The US election result has been broadly seen as a downer for investors in emerging market stocks. And that’s in big part because the president-elect has proposed slapping a 10% minimum tariff on all imports – 60% on things coming from China. But it’s worth taking a closer look at the whole impact. So let’s do that…

Okay, so increased tariffs themselves and other more pro-growth policies could put upward pressure on US inflation, which would then slow the pace at which US interest rates can be cut. In fact, in the days after the election, the US dollar strengthened – which likely reflects the market’s expectation that America’s interest rates might stay higher for longer. Remember, higher interest rates make a currency more attractive for international savers and investors.

The president-elect’s party looks increasingly likely to control both the House of Representatives and the Senate, which would certainly ease the process of pushing through his policy agenda. Still, there’s always the need for pragmatism. The future commander-in-chief acknowledged that in his book, The Art of the Deal, touting the importance of “never getting too attached to one deal or one approach”. That mindset will only have been strengthened by his earlier term in the White House. So while some of his more controversial ideas will have helped grab voter attention, in practice, you can expect some watering down to happen.

Sure, trade tensions between the US and China will probably increase. But whether the new president actually pursues the more aggressive (threatened) policy of imposing 60% or higher tariffs on all Chinese imports to the US remains to be seen. When he actually sits down in the Oval Office in late January, he may need to adopt a more moderate and transactional approach – especially because there will be the potential for retaliatory steps from China.

In any case, increased US tariffs could very likely come with a silver lining: the potential for significant steps from the Chinese government to support the local economy. Indeed, just days after the US election, the National People’s Congress, China’s rubber-stamp parliament, announced a massive $1.4 trillion stimulus package aimed at restructuring local government debt. And though that massive influx of money didn’t tick all the boxes for the market – investors were hoping for measures that would incentivize consumer spending – China’s finance minister did hint that further moves would be coming, with the authorities looking at “intensifying countercyclical adjustments”.

It is worth remembering too that even before the US election, a clear shift toward more pro-growth policies was already evident in China. The vote, then, is likely only to redouble the resolve of Chinese policymakers to forcefully counter any external challenges to growth. Ensuring policy credibility and stopping potential deflationary risks will also be at the forefront of their thinking.

Abrdn’s China funds are well positioned for what happens next in Washington, DC. So far, there’s been no real increase in volatility, which may reflect the possibility that the market had predicted the election outcome more accurately than the polls.

Before all the votes were cast, the funds increased their exposure to higher-conviction China names, where the key decision criteria were: first, the companies’ ability to defend and grow market share; second, their ability to grow overseas earnings and with limited tariff risks; and third, their ability to boost shareholder returns through dividends and/or buybacks.

In addition to this, in what we call the China-A space, around 80% of the portfolio’s revenue is from domestic sources, and the remaining 20% is mostly from non-US regions. More broadly, fund managers across all abrdn’s China portfolios have, for over a year, been steadily managing down holdings in stocks with higher US exposure – generally because of US tariff risks.

While a world of rising tariffs is clearly not ideal for non-China EMs either, the overall picture is in fact more balanced in several respects.

Firstly, it is worth remembering that the president-elect is expected to be looser in terms of government spending, potentially pushing tax cuts and spending aimed at “re-industrialization”, which should boost US growth. And generally faster US growth tends to boost global growth by way of the export channel for other countries. Obviously, increased US tariffs might dampen this tendency, but on the whole, swifter US growth should still be good for most other countries.

Secondly, if, as widely anticipated, the most aggressive tariff measures will be targeted on China, then it's plausible that some of the previous US-China trade flows could be diverted to other EMs. Similarly, the next presidency will likely only accelerate global multinationals’ efforts to diversify their global supply chains away from China – which again, could benefit other EMs a lot.

Thirdly, it would be sensible to remember that there are some potent long-term structural tailwinds driving the growth of non-China EMs that will be totally unimpacted by US politics. That includes factors like big populations with growing incomes, improving technological progress, rising industrial spending, and a growing corporate culture of looking to prioritize and improve shareholder returns.

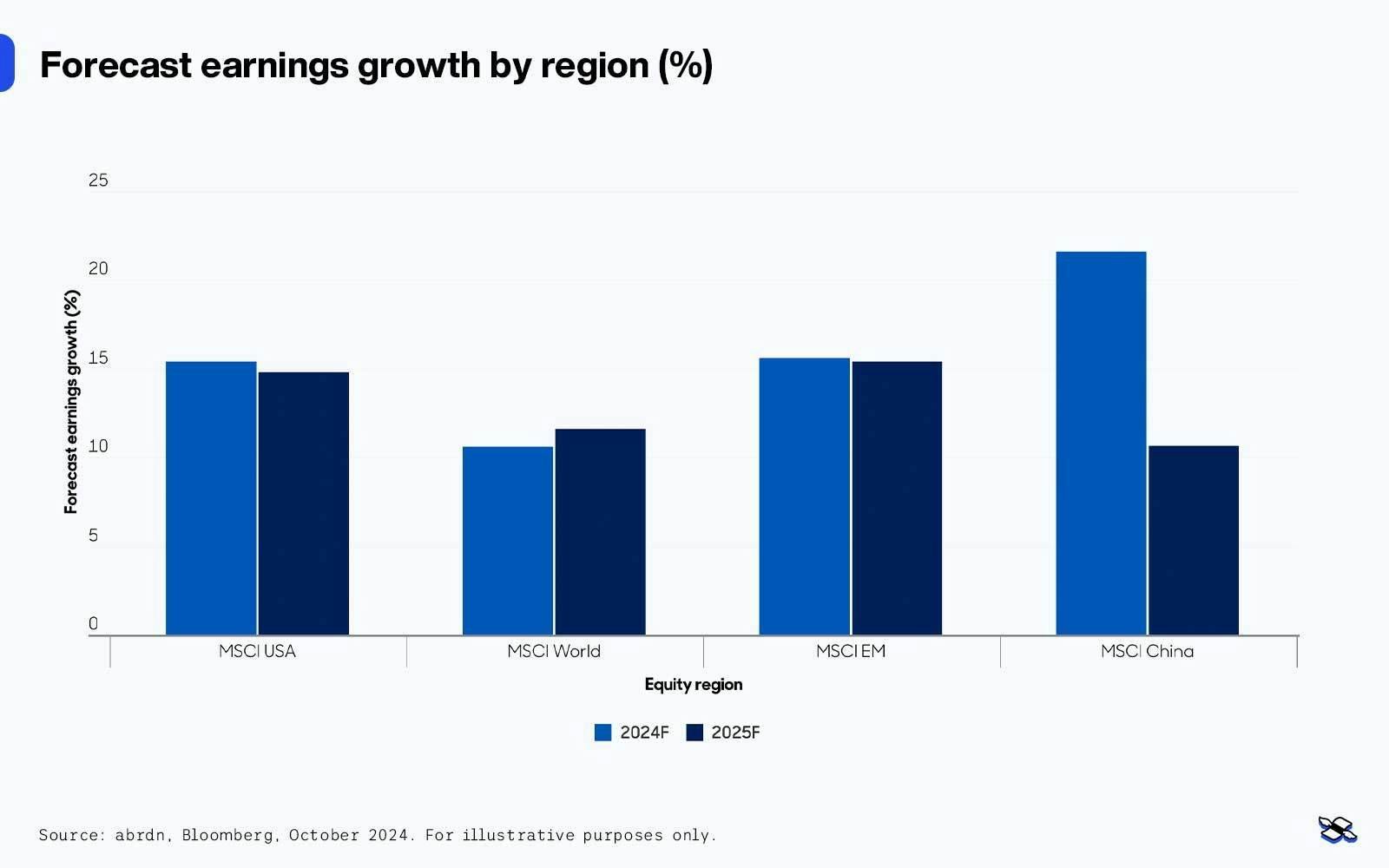

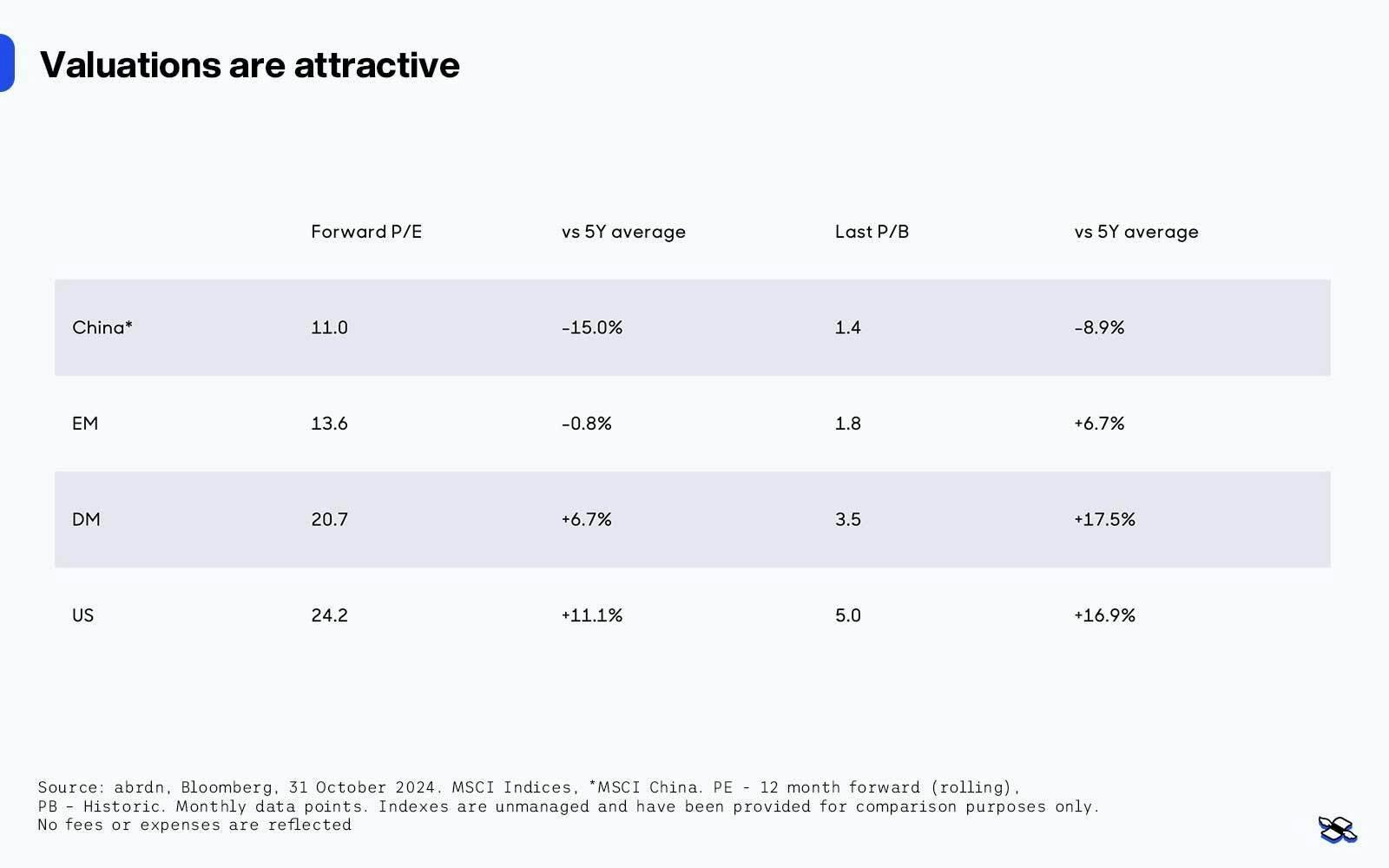

When you’re weighing up the relative merits of any asset class, earnings growth prospects and valuations are always of top importance. And as shown below, these are perhaps the biggest trump cards that EMs have right now – with their stocks projected to grow their earnings by more, while also being considerably cheaper than both their developed market counterparts, including those in the US.

When you put this all together, sure, it’s true that the new White House could pose some challenges for EM economies. But in practice, America’s new chief may have to steer a more pragmatic and transactional approach. What’s more, a tilt toward more defiantly pro-growth US policies should still be a positive for the world.

As the likely biggest target of new US tariff measures, you can expect that China will look to take major countervailing steps aimed at shoring up its growth. Non-China EMs, on the other hand, could actually be among the biggest beneficiaries of global trade and supply chain re-routing activity. Finally, politics aside, it is worth remembering that the earnings and valuation picture very much continues to favor EM equities.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.