Fed Pivot?

Hello Traders,

I hope you are well and off to a successful trading week. During the past month, the Nasdaq-100 has rallied over 20% from its June lows and that has left many participants wondering if the market has pivoted or if is it just a bear market rally? I will try my best to answer this question this week.

The Big Picture

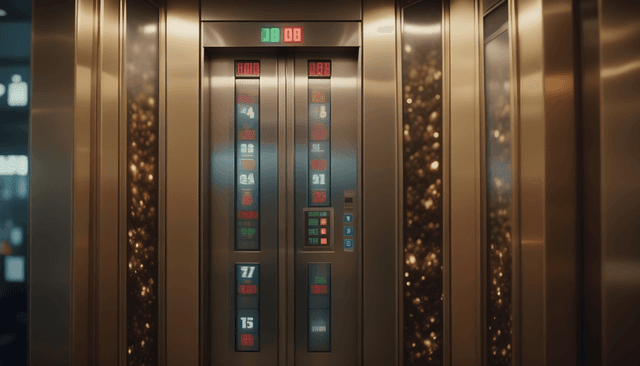

Since the last 75-basis point rate hike, the narrative has changed from a Fed that is hawkish (meaning it is tightening) to a Fed that is dovish and now planning to cut rates in 2023. The chart below shows the Fed fund rate expectations and, as you can see for the month of July, the market started to price in a rate cut in mid-2023.

If it is not obvious by now, it should be clear that the market is a discounting mechanism, discounting future events (such as cash flows and certain other events) back to present value using the discount rate. Since the discount rate is the denominator, the smaller it is, the bigger the present value is going to be. That is why when rate expectations drop, the markets rally, and when the rates move up, the markets sell off.

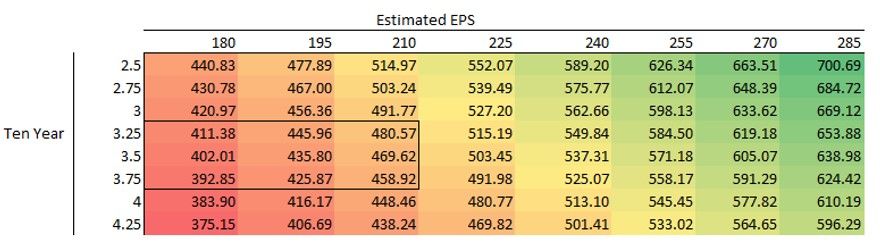

With 10-year Treasuries being at 2.75%, and earnings being closer to $190 for SPX, the year-end looks closer to being somewhere between $420 and $450.

The major question, however, is whether interest rates and earnings can hold up. As for rates, it all depends on Wednesday’s inflation reading. If inflation is hot, that means the Fed has to continue to raise rates and that would push 10-year Treasuries higher, subsequently pushing $SPY lower. If the reading confirms that inflation has peaked, stocks should continue their rally and mark a new regime for the market. I am being extra cautious this week and trying to have hedges in place.

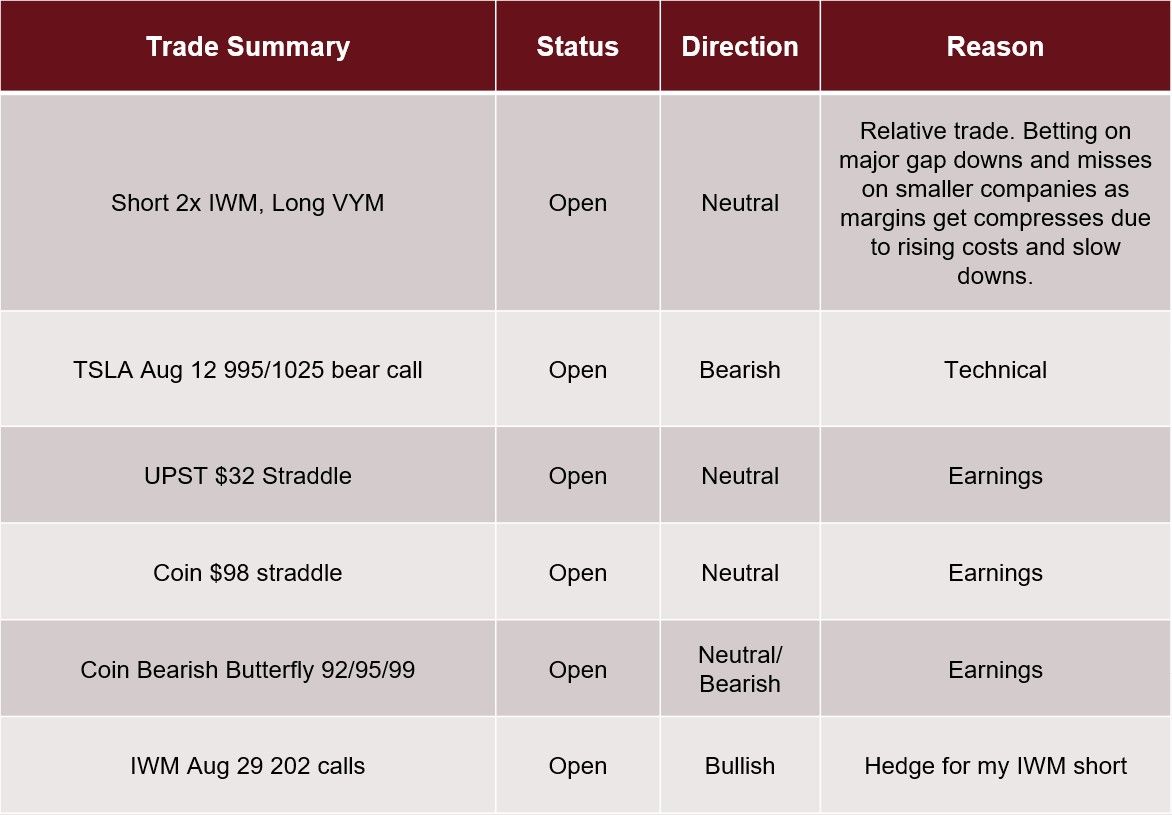

Options Trades for the Week

Below is my trade log for the week. Some of the positions are hedges in place to protect my overall portfolio.

Tweet of the Week: Market Will Humble You

My tweet of the week goes to Michael Gayed. Many people believe that bear markets are easy and they can simply make money by shorting the market. This could not be further from the truth. The bear market makes a fool out of both bulls and bears. Just look at this past month’s rally and how many hedge funds blew up trying to short the market.

One Last Thing: Crede on Mental Toughness

This week's Closing Bell show will feature Créde, our incredible psychologist, talking about mental toughness. The show will air live this Thursday at 3:30pm ET. Make sure to tune in HERE for this amazing conversation.

To your success,

Ardi

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.