Every Stock Has A Story: How To Invest Beyond The Numbers

Investing can feel like a tug-of-war between cold, hard data and captivating stories. On one side, you have the number-crunchers, devoted to ratios and financial metrics. On the other, you have the storytellers, enchanted by a company’s mission and its potential to disrupt. But here’s the reality: effective investing blends both figures and narrative.

Legendary finance professor Aswath Damodaran, often called the “Dean of Valuation”, champions an approach that fuses narratives with solid financial analysis. Let’s explore why numbers alone might miss the bigger picture – and how thoughtful storytelling can help you make smarter investment decisions.

Why numbers alone don’t tell the whole story

A lot of investors rely heavily on financial metrics, analyzing stocks primarily by their price-to-earnings or return-on-investment ratios. But sometimes, these numbers miss the thing that actually makes a company extraordinary.

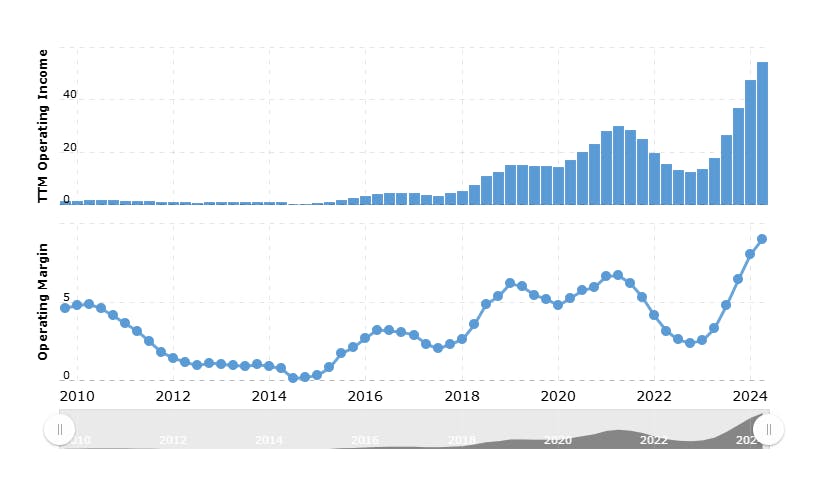

Take a look at what Amazon was like back in 2014. With razor-thin profit and operating margins, hefty reinvestment expenses, and a highly aggressive growth strategy, Amazon looked like a risky bet on paper, as you can see from the chart below. In no way did it look like a “textbook” profitable stock.

Amazon’s story, on the other hand, made a compelling investment case. This wasn’t just an online retailer: it was an innovative tech company, rapidly expanding into various specialties, including cloud computing with its promising new upstart Amazon Web Services (AWS). For investors who viewed Amazon purely as a retailer, the numbers suggested overvaluation. Those who took the long view saw something else: a path toward reinvestment for growth, where short-term profitability would be sacrificed for a longer-term vision of dominating new markets.

In hindsight, that narrative – the emphasis on long-term growth over immediate profits – proved far more useful than the usual stock measurement gauges. Over the past decade, AWS has become a massive revenue driver, generating over $90 billion annually as of 2023 – confirming that a company’s story can sometimes tell you more than its raw numbers.

The danger of relying on pure metrics

On the flip side, sticking to “safe” metrics can backfire, especially when the market shifts in unexpected ways. Classic value investing principles – trusted indicators like low price-to-earnings ratios and high profit margins – have been made popular by hugely successful investors like Warren Buffett. But these metrics don’t always account for market evolutions, especially in tech-heavy industries where old-school metrics might miss the mark.

Just look at Intel. Once a dominant player in the semiconductor industry and a mainstay among value investors’ portfolios, Intel has struggled to keep up with newer, AI-focused chipmakers like Nvidia. Sure, investors who stick rigidly to traditional value principles might cling to Intel, hoping for a return to its former glory. But there’s been a clear shift in its story and identity – from a growth giant to a usurped firm that’s now trying to maintain relevance. Now, that doesn’t mean Intel is without value, but it does suggest it will need a fresh narrative that reflects some direction forward.

The art of bounded storytelling

Of course, there’s always a risk of romanticizing a company’s story. When Uber went public, the firm crowed about a “total addressable market” of $5.2 trillion, encompassing all global transportation spending – even personal car purchases. This massive number painted a rosy picture, but it didn’t reflect the realistic potential of Uber’s actual business. Investors who bought into the grandiose story soon saw the market wasn’t quite as vast.

Bounded storytelling means grounding narratives in reality. Damodaran suggests asking three key questions about a company’s strategy: Is it possible? Is it plausible? Is it probable? For instance, is it likely that Starbucks can sustain growth just by opening new stores? Probably not: with saturated US markets and global competition, Starbucks can’t rely solely on expansion. Contrast this with Costco’s steady approach to store expansion, where even decade-old stores continue to scale and improve. Realistic storytelling includes these limits, helping investors make better-informed choices.

What’s the solution then?

Marrying numbers and narratives is like pairing the logical with the creative. A robust valuation should root the company’s story in reality and offer a roadmap to achievable growth. For example:

Revenue growth: A strong narrative should realistically support how the company’s story drives revenue. Does the company have a growing market or unique offering?

Profitability and margins: Here’s where numbers verify the narrative. Even if the company promises growth, are the costs manageable?

Investment efficiency: This assesses whether the company is investing wisely to sustain its story. Efficient reinvestment means less money is wasted – a factor Tesla improved upon as it scaled.

Now, here’s how to apply this approach as an investor:

Start with the numbers. Get familiar with financial basics – that’s revenue growth, profit margins, and return on invested capital. For high-growth companies, especially in tech, low margins may be acceptable if they serve long-term goals.

Identify the narrative. What’s the company’s story? Is it an industry disruptor (like Uber) or a pioneer in a new field (like Beyond Meat)? See whether the narrative aligns with the numbers. If a company emphasizes innovation, check whether its research and development (R&D) expenses match that vision.

Challenge the story. Play devil’s advocate, hunting for risks or inconsistencies. For example, Uber’s initial story as a “market disruptor” painted it as a new urban transport option, but that growth was never going to be sustainable without substantial cost. Challenge overly optimistic growth narratives by comparing them with practical financial figures.

Monitor feedback loops. Keep an eye on quarterly reports and macroeconomic trends. Stories evolve, and so should our understanding of them. Reassessing a company’s narrative helps in identifying shifts, like Tesla’s transition from a high-risk venture to a market leader. Regularly checking whether the numbers back up the story can keep you from falling for narratives that no longer hold.

Investing is both a science and an art. Numbers offer essential insights, but without a compelling story, they can feel hollow. Likewise, a gripping story without financial grounding can lead to speculative bubbles. By merging numbers and narrative, you can gain a fuller view of potential investments.

So next time you’re assessing a stock, ask yourself: What’s the story behind the numbers? And do the numbers support that story? Investing with this balanced approach doesn’t just improve your odds of achieving long-term gains – it also deepens your understanding of the companies shaping our world.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.