TransMedics Is Improving How Organ Transplants Are Done. Its Stock Could Be Life-Changing.

Introduction

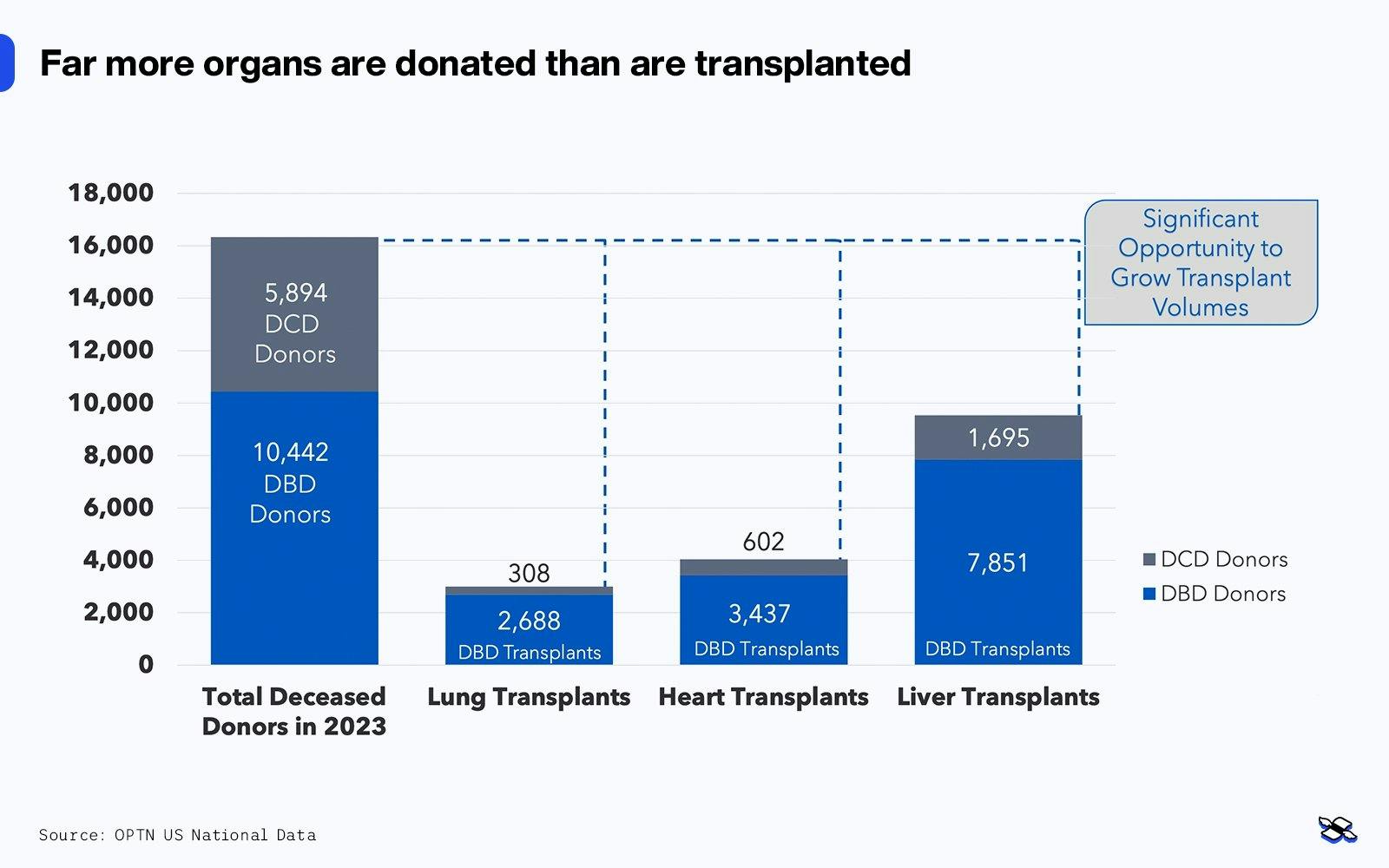

Donated organs don’t stay viable outside a human body for very long. And because they have to be a match for a potential recipient – in terms of size, genetics, and geographical location – most end up wasted rather than transplanted, despite an overwhelming need for them.

There’s always been a complex web of problems in this part of healthcare, from the medical to the logistical. But a company called TransMedics has been working to solve the ones it can. And now its big innovation – the Organ Care System (OCS), a portable device that replicates an organ’s natural, functioning environment – has been approved by the US Food and Drug Administration. And that makes TransMedics’s stock worth looking into.

Thesis

- TransMedics has developed a portable device that’s already transforming the organ transplant market.

- TransMedics’ Organ Care System (OCS) can keep organs healthy for longer outside of a human body, up to 24 hours in some cases, with warm perfusion technology that helps keep it in a “living” functioning state. The process increases the likelihood of a successful transplant operation.

- Traditionally, the standard of care for organs has been cold storage, which keeps body parts healthy for just a few hours.

- The OCS technology allows the donor organ to be checked to see whether it’s healthy and fully viable before surgery.

- The firm has also developed a transplant logistics network – including buying a charter plane outfit – to help with its next growth phase – an upgraded OCS for heart and lungs.

Risks

- Expected volume and market share gains in the organ transplant market could fail to materialize.

- With investors already pricing in strong growth expectations, any shortfalls in sales and profits would likely lead to sudden drops in the share price.

- Clinical evidence on the firm’s new OCS for lungs and hearts – due for launch next year – could fail to achieve its goals.

- Ongoing and future advances in bioengineering (synthetic organs) could change the state of the global transplant market.

- New competitors could enter the transplant market, upending the firm’s market-leading position.

- Regulatory changes could impact the firm’s pricing and volume growth, and a potential shift in leadership in the US Health and Human Services Department could amplify those risks.

This is a new type of analysis: detailed research into a single company’s stock, aimed at helping you evaluate a potential opportunity. Let us know your thoughts, and what you’d like to see next.

What does TransMedics do?

TransMedics’s new technology and its extensive logistics and support system make previously impossible transplants possible. Its Organ Care System (OCS) buys medical teams more time than they’d have under the old cold storage methods. And its National OCS Program (NOP) provides the transport systems and the medical specialists that transplant centers need.

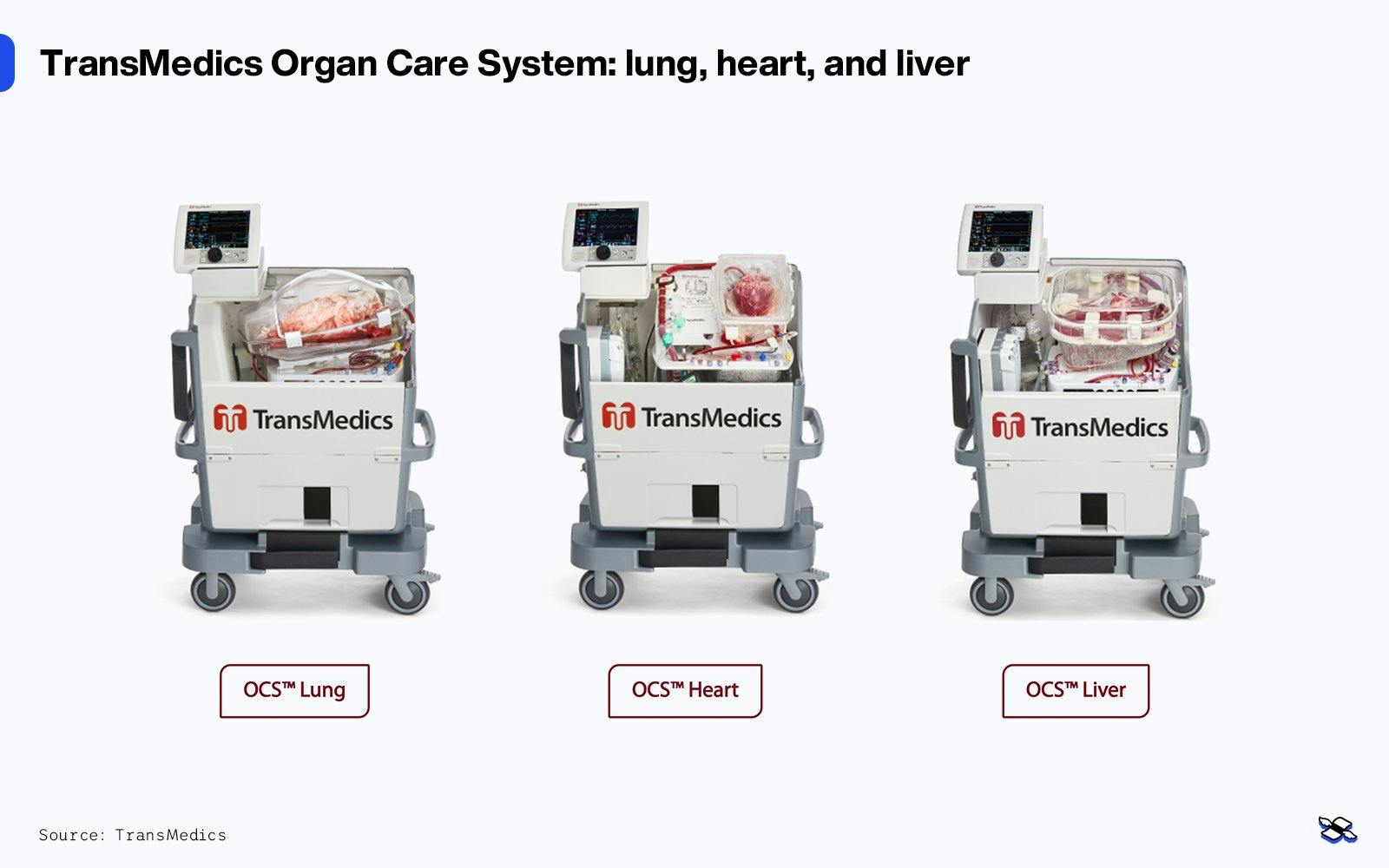

The TransMedics Organ Care System (OCS)

The OCS is transforming the transplant market by extending how long donated organs remain viable for transplant. See, the cold storage method (essentially: putting things on ice in a cooler) has long been the standard of care in transplant work. But it comes with severe limitations: organs placed on ice remain viable for only a few hours: this ischemic state – with no blood supply, and therefore no oxygen – can leave them permanently damaged. What’s more, organs in cold storage can’t be assessed for their viability – which adds to the risk of using them. With lungs especially, surgeons will typically refrain from using any donated material that’s of uncertain quality.

With OCS, donor material can be maintained in a living, functioning state, supplied (or “perfused”) with warm, oxygenated, and nutrient-enriched blood. The organs’ health can actually be optimized during transport, which increases the probability of successful transplants. The OCS also allows physicians to monitor and assess the viability of organs. It’s the only platform that can be used for donor lungs, hearts, and livers, and its transformative technology and improved clinical outcomes have seen its user base grow to 70 of the leading US and global transplant centers. All that and it's portable too.

Last year, 16,336 people who died in the US donated one or more of their organs – an almost 10% increase over 2022. With lungs, hearts, and livers combined, that’s a potential 49,000-plus transplants that TransMedics could have helped facilitate.

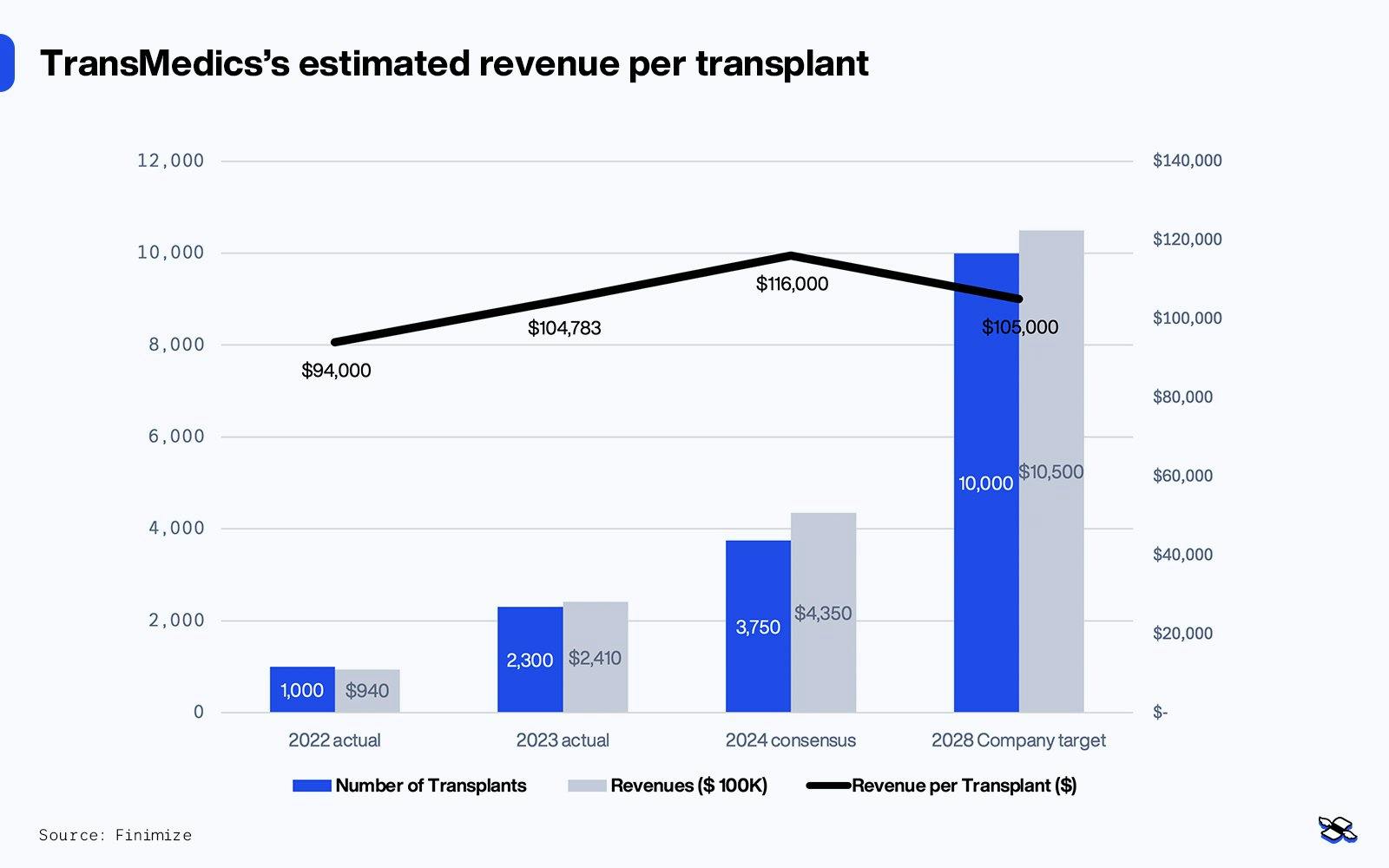

TransMedics carried out 1,000 transplants in 2022 and 2,300 transplants in 2023, and it’s on track to perform at least 3,500 this year. It’s aiming to do 10,000 transplants in the US by 2028.

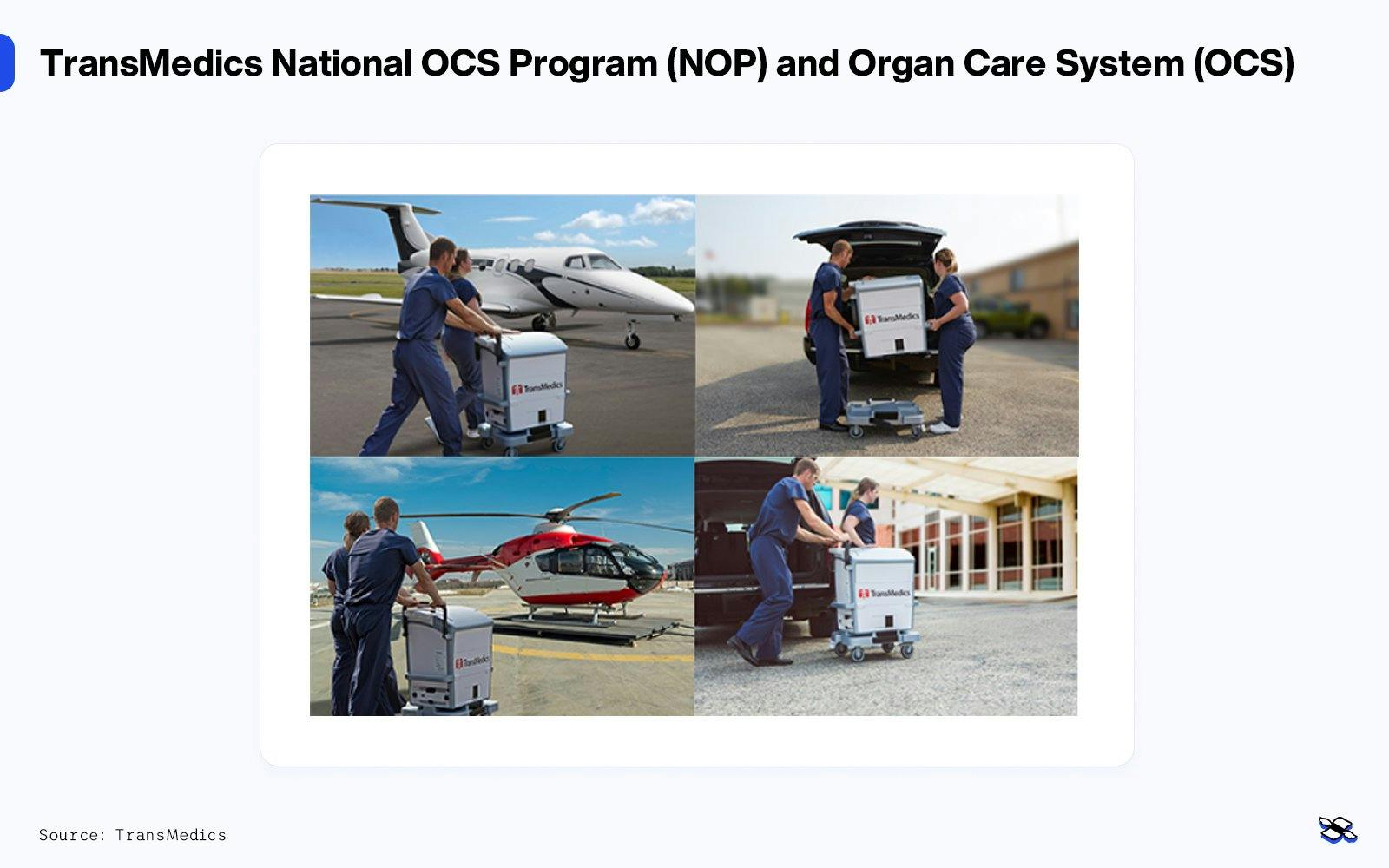

The TransMedics National OCS Program (NOP)

TransMedics started out as a medical tech firm, selling the OCS to transplant programs and transplant hospitals. And that was going okay, but the company ran into trouble when it tried to scale the business. Initially, medical experts had to visit the TransMedics HQ in Massachusetts to be trained to use the OCS and they had to be “on call” 24/7. When a donor was identified, they’d have to go to the donor, use the OCS to manage the organ, and bring it to the recipient, sometimes then performing or assisting in the transplant procedure itself.

The process was expensive and full of technical challenges. And there were lots of missed transplant opportunities – airplanes were expensive to rent and were often in the wrong place at the wrong time, and pilots weren’t always available when there was a plane.

So TransMedics built a solution: the National OCS Program (NOP). The company hired and trained medical specialists and invested in a big logistics network.

By the end of September 2024, the firm had purchased 18 planes and it’s planning to buy a few more in the next few months. It now has dedicated pilot crews that allow it to maintain constant operational availability, 24/7, 365 days a year. Hospitals now call TransMedics and say where the donor is located, and the firm can look after the whole process – sourcing, assessing, and delivering the organ to the receiving center – sometimes even babysitting the organ overnight, until the transplant procedure the next morning.

Controlling its logistics network enables the firm to share some cost savings with the transplant centers. See, an organ that’s donated after circulatory death (DCD) typically has about a 50/50 chance of actually progressing – often they’re not suitable for transplant. And in those unsuccessful cases, there’s no need to fly the organ anywhere. So TransMedics’ OCS assesses the organ on-site and if it’s not viable and no further flight is required, no additional costs are charged. That’s a saving over its rivals and over the firm’s old system – when traveling medical specialists would have to be transported back to their original destinations.

How is this changing the field?

The combination of OCS and NOP has resulted in increased transplant volumes, better clinical outcomes for patients, improved quality of life for patients and surgeons, and real cost savings for transplant centers.

Organs that become available are labeled as being from a donor after brain death (DBD) or a donor after circulatory or cardiac death (DCD). Before OCS, donors were predominantly DBD, because once the heart stops for more than 30 minutes, it’s uncertain whether it or the liver would ever function again. OCS and NOP have changed all that – and now DCD is the fastest-growing donor segment – and that’s a major reason heart and liver transplant volumes in the US grew by double-digits in 2023 far faster than they had been growing in recent history.

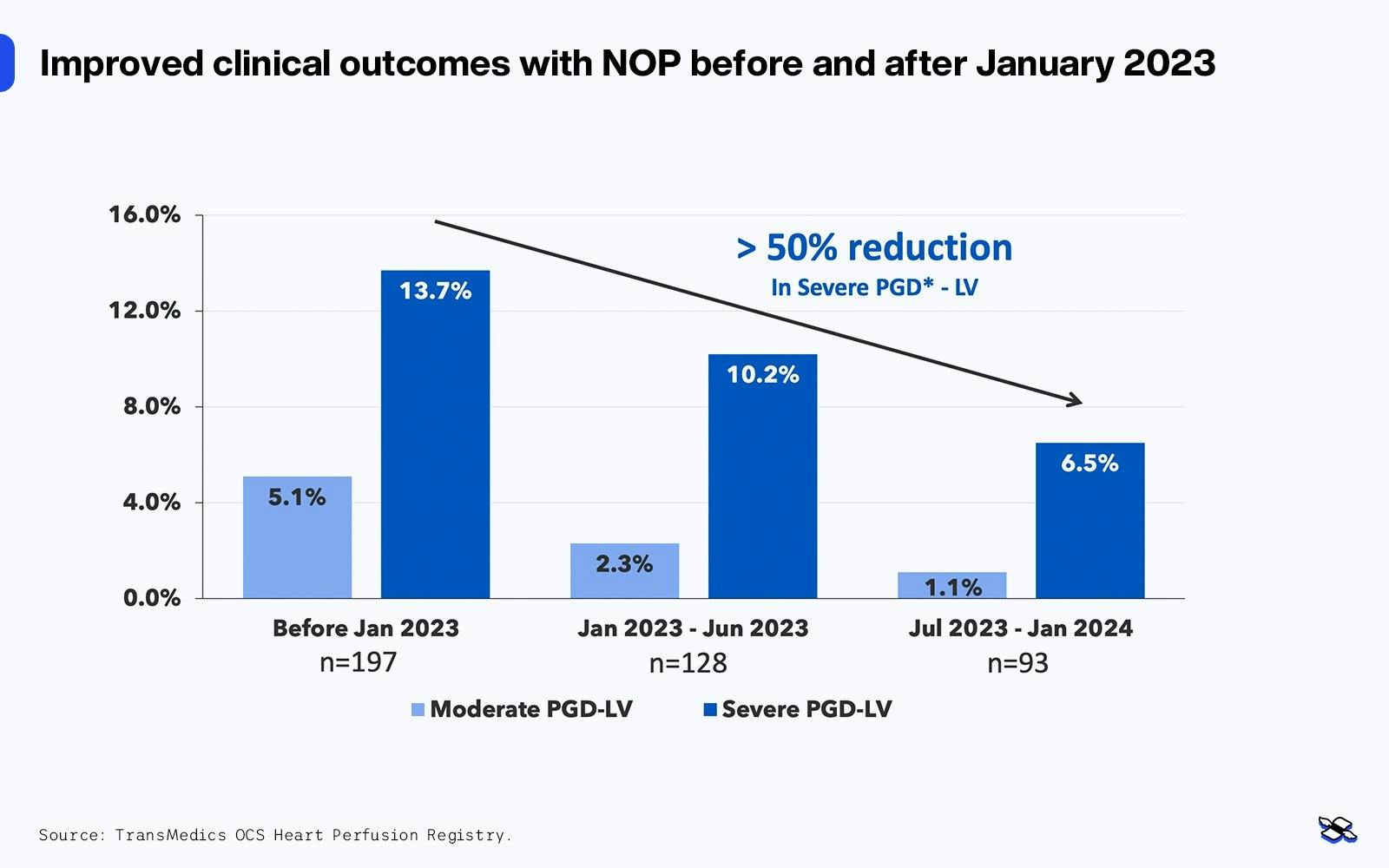

What’s more, there’s been a sharp decline in the number of transplants with moderate and severe primary graft dysfunction (PGD), or lung injury, since early last year.

Surgeons are seeing the benefit of the technology too – in terms of their own work-life balance. OCS has cut the number of nighttime liver transplants in half. When donated organs are stored on ice, they remain healthy and viable for a very short time – which means transplant operations have to be performed on excruciatingly short notice, no matter what the hour. Daytime surgeries are better for surgeons and patients: no one wants to perform or undergo an operation at 3 in the morning. And those procedures in the wee hours tend to cost hospitals more too, because of overnight labor expenses.

The ideal scenario is for organ transplant operations to be scheduled for regular day shifts – which has long been the practice for complex open heart and brain surgeries. That would not only improve the professional lives of surgeons working today, but it also might help attract new folks to specialize in this area, knowing the hours wouldn’t be quite so erratic.

What’s the firm’s next innovation then?

The company is set to launch new lung and heart OCS technology in 2025 and it has already shown successful results in pre-clinical trials. Helped by that new tech and its investment in its logistics network, the company is expecting to profit from a forecasted increase in transplant volumes.

Liver transplants have been the key driver of TransMedics’s revenue so far. But the firm has been developing its new OCS perfusion solution and new circuit designs for its OCS lung and heart clinical programs. Warm perfusions for the heart and lungs are expected early next year, and cold perfusions for the heart later next year.

Pre-clinical testing results have been encouraging – consistently demonstrating strong outcomes for OCS Heart and OCS Lung, with up to 24 hours of OCS perfusion. The advancement is being seen as an important milestone for the company and the industry, enabling morning transplants for lung and heart transplants, and putting the 10,000 transplants target within reach in 2028. The firm plans to showcase its findings at the Heart and Lung Transplant Scientific Conference in Boston early next year.

What is the firm’s competitive position and what are its risks?

There are rivals out there, but TransMedics' portable warm perfusion technology puts the company in a very strong place, especially for organs that need to travel longer distances to their recipients.

No other firm has a warm physiologic portable technology that addresses the heart, lungs, and liver, and that gives TransMedics a major advantage with further-flung organ donors. But there are a few competitors in the market.

Sweden-based Getinge recently acquired Paragonix, a US-based transplant specialist, for nearly $500 million. Paragonix’s technology has added pumps to help improve the quality of organ preservation, but it still uses the more limited cold storage science and doesn’t have the functionality for DCD cases. TransMedics, meanwhile, is planning to launch its own OCS cold perfusion technology for the heart in about a year – which it expects to be competitive.

Sweden-based Xvivo has developed a portable warm liver support technology, but it can support a liver for only six hours, compared to the 24 hours that TransMedics’s OCS can do. It’s also available only in Europe: it hasn’t been approved for the US market. And for heart and lung, Xvivo remains far behind TransMedics’s OCS offering.

And two other methods have experts’ attention right now.

The first is a new single-organ non-portable warm perfusion technology that’s being used in some centers. It works, but because it’s not portable, the liver is still initially stored in cool temperatures – and that risks damage. It then requires two or three hours of warm perfusion in the hospital, which extends the process further. OCS avoids those additional warming hours, so it’s more efficient.

The other is normothermic regional perfusion (NRP), a controversial process that restores oxygenated blood flow after circulatory death or cardiac arrest while the organs are in the body. Importantly, thoracic-abdominal NRP for the heart, lungs, liver, and so on, still has some unresolved serious ethical questions that are being examined by the Organ Procurement and Transplantation Network (OPTN). The issue is that the method circulates blood around the organs and negates the prior declaration of death by circulatory criteria. In addition, the process prevents blood flow to the brain, so it induces brain death.

So TransMedics has an edge in the field now. That said, potential changes to regulations regarding healthcare benefits, practices, and costs in the US could impact the firm’s future sales, profit margins, and share price. Roughly a third of Americans who undergo heart, lung, or liver transplants are Medicare patients. The majority are covered by private health insurers.

What’s the stock look like now?

TransMedics has reported impressive annual sales growth in the past two years. And if the company meets its goal of 10,000 transplants in 2028, the current stock price will prove cheap. But plenty of hedge funds appear to have doubts: they’ve built a considerable short position.

Recent earnings

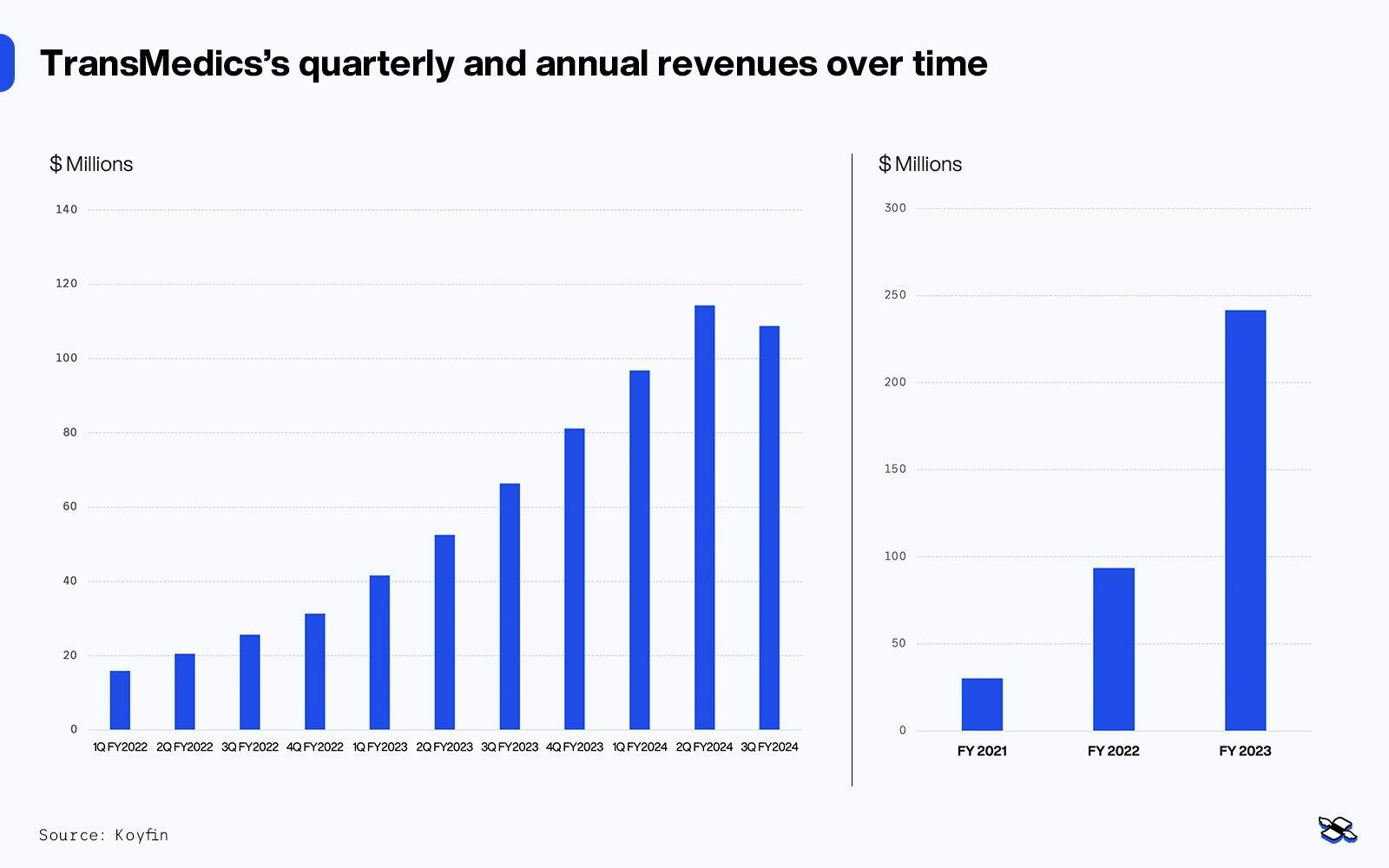

The company is expected to post its first profitable year in 2024 and is forecast to see robust growth over the coming years. It turned free-cash-flow positive for the first time in the second quarter of this year and continued that streak in the third quarter.

In the latest quarter, revenue was at $108.8 million, up 64% on the same period last year, but down 4.8% on the prior quarter and roughly 6% shy of analyst expectations.

By organ, its revenue was $76.7 million from liver procedures, $24.5 million from heart, and $3.7 million from lung – all slightly below expectations. Sales from outside the US totaled $2.6 million – not massive but with plenty of room to grow and that’s part of the company’s mid- and long-term plan. The firm didn’t change its full-year revenue guidance – forecasting $425 million to $445 million, which represents growth of at least 76% from the year before.

The firm’s executives said the sales shortfall happened because of a 5% slip in US transplant volumes in the third quarter – which they explained as a typical summer seasonal effect. They were pretty adamant that the company hadn’t lost market share to anyone. Still, investors seemed concerned that recent strong market share gains had slowed.

Deeper into the numbers, gross margins (that’s net sales minus the cost of the goods) dropped sharply to 56% in the quarter, from 61% in the first half of the year, and net income (that’s the profit after all expenses) was $4.2 million, down from $12.2 million in the second quarter as costs catapulted higher.

While the product gross margin was 80%, up from 77% from the year-earlier period and steady from the quarter before, its services gross margin dropped to 19%, as one-off costs increased sharply.

Investments – like buying four planes and doing scheduled maintenance on eight other planes – impacted margins. But the firm said those costs were one-offs – necessary to support its sales acceleration in 2025 – and would drop away in the fourth quarter.

Forecasts and valuations

Now, remember: TransMedics carried out 1,000 transplants in 2022 and 2,300 transplants in 2023, and is on track to do between 3,500 and 4,000 transplants this year. Its revenues were $94 million in 2022 and $241 million in 2023, and are expected to be around $435 million in 2024. That averages around $105,000 in revenue per transplant across the three years – because the revenue per organ includes both the case volume and the service component. Based on the average, if the company hits its target of 10,000 transplants in 2028, its revenues would be just above $1 billion. Its profits, on the other hand, will depend on what margins it achieves.

High-growth medical tech firms generally trade in a range of around 6x to 9x price-to-sales, depending on expectations, and that wide range helps explain analyst target prices of $87 to $180, versus its recent price of $80. TransMedics’s shortfall in third-quarter results sent the stock down more than 30% – to $80 less than half of what it was in August when it hit an all-time high of $177.

Now, the company’s sales are predicted to grow strongly, to around $550 million in 2025, and $670 million in 2026. TransMedics’s current market cap is $2.7 billion. And based on a 6x price-to-sales ratio, its market cap would be around $3.3 billion on 2025 estimates, $4 billion in 2026, and in 2028, if it reaches its 10,000 transplant target and revenues do hit $1 billion, then its market cap would hit $6 billion. That’s a little more than double the current level.

But if the company achieves that faster growth trajectory, and a 9x multiple becomes more justified, then its market cap would increase to around $5 billion in 2025, $6 billion in 2026, and $9 billion in 2028. That would be a little more than triple the current share price.

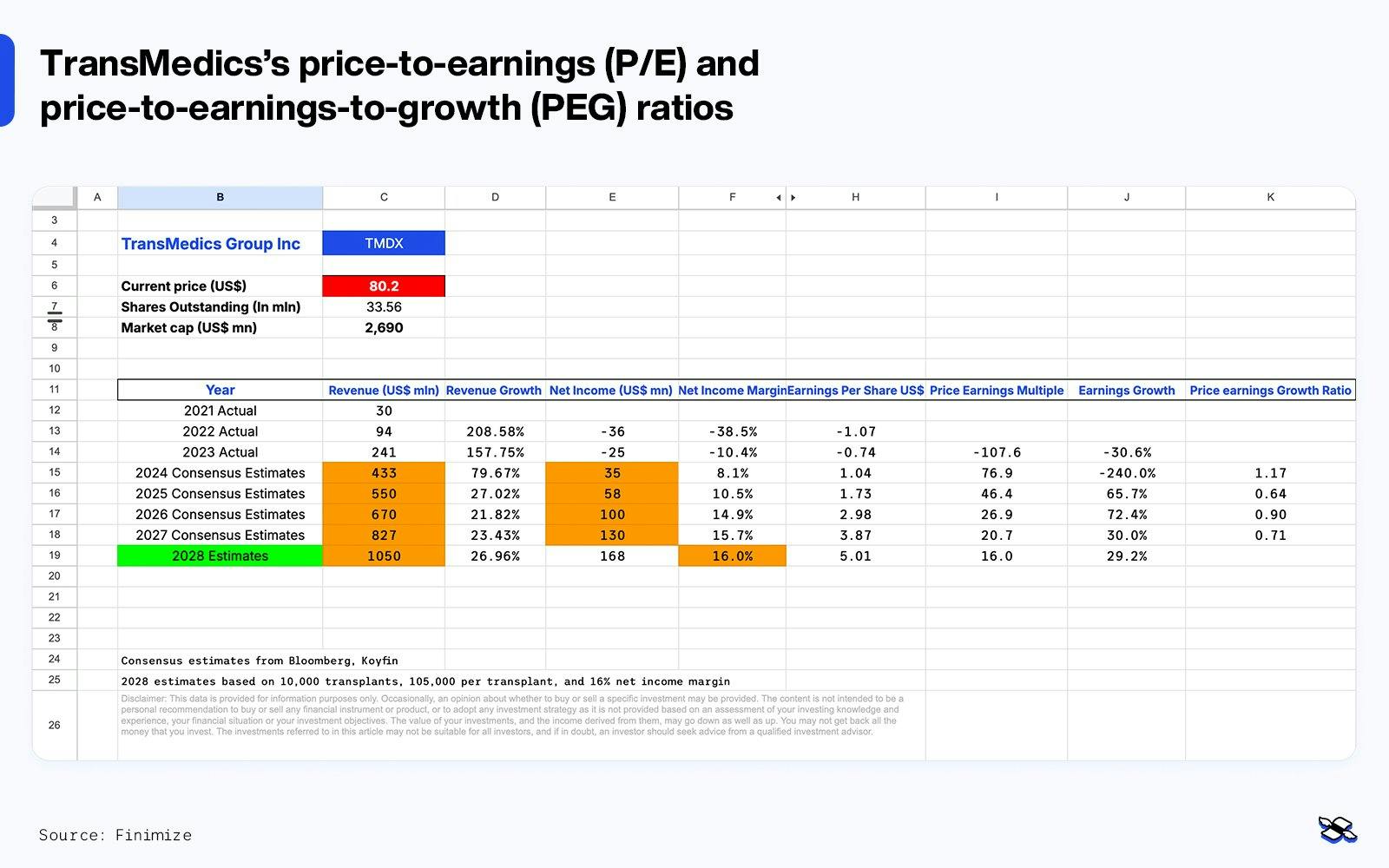

A price-to-earnings-to-growth (PEG) ratio factors in profits, not just revenues. A low PEG ratio makes the stock more appealing – with anything below 1x considered attractive. The figure is calculated by dividing a share’s price-to-earnings (P/E) ratio by the growth rate of its earnings. Using consensus growth forecasts for 2025 to 2027, TransMedics is trading at a 0.91x PEG ratio. But if in 2028, TransMedics hits its 10,000 transplant target, with a similar net margin, the PEG ratio would drop to 0.7x – and the stock would be trading at 16x P/E.

All that data is shown here on this sheet and you can adjust the assumptions to see how things pan out. Just note that you’ll need to copy and save a version of the sheet so that you can play around with the sales and profit margin assumptions. Cells highlighted in orange can be edited – that’s mostly revenues and net profits – the other cells are formulas and will calculate automatically.

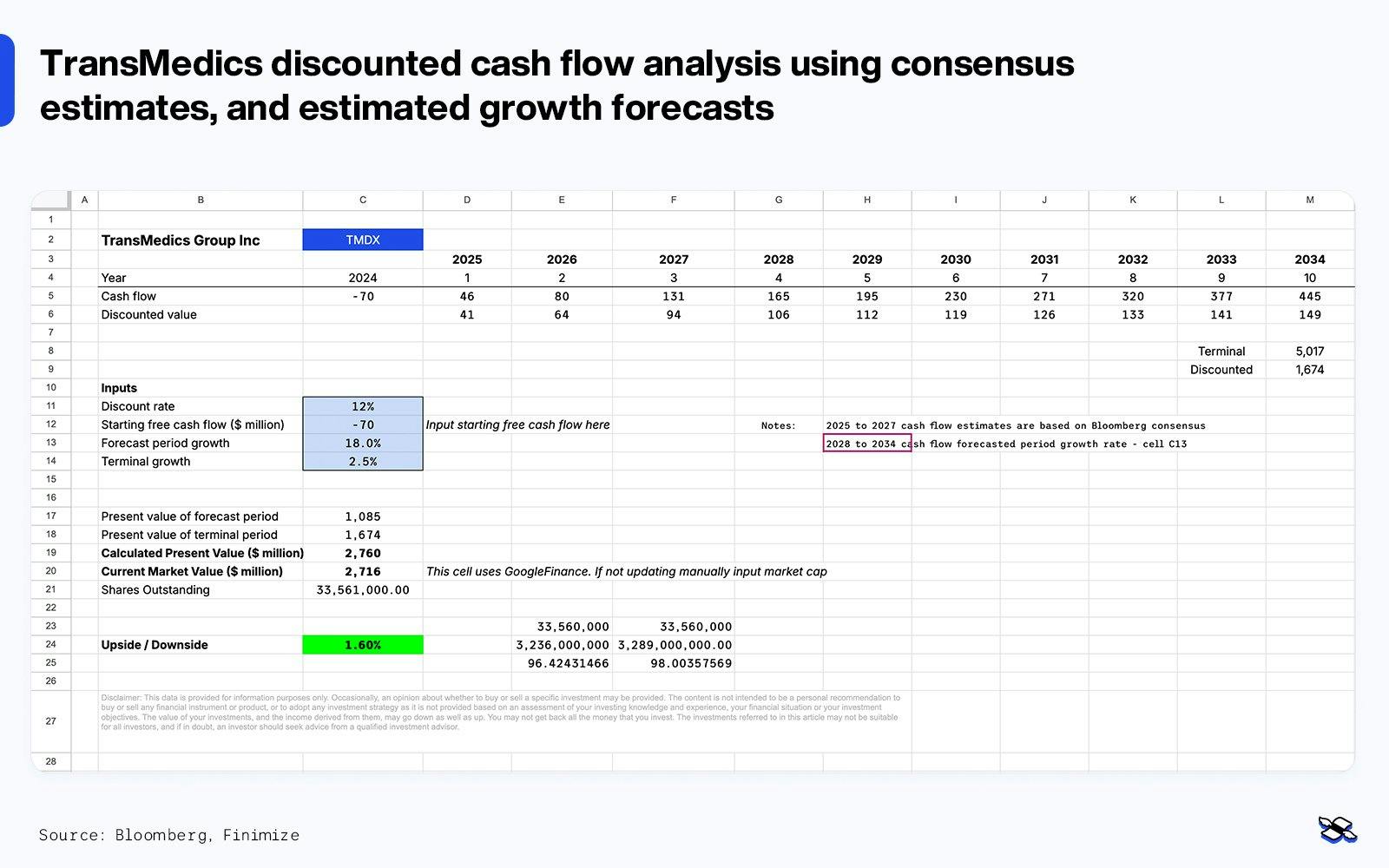

Using a simple discounted cash flow model, you can see what’s currently priced into the share price. And, again, you can copy and save a version of the model for yourself. It shows that the company is trading at fair value (cell C24 in green), based on consensus cash flow estimates for 2024 through 2027, with 18% cash flow growth from 2028 to 2034, along with a terminal, or indefinite growth rate of 2.5%. To exceed those expectations, the company would have to achieve its 2028 sales targets and operate its logistics network efficiently, benefitting from the strong operating leverage after its recent capital investment program. You can change the assumptions in the light blue cells in column “C” to test different scenarios.

But here’s something important to be aware of: TransMedics’s elevated valuations and its poor third-quarter results prompted some hedge funds to short the company. And, according to Bloomberg, there’s been a further increase in shorts to around 8.4 million shares – or roughly 26% of the total shares outstanding – with medical device, pharma, and biotech stocks under pressure since last week when a medicine and science skeptic was tapped to lead the US’s department of health. That’s big: anything over 10% can be considered to be a “crowded short”.

The hedge funds may be glad about those shorts if TransMedics fails to deliver on its promises, or if pricing pressures from the new US government change the profit outlook for the firm. But if the company delivers on its planned strong growth, or those regulatory worries prove to be exaggerated, then these shorts will likely be forced to cover, giving the stock a major boost.

The shares are volatile: in 2023, the stock price fell 60% when the company announced the acquisition of the charter plane company Summit Aviation. At the time, investors panicked that the firm was perhaps making the wrong strategic move. By August 2024, all had been forgiven, and the share price had rallied around 400% because of a sunnier revenue outlook. Now sentiment and expectations have reversed again. It’s a fairly erratic stock, but then again: it’s always difficult for fast-growing companies to report smooth quarterly results, especially when they’re investing for future growth.

Overall, I like TransMedics’s growth outlook, thanks to its leading technology and how it’s changing the organ transplant scene. Regulatory changes in pricing and reimbursement remain a risk, but recent weakness has arguably factored that in. The stock may not be suitable for a core position, since it's a high-risk, high-reward idea and its share price is likely to keep its volatile ways, but if its sales and profits get back on track, and those regulation fears come to nothing, it could be a rewarding investment.

You can look at TransMedics’s last five years' financial highlights here.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

More from Trading Terminal

November 21, 2024

November 21, 2024What Nu’s Latest Results Mean For Latin America’s Hottest Growth Stock

November 21, 2024

November 21, 2024ECB Eyes Rate Cuts Despite Germany's Wage Boom

November 20, 2024

November 20, 2024Profit Warnings Can Trigger A Stock Selloff: Here’s How To Know When They’re Coming

November 19, 2024

November 19, 2024