What's going on here?

Bill Ackman’s Pershing Square doubled down on its Nike investment last quarter.

What does this mean?

Pershing Square's Nike bet rose to $1.4 billion in the third quarter, up from $220 million at the end of the second quarter.

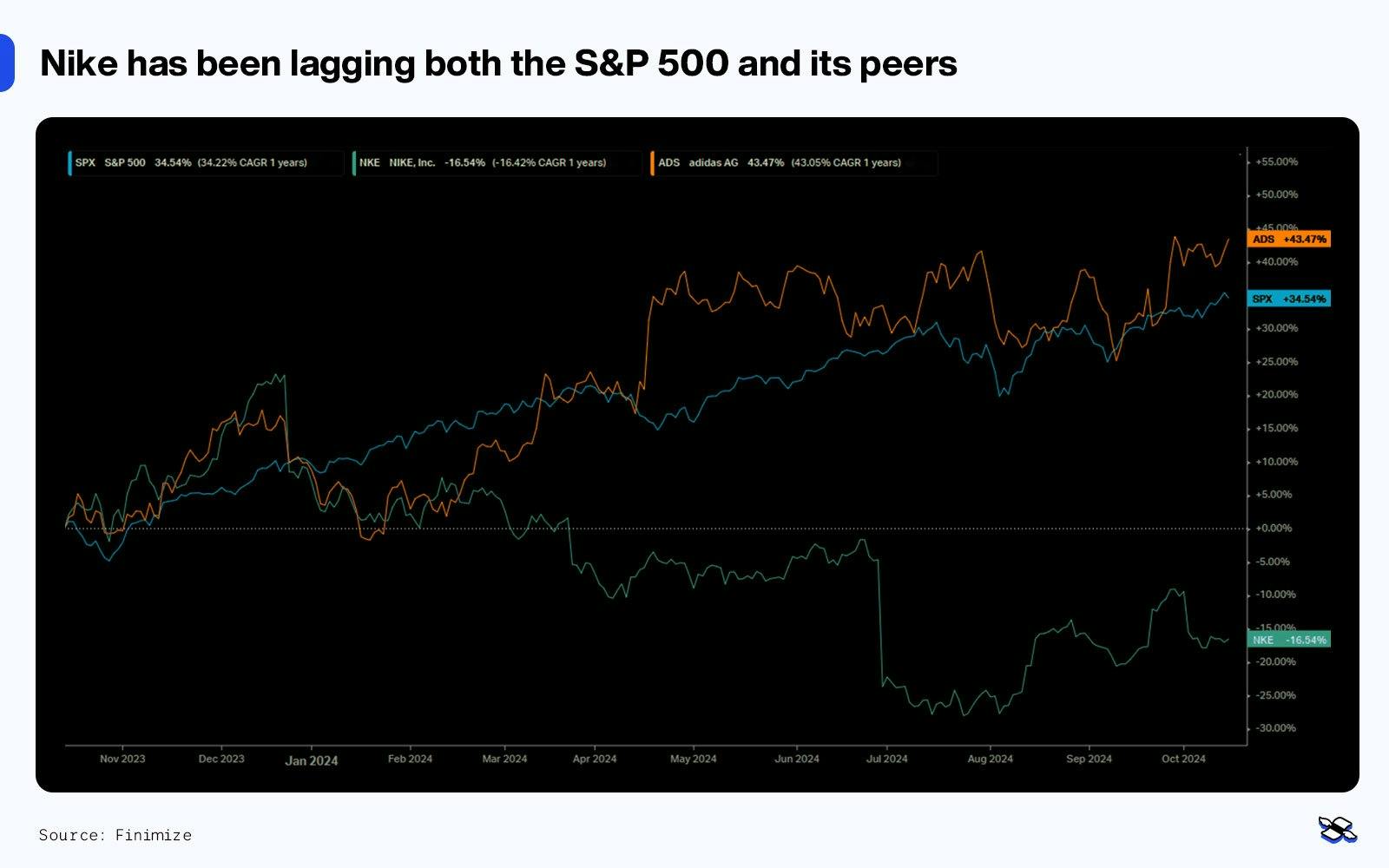

Nike may be down, but as any sports fan knows, that doesn’t mean it’s out. The company’s stock has slumped 30% this year, which just might bring long-term investors back into the arena. Sure, the firm’s had some challenges – slowing global demand and a sales strategy revamp that badly missed the mark, to name just two. But the swoosh-emblazoned sportswear brand is still the undisputed champ of this league, with a 40% market share. And with Nike veteran Elliott Hill coming out of retirement to serve as its new CEO and a big 40th-anniversary celebration in the works for the iconic Jordan line, this firm could be ready to rally.

Why should I care?

For markets: 35% potential upside in the next year.

Running the numbers based on conservative estimates, Nike has an upside potential of at least 35% over the next 12 to 18 months, making it a compelling opportunity for those who love a good comeback story. But if global economic conditions worsen, consumer spending could take a big hit, affecting Nike’s sales, particularly in North America.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

November 21, 2024

November 21, 2024 November 21, 2024

November 21, 2024 November 20, 2024

November 20, 2024 November 19, 2024

November 19, 2024