ECB Eyes Rate Cuts Despite Germany's Wage Boom

What’s going on here?

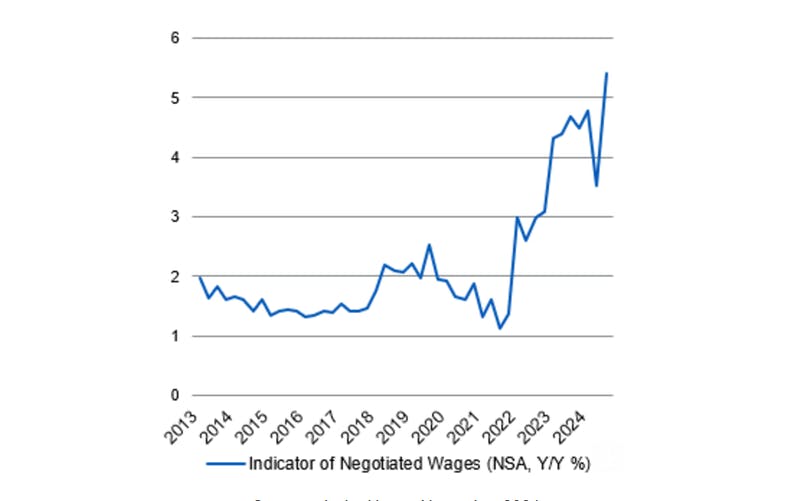

The European Central Bank’s indicator of negotiated wages surged from 3.5% in Q2 to 5.4% in Q3, led by significant salary increases in Germany.

What does this mean?

The unexpected spike in German wages contributed to a noticeable rise in the eurozone's overall wage growth, suggesting robust bargaining power in Europe’s largest economy. However, easing labor market conditions in Germany hint that this surge is not sustainable long-term. The ECB anticipates that wage growth across the eurozone will decelerate by 2025.

Why should I care?

For markets: Navigating rate cuts and market expectations.

Despite the current wage inflation, the ECB will probably move ahead with monetary easing by implementing a 25 basis point rate cut in December. And looking into 2025, economists at abrdn estimate there'll be four additional 25 basis point cuts, potentially reducing the deposit rate to 2.25% by April.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

More from Trading Terminal

November 21, 2024

November 21, 2024What Nu’s Latest Results Mean For Latin America’s Hottest Growth Stock

November 21, 2024

November 21, 2024ECB Eyes Rate Cuts Despite Germany's Wage Boom

November 20, 2024

November 20, 2024Profit Warnings Can Trigger A Stock Selloff: Here’s How To Know When They’re Coming

November 19, 2024

November 19, 2024