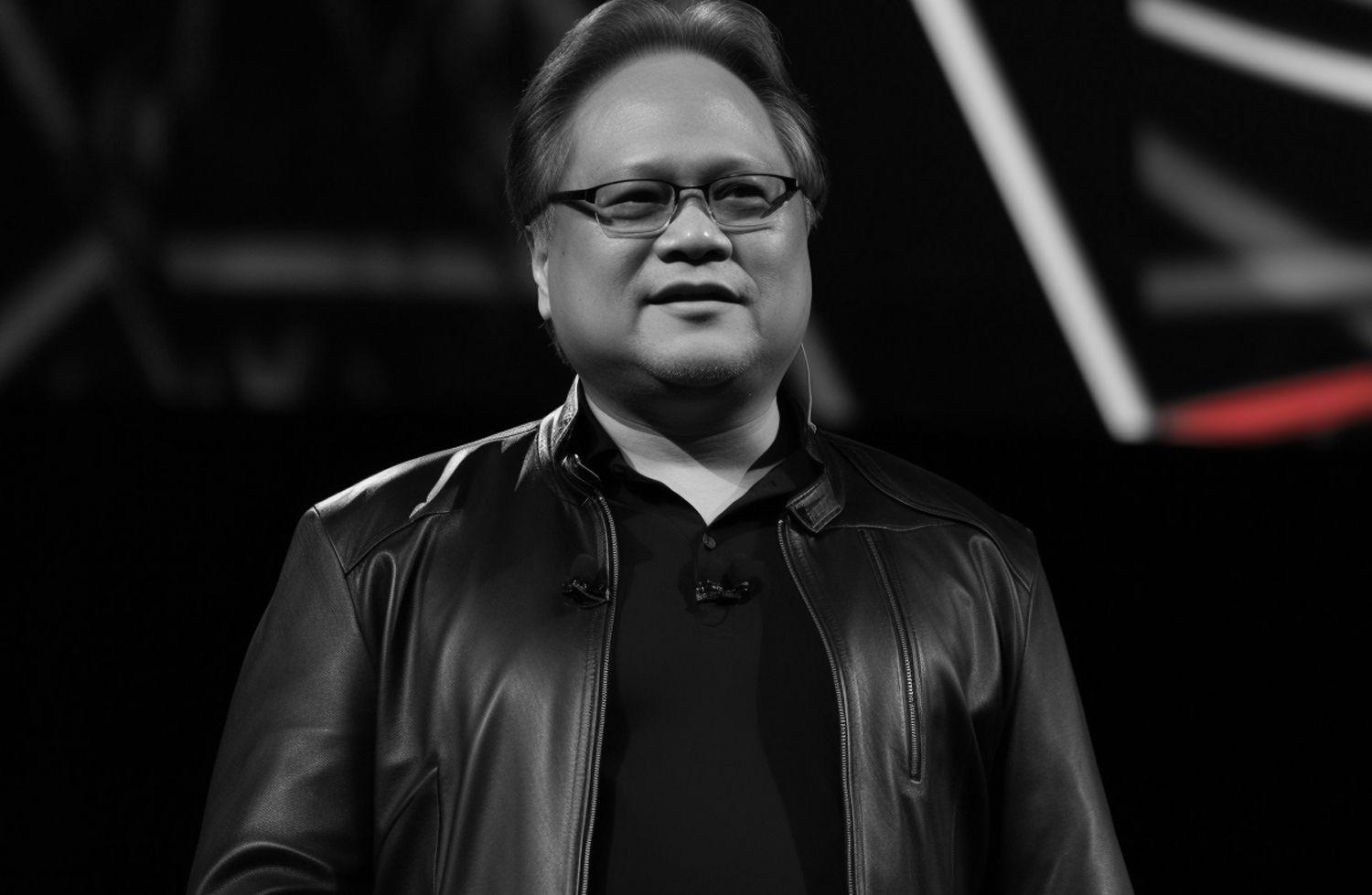

NVIDIA's leadership in the AI market is evident from its outstanding performance in numerous AI benchmarks. Industry analysts have consistently observed that the company outperforms its rivals in every AI performance test. As seen above, NVIDIA's newly launched H100 data center GPU has garnered rave reviews from clients, boasting superior AI inference performance compared to its predecessor, the A100. A100 alone is powerful enough to power many of the AI applications and suited to power tools like AI Bing or ChaptGPT. According to New Street Research, Nvidia takes 95% of the market for graphics processors that can be used for machine learning that power those tools. As demand for AI increases, companies like Meta and OpenAI’s demand for NVIDIA chips will increase. Consequently, revenue of NVIDIA will increase as well. In fact, Jensen Huang (NVIDIA CEO) mentioned at the recent company’s annual GTC developer conference that he expects revenue from generative AI to grow significantly. Given these factors, it looks like NVIDIA is poised for a significant revenue increase within the next 5 to 10 years.

Generative AI, a rapidly expanding and highly profitable segment of the AI market, could be a significant driving force behind NVIDIA's growth potential. Generative AI algorithms are capable of creating new content, including images, text, audio, or video. NVIDIA's GPUs are ideally suited to power devices that employ generative AI.

Generative AI potential growth could be the catalyst to help NVIDIA maintain its growth trajectory. According to market.us report, generative AI is expected to provide incremental revenue of $151.9B by 2032 – that is 31.4% CAGR. Given that Nvidia is the market leader in the GPUs, I expect this to have a massive positive impact on its revenue.

Business and Financials

Over the past few years, Nvidia has been growing its data center, which is the leading computer platform for AI, high-performing computing, and graphics. As seen in the chart below, Nvidia’s 2023 fiscal year revenue from its Data Center segment amounted to about USD 15 billion – represents 55% of the company’s total revenue. Nvidia’s data center segment has become its largest segment of revenues recently and had 51% Compound Annual Growth Rate (CAGR) in the past 5 years. Also, NVIDIA reported $4.3B revenue in Q1 2023 for Data Center – a record revenue, and represents ~60% of the total revenue.

NVIDIA's most recent quarterly revenue was $7.2 billion, up 19% from the previous quarter, and the company is projecting a second quarter revenue outlook of $11 billion. However, it's very important to note that NVIDIA's $7.2B revenue for the quarter ending April 30, 2023, was 13% decline year-over-year – a good reference for bears’ view.

NVIDIA’s valuation looks unimpressive. Its current P/E ratio is 203.9, which is significantly higher than the industry average P/E ratio. This initially suggests that NVIDIA's stock is expensive compared to other companies in the industry. However, looking at the forward P/E ratio, which is a measure based on forecasted earnings, NVIDIA's forward P/E ratio is around 39.5 (https://www.tradingterminal.com/fundamental/nvda). This might be higher than the industry average but not as high as the current P/E ratio. The forward P/E ratio is a more relevant measure for investors as it's based on the projected earnings of the company. This suggests that the market expects NVIDIA's earnings to grow, which supports the view that NVIDIA is not overly expensive when considering its growth potential.

Therefore, while NVIDIA's current P/E ratio seems high compared to the industry average, its forward P/E ratio is close or more in line with the industry, suggesting that the market has high expectations for NVIDIA's future growth. The company's strong revenue growth and outlook further support this. However, the recent year-over-year decline in revenue may be a concern, and it will be important to monitor NVIDIA's future earnings releases to see if the company can continue to deliver strong growth. To maintain and sustain its leadership in the AI space, would like to see NVDIA’s CAGR to be greater than 31.4%.

Bottom Line:

NVIDIA's dominant position in the AI market, significant growth potential in generative AI applications, and attractive earnings growth prospects make it a compelling investment choice among AI-related companies. While the company faces risks and challenges in the AI market, its strengths appear to outweigh these concerns, making it an appealing option for investors seeking exposure to the AI sector. It’s important to mention that investors expect a lot from NVIDIA given that it’s trading at a substantial premium when comparing its valuation to its peers. It’s advisable for investors to keep an eye on Nvidia’s revenue growth as well as the AI buzz momentum to help make informed decisions.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

Femi Agboola, CFA

Femi Agboola, CFAFemi is a data-driven professional investor. He uses both technical & fundamental analyses to make investment decisions. He also specializes in strategically driving the financial planning process to achieve impactful and profitable business goals.

December 28, 2024

December 28, 2024 December 28, 2023

December 28, 2023 May 31, 2023

May 31, 2023 May 5, 2023

May 5, 2023