History Predicts a Comeback in 2023

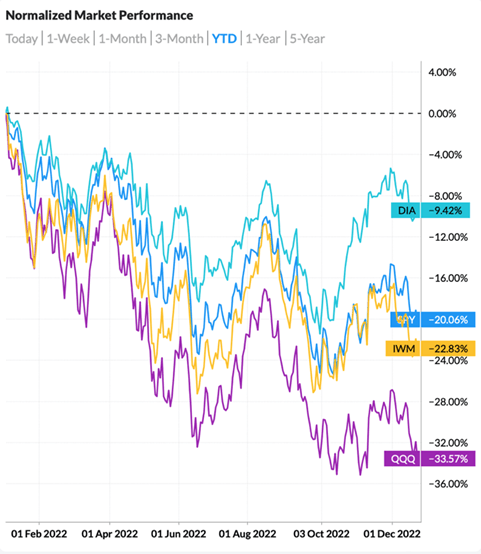

The markets have returned negative double-digit percentages so far in 2022, just one year after an amazing market run. As shown in the chart below, QQQ is down by approximately 33% and SPY by 20%. It’s been a brutal, punishing year for stocks – especially technology companies. Investors have shown no mercy and have lacked patience for companies that missed earnings. They have been ruthless in response to earnings misses and conservative outlooks during this inflationary environment.

The stock market has a long and volatile history, with periods of both positive and negative performance. It is not uncommon for the stock market to experience negative performance in a given year, and it is important to note that past performance is not necessarily indicative of future results. That being said, the stock market has generally shown a strong tendency to bounce back after periods of negative performance. In this article, we will explore the history of stock market performance in the year following a negative year and examine some of the factors that can influence the market's performance in this period.

To begin with, it is useful to define what is meant by "negative performance" and “positive performance” in the context of the stock market. Negative performance refers to a decline in the value of the stock market over a given period. This can be measured by a variety of different indices, such as the S&P 500 index, which tracks the performance of 500 large publicly traded companies in the United States, or the Dow Jones Industrial Average, which tracks the performance of 30 large publicly traded companies. When the value of these indices falls over a given period, it is considered negative performance. When their value however rises, it’s considered positive performance.

Why the Stock Market is Poised for a Comeback in 2023

In the history of the stock market, there have been a few instances where the market has experienced negative performance. For example, in 2008, the S&P 500 index fell by approximately 38% due to the global financial crisis. In 2002, the index fell by approximately 23% due to a combination of economic and geopolitical factors. And in 2022, index is down so far by 20% due to rise in interest rates, inflation, and geopolitical factor.

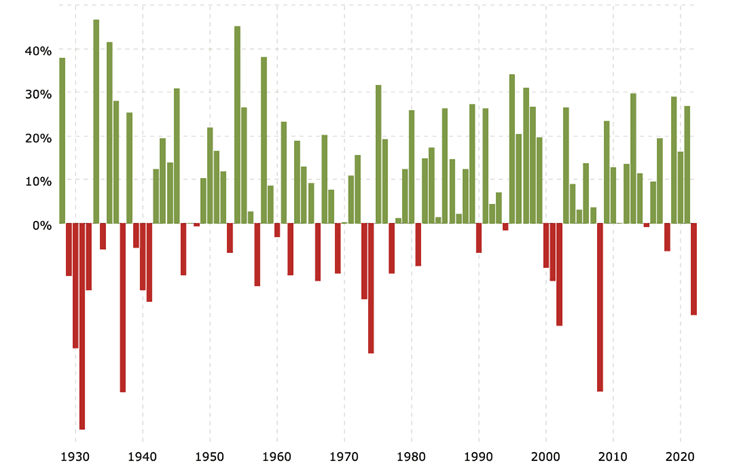

Despite these instances of negative performance, the stock market has generally shown a strong tendency to bounce back in the year following a negative year. In the year following the negative performance in 2008, for example, the S&P 500 index gained approximately 24%. In the year following the negative performance in 2002, the index gained approximately 26%. And in the year 2023, well, index could bounce back and deliver positive performance if past repeats itself.

There are a few factors that can influence the stock market's performance in the year following a negative year. One key factor is the overall state of the economy. When the economy is strong and growing, companies are more likely to be profitable, which can drive up the value of their stock. On the other hand, when the economy is weak or contracting, companies may struggle to generate profits, which can lead to a decline in the value of their stock. Most indicators surprisingly show US economy is still strong – consumer confidence grew in December, GDP grew at a 3.2% annualized rate in Q3, and unemployment remains low. Recent reports also show inflation is cooling off; now at 7.1% from 9.1% high in June. If the trend continues, it could help index to return a positive performance in 2023.

Geopolitical events can also have a significant impact on the stock market's performance. For example, conflicts or tensions between countries can create uncertainty and risk for investors, which can lead to a decline in the value of the stock market. Similarly, natural disasters or other major events, such as pandemics, can also impact the market's performance. Other than high inflation, one of the drivers of energy cost is the war in Ukraine. This geopolitical event is affecting lots of companies and driving their cost up. A peace agreement or ceasefire in 2023 could help drag down the energy cost, and consequently help reduce the impact on some of the energy dependent companies’ earnings. This could be one of the catalysts to help the market bounce back in 2023.

Company-specific news can also play a role in the stock market's performance in the year following a negative year. If a particular company experiences negative news, such as declining sales or profits, it can lead to a decline in the value of its stock, which can in turn impact the overall performance of the stock market. On the other hand, if a company experiences positive news, such as strong earnings or an expansion into a new market, it can lead to an increase in the value of its stock and contribute to overall market performance. Q1 2023 earnings will provide clues of how the index will perform by end of 2023. Improved earnings and hawkish outlook could help the market to produce positive performance in 2023.

Despite the lousy YTD performances of the major indices (as seen above), the market will perform better in 2023 if history repeats itself. According to the chart below, the S&P 500 ends up in the green a year after it produced a negative return. Some exceptions do exist, including 2000-2002 (the dotcom crash), 1973-1974, 1939-1941, and 1929-1932. However, over the past 95 years, the S&P 500 has consistently provided positive annual returns one year after a negative performance. If history repeats itself, we will see a strong rally in 2023. Although there is no way to accurately predict or time the market, the best action investors can take is to stick to their investment plan based on their risk profile and risk management plan.

Source: www.macrotrends.net

In conclusion, while the major indices have had poor performances in the year-to-date, there is a possibility that the market will improve in 2023 based on historical data. The S&P 500 has generally provided positive annual returns one year after a negative performance over the past 95 years. It is worth noting that the stock market's performance in the year following a negative year can vary significantly depending on the specific circumstances and factors that contributed to the negative performance. In some cases, the market may recover quickly and return to positive performance, while in other cases it may take longer for the market to recover. Investors should conduct technical analysis, evaluate the Q4 2022 and Q1 2023 earnings, consider the CPI reports, and assess the Fed actions before making investment decisions.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

More from Femi Agboola, CFA

December 28, 2024

December 28, 20242025 Outlook: Historical Cycles and the Case for a Sustained Bull Market

December 28, 2023

December 28, 2023Why I’m Bullish on the Stock Market in 2024: A Historical Perspective

May 31, 2023

May 31, 2023NVIDIA: Leading the AI Pack for Investment

May 5, 2023

May 5, 2023