Hello Traders,

Welcome to this week’s newsletter. This week is all about a strong dollar and earnings. As I have written before, the market is closely monitoring how a slow economic forecast will impact companies’ guidance and earnings and it’s also patiently waiting to price where SPX should accordingly be.

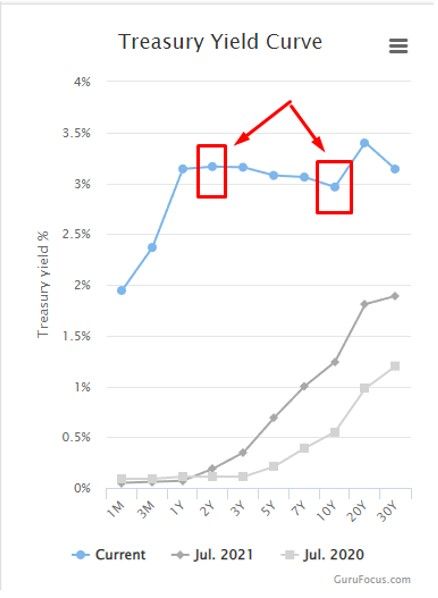

Morgan Stanley and JPMorgan Chase started off the earnings season last week and, as expected, the provision for credit losses increased. Both banks signaled a slowdown in the economy and both transaction volume and M&A volume were down sharply. The yield curve is now completely inverted, pointing to a significant slowdown in economic activity.

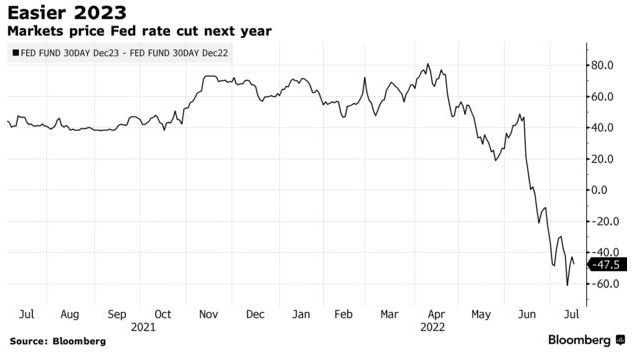

Looking at the spread between the swaps for 2023 vs. 2022, we can clearly see that the market is pricing in a rate cut in late 2023! If you are eager to add leverage to your portfolio, my advice is to try to stay solvent and survive the next few months. Once the Fed starts cutting again, you can add leverage to your portfolio.

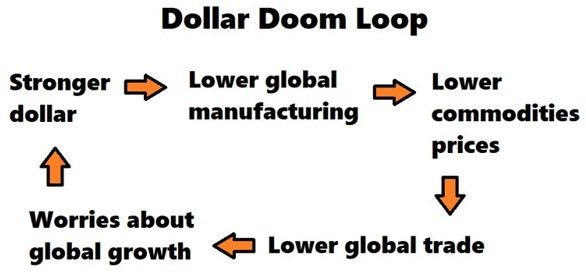

As I wrote last week, a headwind for the majority of multinational corporations (such as the companies comprising FAANG) is the strong dollar. A strong dollar will put downward pressure on international sales and will impact earnings. A strong dollar will also lead into sluggish growth for the world economy.

Below is my trade log for the week. I remain unconvinced that the market can continue its strength until earnings improve. I am still 55% cash and the majority of my trades are bearish or neutral.

My tweet of the week goes to Jay Singh for sharing Deutsche Bank’s research on how, based on their prime brokers’ book, the smart money is now net short. This is important to note because if this is true in scale, there is a high probability of a bear market rally since the short books need to cover.

Over the weekend I wrote a new piece on my personal blog regarding what to look for in order to figure out when the market is bottoming. I discuss three key indicators and what they mean. Feel free to check out my article HERE.

To your success,

Ardi

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.