Decoding Powell's Remarks: Navigating Market Volatility Amid Fed's Interest Rate Policy

Femi Agboola, CFAMay 5, 2023

Femi Agboola, CFAMay 5, 2023

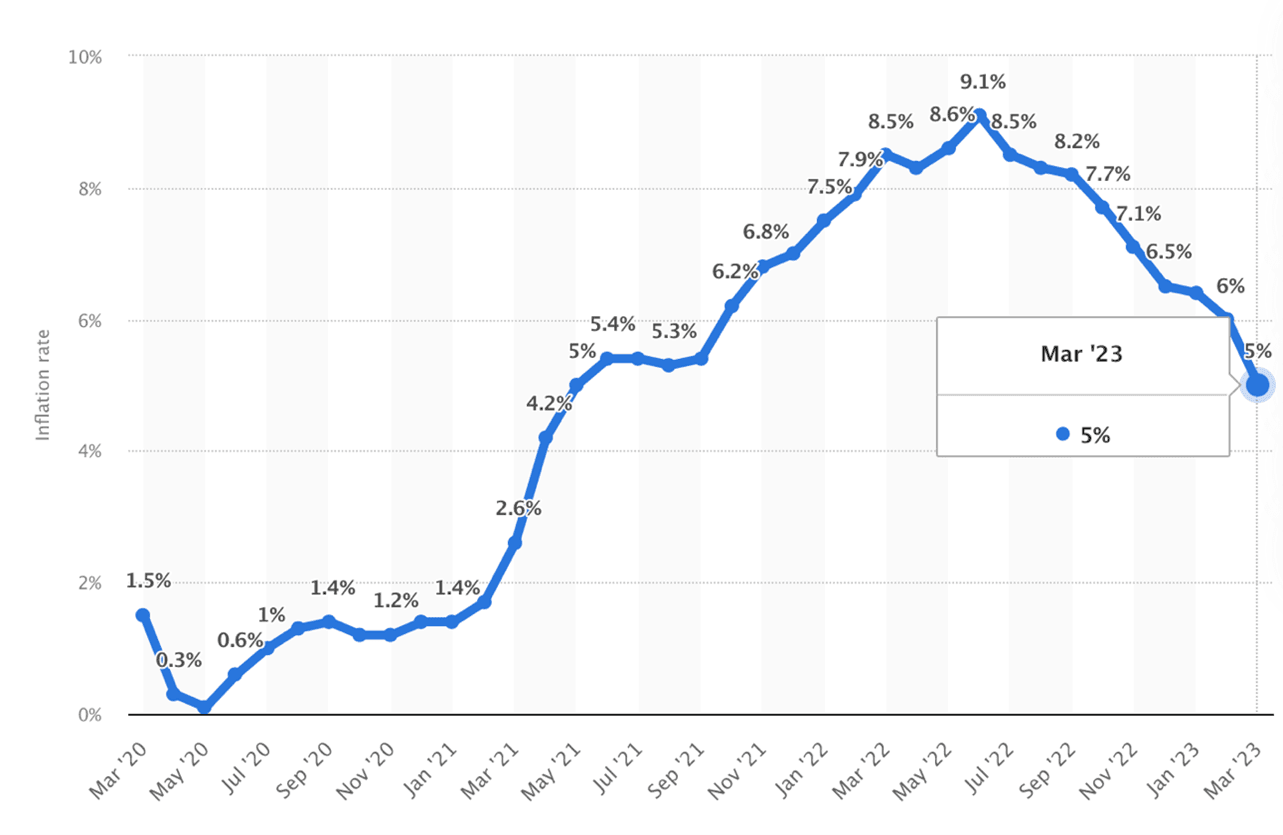

As expected, the Federal Reserve (Fed) raised benchmark interest rate by a quarter percentage point, from 5% to 5.25%. The fed has increased the rate for the 10th consecutive time. The Fed’s decision reflects its success in fighting inflation, which has been above its 2% target for several months. One could say that the effects of the fed’s policy is positive so far because inflation is easing gradually as seen in the chart below.

Source: https://www.statista.com/statistics/273418/unadjusted-monthly-inflation-rate-in-the-us/

In the press conference yesterday, Fed chairman, Jerome Powell discussed fed's policy decisions and their implications for the US economy. The Fed's focus remains on its dual mandate of promoting maximum employment and price stability. With inflation still running high, Powell emphasized the need to bring it back down to the Fed's 2% goal. As the markets react to these comments, both short term and long-term investors need to evaluate the impacts on their portfolios and make informed decisions.

In this piece, I delve into Powell's remarks in search of indications or hints that suggest the Federal Reserve may be nearing the conclusion of its monetary tightening phase. Additionally, I evaluate the potential impact of these statements on equity markets and offer guidance on maneuvering through the uncertainties that may arise.

At the meeting, the Federal Reserve (Fed) removed certain words from its description of the pace of rate increases. This caught my attention. Traditionally, when the Fed Chair Jerome Powell discusses interest rate increases, he provides a clue about the direction the Fed plans to take after mentioning the current increase. However, during the meeting, Powell provided no such clue, which has led me to speculate that the Fed may be close to the end of its tightening cycle.

One possible reason for this change is that the Fed is waiting for more data to confirm its outlook before making any further changes. By removing the words "continue" or "anticipate" from its description of the pace of rate increases, the Fed is signaling that it may not need to raise interest rates much further, or that it may pause or slow down its rate hikes soon. This change is significant because it suggests that the Fed may be taking a more cautious approach to monetary policy amid uncertainties in the financial institutions, US economy and financial markets.

It is interesting to know that the Fed is considering the lags with which monetary policy affects the economy, inflation, and financial developments. This statement could suggest that the Fed is not committed to a predetermined path of interest rate changes but rather, it will remain flexible and responsive to incoming data and information. Acknowledging the uncertain headwinds related to economic activity and hiring, the Fed is expressing its willingness to support stability with appropriate monetary policy. This announcement is significant because it implies that the Fed will remain vigilant and take a more cautious approach to interest rate changes, as it aims to support the economy.

Overall, it is unclear what these changes in language mean for the future of interest rates and the US economy. However, it is clear that the Fed is adopting a more prudent strategy to monetary policy. It will be interesting to see how the markets react in the near future to the Fed actions and Powell’s comments after they are well processed.

The Fed's Comments and the Stock Market

In the short term, Powell's comments on the Fed's policy actions, including the recent 1/4 percentage point interest rate hike, have led to increase in the market volatility. While the interest rate increase was expected, investors are not convinced of the future interest rate pause signal - led to volatility in the stock market. As Powell mentioned yesterday, tighter credit conditions resulting from the Fed's policy actions and recent banking sector developments have impacted various sectors of the economy. Interest rate-sensitive sectors, such as housing and financial institutions have been particularly affected. Consequently, stock performance in these sectors may be weaker in the short term.

In the long term, Powell's commitment to bringing inflation back down to the 2% goal may have a positive impact to the stock market if the clues on the pause to increase in the interest rate hike provided above are to be true. However, if not, i.e., Fed keeps increasing the interest rate, there might be a long-term implication for the stock market. As the Fed continues to raise interest rates in pursuit of its objectives, investors may shift their preferences from high-growth stocks to value and dividend-paying stocks. This may lead to a rotation in market leadership, affecting long-term stock market trends. If the Fed's policy actions result in a period of below-trend growth and softened labor market conditions, corporate earnings could be affected. Lower economic growth may translate to weaker revenue growth and profitability for businesses, which could negatively impact stock prices in the long term.

What Can Investors Do?

Considering the market impacts stemming from the Fed's policy decisions, investors should consider diversifying their portfolios across different asset classes, sectors, and geographic regions. Diversification helps mitigate risks and dampen the effect of market volatility on investment returns. Investors should also periodically rebalance their portfolios to maintain their desired asset allocation. As interest rates rise and market conditions change, rebalancing can help investors stay aligned with their risk tolerance and investment goals.

Also, investors should focus on high-quality stocks with strong balance sheets, reliable cash flows, and sustainable dividends. These stocks tend to be more resilient in times of economic stress and can provide a stable foundation for long-term growth. You also want to make sure you read quarterly earnings reports of companies’ stocks you hold in your portfolio. Focus on revenue, EBIT, net income, EPS, and statement of cash flow. Most importantly, read the risk factors and notes to financial statements. It’s also important to consider any material information or news about the company to make a quick and informed decisions.

Lastly, market volatility and changing economic conditions may present buying opportunities for long-term investors. By keeping some cash on hand and staying informed about market developments, investors can be prepared to take advantage of potential bargains. Market volatility provides great opportunities to purchase quality stocks at a bargain price. Make sure to put those quality companies on your watchlist, and pay attention to their business performances/fundamentals to ensure they are still solid, while monitoring key economic indicators such as inflation.

Bottom Line

Chairman Powell's comments on the Fed's policy actions and their implications for the US economy may have signaled a new direction they want to take. While it sounds good, it looks like investors do not have the confidence yet given the market reaction. The Fed’s policy has undoubtedly impacted stock markets in both the short and long term. Investors need to be flexible, agile and process information quickly to make informed decisions on rebalancing or managing their portfolios in the face of changing market conditions.

As the economy evolves, and the Federal Reserve continues to implement its dual mandate “to promote maximum employment and stable prices”, staying informed and adapting investment strategies accordingly will be essential for investors seeking long-term success. By focusing on diversification, rebalancing, quality stocks, and monitoring key economic indicators, investors can navigate these uncertain times and position their portfolios for future growth.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

Femi Agboola, CFA

Femi Agboola, CFAFemi is a data-driven professional investor. He uses both technical & fundamental analyses to make investment decisions. He also specializes in strategically driving the financial planning process to achieve impactful and profitable business goals.

More from Femi Agboola, CFA

December 28, 2024

December 28, 20242025 Outlook: Historical Cycles and the Case for a Sustained Bull Market

December 28, 2023

December 28, 2023Why I’m Bullish on the Stock Market in 2024: A Historical Perspective

May 31, 2023

May 31, 2023NVIDIA: Leading the AI Pack for Investment

May 5, 2023

May 5, 2023