What’s going on here?

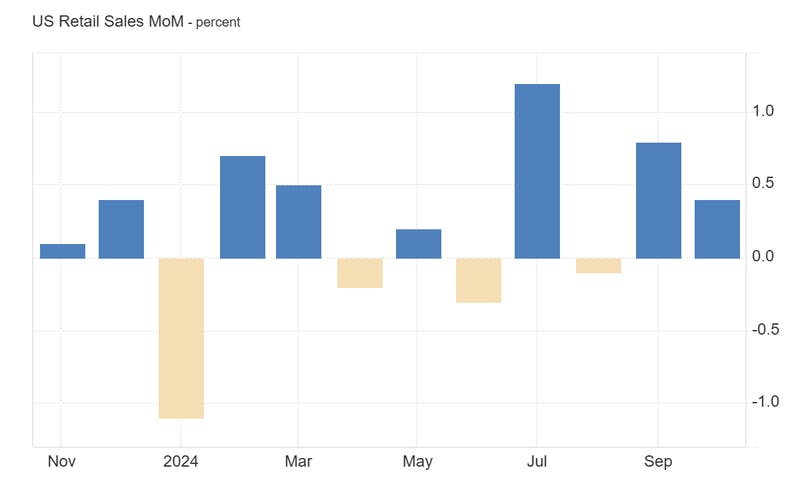

US retail sales inched up by 0.4% month-over-month in October, buoyed by a surge in auto sales, despite a drop in core sales which trailed market predictions.

What does this mean?

The increase in US retail sales indicates consumer strength, particularly in autos. October's retail uptick came mainly from car sales, while core retail sales – excluding autos – fell by 0.1%, sparking concerns about broader consumer spending patterns.

That said, the upcoming holiday season typically boosts retail activity, suggesting potential resilience ahead. And the Federal Reserve's outlook, painted as "remarkably good", suggests a steady economic footing.

Why should I care?

For markets: Retail and rate ruminations.

The slight rise in retail sales is a balm for markets experiencing manufacturing turbulence. Investors are eyeing the Federal Reserve's next moves, with potential rate cuts this winter contingent on steady consumer spending trends and pending geopolitical pressures. Market sectors linked to discretionary spending and automotive sales are better positioned for possible growth amidst the holiday shopping surge.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

November 21, 2024

November 21, 2024 November 21, 2024

November 21, 2024 November 20, 2024

November 20, 2024 November 19, 2024

November 19, 2024