In just over a decade, Nubank went from an obscure fintech startup to Latin America’s most valuable bank. So somewhere along the way, I started tracking it pretty closely.

Over the past week, Nu Holding’s share price has fallen 17%, but it’s still up 62% so far this year. Let’s check out some possible reasons for the decline, look for any potential red flags in its recent quarterly results, and see whether the recent pullback might make for an interesting investment opportunity.

No question: this recent sharp price decline looks a little disconcerting. But the stock had similar-sized falls in April and October, and an even bigger one in August, before rebounding – so this recent drop may simply be business as usual – just the way the stock trades. That said, it’s important to try to understand the reasons for short-term moves in case they signal the start of something more meaningful.

Now, Nu did release its third-quarter results last week – but there was nothing overly surprising in the release. So the more likely reason for the drop was Berkshire Hathaway’s regulatory filing last week, which revealed that Warren Buffett’s big investing conglomerate had reduced its stake in Nu by 20% in the recent quarter. A lot of investors adjust their own holdings based on the moves the Oracle of Omaha makes, so that news likely had an impact on the stock.

The digital bank’s customer numbers continued its trend of picking up nicely – with five million new account holders at the end of the quarter, for a total 110 million. And that’s thanks to some strong growth in all three places where it does business – Brazil, Mexico, and Colombia. Deposits rose sharply, especially in its newer markets, Mexico and Colombia.

Profit reached $553 million – rising a better-than-expected 14% from the quarter before – with help from a lower tax rate and fewer potential uncollected loans. Return on equity (ROE) reached a record high 30%. Worth noting, though, that the lower tax rate is seasonal – and related to benefits from tax incentives – and will happen every year in the third quarter. So the earnings outperformance wasn’t as impressive as the headline figure suggested.

The average revenue per active customer (ARPAC) was $11 – down 2% from the previous quarter, but if you strip away the effects of currency fluctuations, it was actually up 2%. Yep, ideally, you’d want those numbers to grow, but that doesn’t mean this was a cause for concern. After all, those numbers include new accounts in Mexico and Columbia – where the company’s still in the typically expensive customer-acquisition stage.

Importantly, Nu has maintained its super low cost-to-serve per active customer at $0.80. And because its costs increased slower than its revenues during the quarter, its efficiency ratio improved again to an impressive 31.4%.

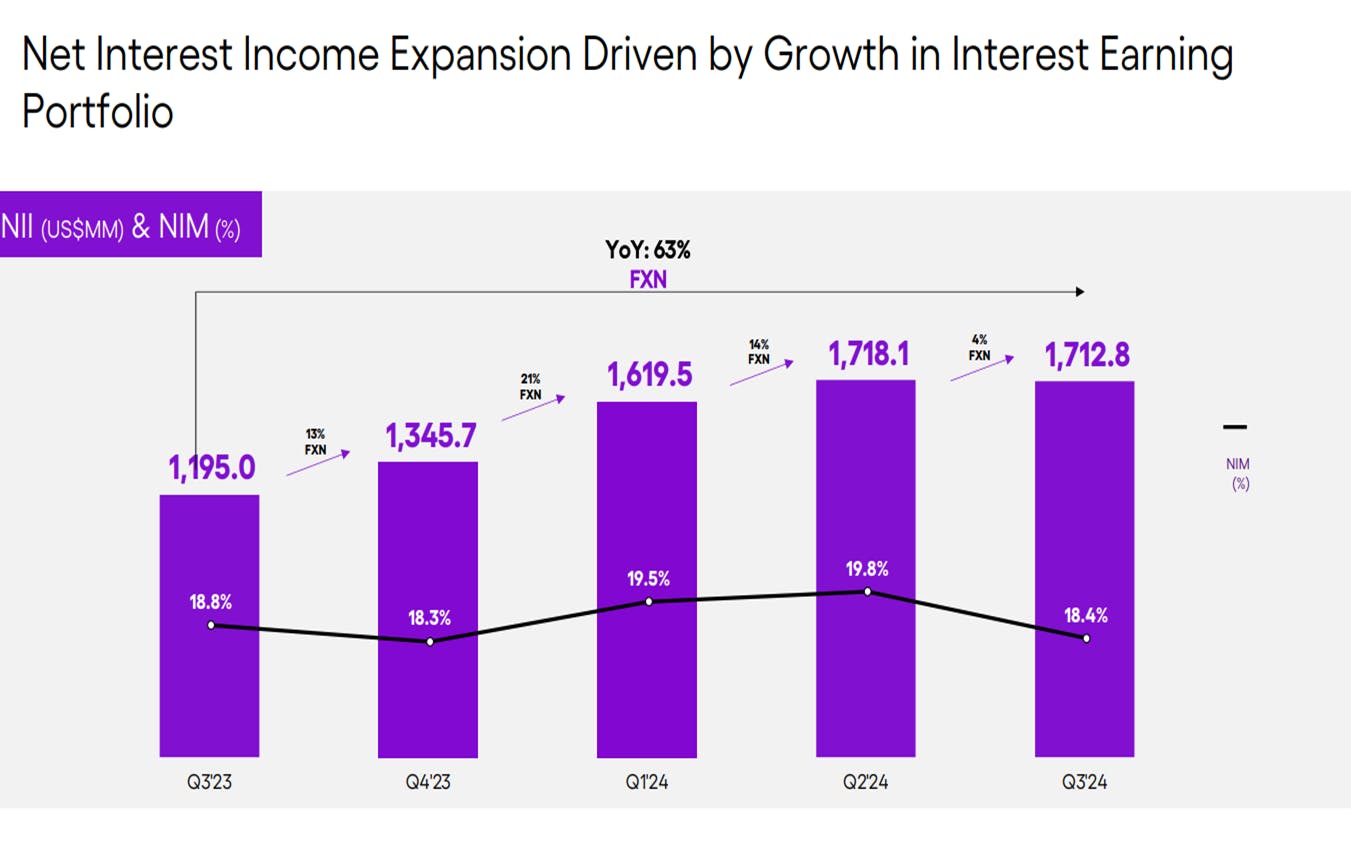

Nu’s net interest margin (NIM) – that’s the interest it makes from borrowers, minus the interest it pays out to savers – fell to 18.4%, from 19.8%. That could be a red flag, but when you look at the underlying factors, it doesn’t seem overly concerning. For starters, the bank’s funding costs increased as Nu attracted deposits from new customers in Mexico and Columbia – many of which are attractive, high-quality clients, with lots of potential cross-sell opportunities. Plus, the firm has already lowered its high rates for deposits in Mexico, and plans to do so again – and as it expands its loan book, the NIM will tick higher. And Nu has been intentionally doing more lending in secured products that have slighter lower yields, because they tend to have slimmer delinquency rates and so they’re less risky. Yields on Nu’s credit card portfolio also fell, reflecting an improvement in its customers’ risk profile and lower rates offered to some clients to maximize their lifetime potential value.

And then there was the foreign exchange impact. The Brazilian real fell 5% against the US dollar during the quarter, and the Mexican peso declined 10%. And that’s thorny for Nu, which makes money in those Latin American currencies but posts its quarterly results in US dollars. Still, with its loan-to-deposit ratio still modest, at around 33%, the bank has plenty of room to increase loans – which should improve its NIM.

Nu also launched its NuCel mobile phone service in the latest quarter. The firm’s looking to be more than a digital bank and it sees room for disruption in the region’s telecom space. After all, it’s a big market with millions of users and lackluster customer experience. Nu is partnering with América Móvil’s Claro, with the hopes of diversifying its revenue and building steadier fee-related income streams.

In a routine regulatory filing last week, Berkshire Hathaway announced that it trimmed its holding in Nu by 20% last quarter. Buffett’s firm still holds more than $1 billion in stock, but because investors like to mirror Berkshire’s portfolio with their own, the news likely had some folks hitting the sell button. And to me, that seems the most likely reason for the shares’ current weakness.

There’s also the fact that Brazil’s economy is under pressure, with its government’s high debt levels undermining its efforts to control inflation and forcing interest rates higher as a result. That's not a new development, however – and importantly, the company has proved itself adept at growing even when the broader economy has struggled. So a slowdown on that front shouldn’t be a major issue – aside from the consequences that stem from a weaker Brazilian real.

There have been no significant changes to earnings estimates since its earnings update. Nu’s stock is trading at a 22x price-to-earnings (P/E) ratio based on 2025 consensus earnings, dropping to 16x based on 2026’s consensus, with profits expected to grow by an annualized 40% and return on equity seen as holding steady at 30%. With a price-to-earnings to growth (PEG) ratio of around 0.5x, the company looks attractive for a fintech and that’s thanks to its strong growth potential.

For more about Nu Holdings, check out my in-depth analysis. You can read it here.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

November 21, 2024

November 21, 2024 November 21, 2024

November 21, 2024 November 20, 2024

November 20, 2024 November 19, 2024

November 19, 2024