3 Day Trading Strategies With Level 2 Signals

Andrew AzizApril 17, 2023

Andrew AzizApril 17, 2023

Dear Traders,

It is official, the earnings season officially started today with major banks and hedge funds reporting their earnings. JPMorgan Chase nailed their earnings and surged over 7%. I traded JPM with 3 trading strategies: ORB, ABCD Pattern, and 9/20 trade.

We had some solid trading from Brian this morning on Apple and Tesla and lots of trade setups were available. Paras nailed it on AMD and Thor traded many futures. John traded Google. Please watch my recap here where I walk you through what I saw plus explain how I traded 1 stock with 3 different strategies.

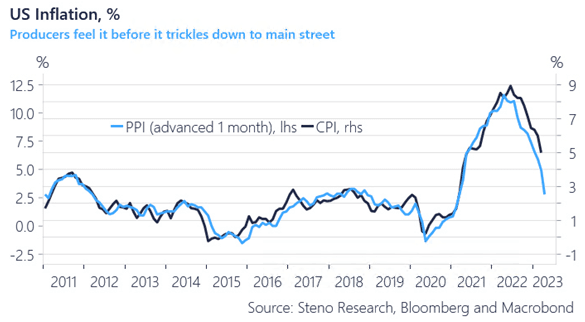

As Ardi wrote for Trading Terminal, it has been an interesting week with 2 major data points coming in this week: the CPI and the PPI. For those who don't know, the CPI is the consumer price index and the PPI is the producer price index. Usually, the producer price index leads inflation by about 1 or 2 months. The chart below shows this relationship clearly.

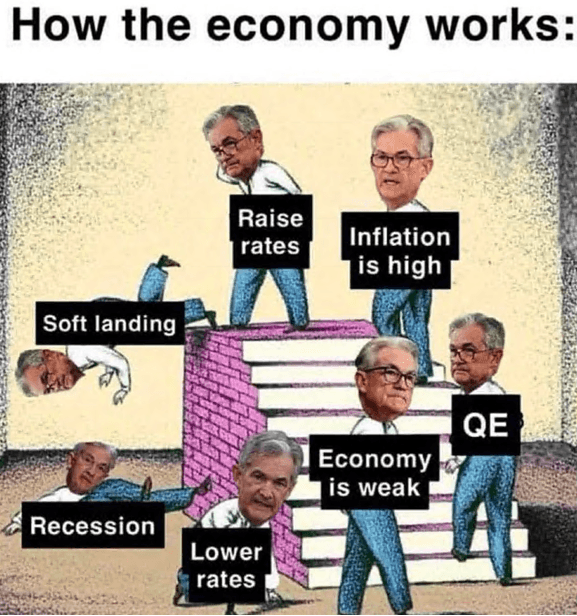

Mark May 3 in your calendar now. That’s when traders expect the Federal Reserve to hike rates for the last time in this tightening cycle. But what is interesting is that despite repeated pushback from central bankers that the rates be kept higher, the market is now betting on 3 rate cuts this year from that peak, firm in the belief that a US recession is coming. It is funny that the Fed is saying "we will keep the rates higher" but the market says "nope, you are bluffing, you will bring the rates down! That is how a business cycle works".

But why are bond traders betting that rates are coming down? It’s because they expect the economy will get worse. They believe inflation is coming down due to the imminent recession risk that is being priced in the markets. If a recession hits, the rates have to come down.

At Peak Capital Trading, we sold out 50% of our bootcamp spots this week! Thanks to everyone who is excited to join me and our senior traders in a 3-month intense journey focused on their development as a trader. We usually have about 20% of our traders coming back every bootcamp to repeat the semi-private mentorship development process we offer.

We are starting our 9th bootcamp at Peak Capital Trading! We have been fortunate enough to have our bootcamp sold out each and every time, and we are hoping to achieve the same result this time around as well. If you are a trader struggling to build your TradeBook or reach consistency, please consider joining the PCT bootcamp. We have changed the way we do these bootcamps and they are now far more hands-on than they were at the beginning. In most respects, you will feel like you are receiving private mentorship.

As part of our bootcamp, you will participate in 22 live trading sessions, and they have been described as “game changing” by our previous cohort of traders. Feel free to check out the program and the testimonials here.

Looking forward to seeing many of you in the chatroom on Monday.

To your success,

Andrew

PS: I love to stay connected with everyone on social media and each platform is of course different:

> Follow me on Instagram for the travelling trader lifestyle!

> Connect with me on LinkedIn for professional content.

> Follow me on Twitter for trade recaps and some memes!

> Subscribe to my YouTube channel for hot content from BBT team.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

Andrew Aziz

Andrew AzizAndrew Aziz (Ph.D.) is a Canadian trader, investor, proprietary fund manager, official Forbes business Council member, investor, and #1 best-selling author.