How Much Money Will You Need at Retirement?

Yet again, the “fear of not having enough money in the future” reaches top 10 fears in America. Year after year, this fear is amongst the heaviest on American minds, next to running out of drinkable water, nuclear war, climate change, and death. But why? It could be a natural survival instinct, but I don’t think it’s that deep. I believe the real issue is that we don’t have a plan during the accumulation stage of our life. Many Americans will just opt into a 401(K) plan (if that) and hope for the best, then fear kicks in roughly 15 years away from retirement age. I’m here to tell you there’s a better way! Creating a retirement plan in your mid-20s is very doable, and not as hard as the financial industry would have you believe. Allow me to walk you through a template that can get you started in creating your own personal, customizable retirement plan. Keep in mind that this is a plan, every plan needs adjustments along the way, and unless you have a crystal ball, we do not know what will happen in the future.

Step 1: Start with the end in mind

When approaching any endeavor in life it’s always good to start with “what’s my end goal?”. The end goal of a retirement plan is NOT to be rich, and it’s NOT to pass on generational wealth. That would be nice icing on the cake. However, your primary goal for your retirement account(s) is to: provide income (aka cashflow) for you, when you are no longer working, to sustain your lifestyle.

So, by working our way backwards we need to ask ourselves, how much income in today’s dollars will I need at retirement (we will also attempt to plan for inflation)? Spend some time on this question because it will be the basis of all the calculations to come. Now it is critical that you are fully transparent with yourself and honest. I’ve done multiple seminars and workshops with dozens of people in the crowd, and I’ve gotten answers ranging from $20k/year to $1M/year. $1M per year may not be reasonable for some, and $20k/year might be laughable for others. However, in the end I will share my thoughts on this. But if you are an average American then your goal will probably range somewhere between $50K-$100K/year to maintain your current lifestyle. According to the U.S Bureau of Labor Statistics, the median income for a working adult, ages 25-64, is between $50k to $60K. I used median income, rather than average, to remove the tail-ends.

Therefore, moving forward we will use $60K per year for our example. Keep in mind that this is assuming that you will retire in the U.S. Numbers change drastically if you consider the expat life. I’m a huge advocate of this, as it is a major financial hack! The U.S is one of the top countries for accumulation, BUT one of the worse for decumulation! Take for example these comparisons, in the U.S, $60,000/year income for 2 adults puts you in the 50th percentile (aka average lifestyle) But the “average lifestyle” in the following countries is:

- Spain, UK, Italy: $40,000/yr.

- France, Portugal, Japan: $30,000/yr.

- Mexico, Costa Rica, Colombia: $12,000/yr.

- Argentina, Uruguay: $18,000/yr.

So, you can live like kings and queens in Latin American countries, or even upper middle class in Europe, for the same cost of the average American lifestyle. If you are set on retiring in the U.S that’s fine, I’m just encouraging you to take some time to see what your USD can buy you in other countries. For example, I saw a listing in Colombia for $670K, that was the equivalent of a $5M property in the U.S! I’m just saying at the very least you could find it to be a fun exercise!

Step 2: Run the numbers

Ok so now you have your target cashflow (income). Remember we’re using $60k for our example. Now, there’s many approaches to how you can go about it. But to avoid discussion of the endless possibilities I will provide a simple, yet realistic calculation that can get you there. By going to calculator.net you can plug in the numbers that best fit your lifestyle and market expectations. Remember the goal of this exercise is to provide you with a template that you can use to calculate your own needs.

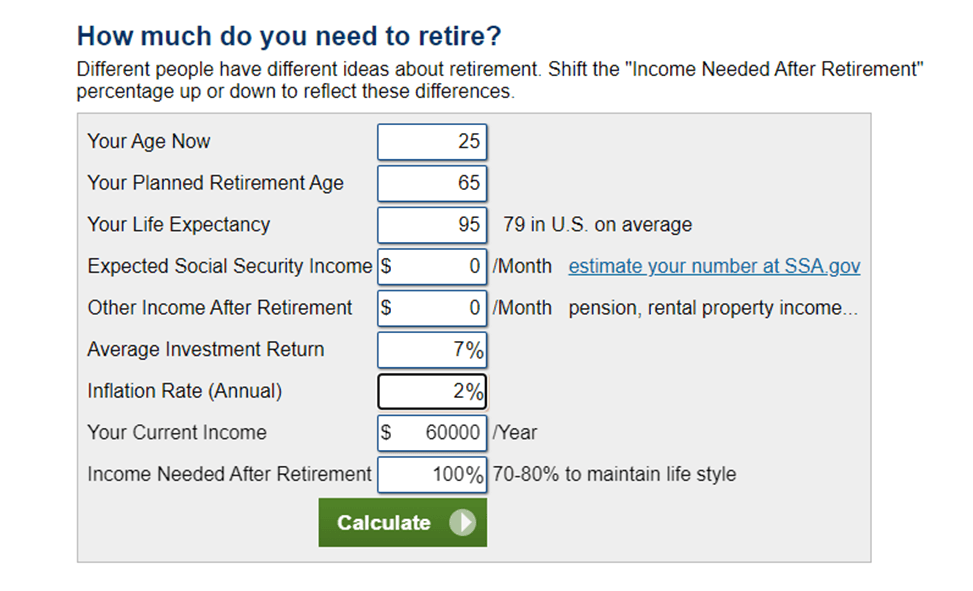

In this example you invest from age 25 to 65. Your life expectancy is 95, let’s be optimistic and believe you will have a long and prosperous life, but if you die earlier, then your financial worries are over, and your spouse and children will inherit the left-over capital. I’m using a 7% expected return during your accumulation stage, feel free to adjust it if you find it too conservative or aggressive. This is probably where you should consult a financial advisor to help you build a portfolio with your risk tolerance and desired returns. In this example, I have zero expectations for social security income or pensions. Those are topics for another day, but ultimately 40 years from now those are incomes that we have no say in, so better we leave them out in my opinion. Unless you are already closer to retirement and can confidently calculate your expected income. We will use a 2% inflation rate because that’s the average rate the Fed says we’ve experience in the last 10 years (but use 3% if you want to be more conservative).

Plug in our $60k salary with the same expectation (100% of it) at retirement. We press calculate and we get $2.1M.

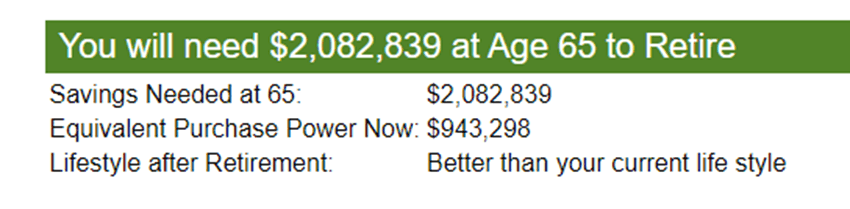

Below is an image that uses the “equivalent purchase power now” number of $943,298 to give you an idea in today’s dollars, of how that drawdown plays out throughout the retirement years. Using a 4% annual yield on your portfolio at retirement and the 2% inflation rate. Remember we will re-do this with the inflation adjusted number of $2,082,839.

Step: 3 Take the actions to make it happen!

Now we know how much you need to have at retirement to live on $60,000 in today’s dollars. Which is roughly $2.1M. Seems like a lot? It’s not really that hard to achieve! Let me walk you through it. Remember the $60K lifestyle to be in the 50th percentile in the U.S is for 2 adults! This is key because assuming you will have a spouse/partner at retirement, each of you will only need to bring half of that bag! That’s roughly $1.05M target balance per person.

We continue to work ourselves backwards and now we need to calculate how much we need to contribute each month to trend to hit that number.

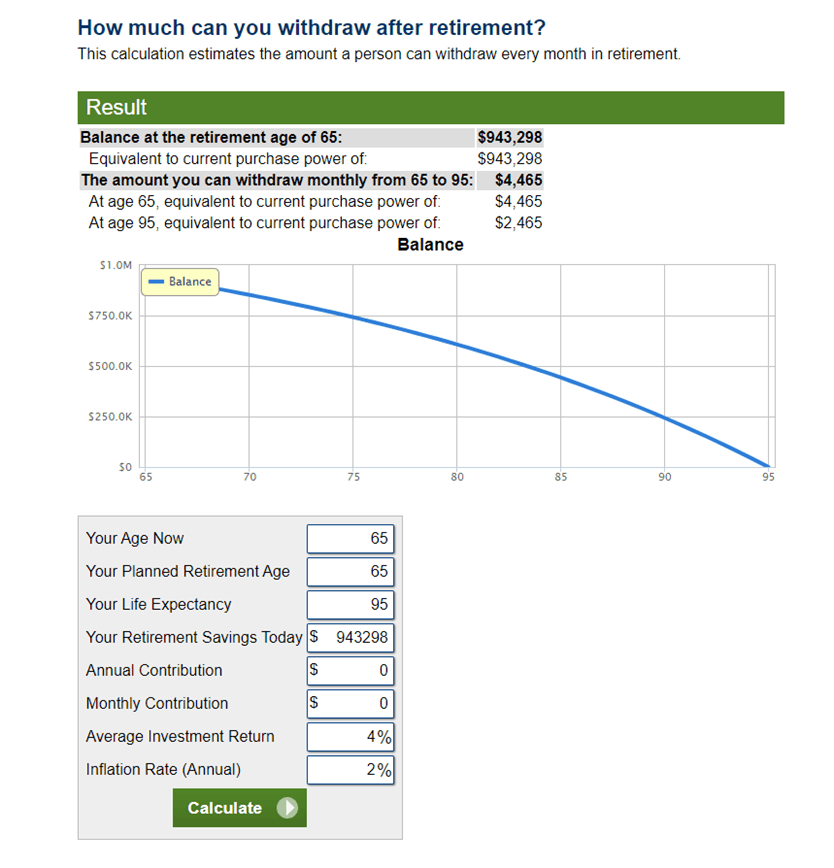

Here you can see that investing from age 25-65 (40 years) at a 7% return, contributing $500 per month, gets you well over your individual $1.05M target, putting you closer to $1.25M each and a joint $2.5M retirement balance. In this scenario I believe that should be a very healthy number to aim for to account for discrepancies.

Now more importantly why did I use a $500 contribution? Most Americans work for companies that offer 401(K) programs. Many 401(k) programs do a match to your contributions. Anywhere between 3%-9% is common, if we use the more popular 5% match, then on a $60,000 salary they will match $3,000 annually or $250 monthly. Meaning all you need to do is contribute $250 monthly into your 401(K) to get that $250 match from your employer! Simply doing that will (hypothetically) give you a retirement balance of $1,235,771 by only contributing $120,000 ($250 x 12 months x 40 years).

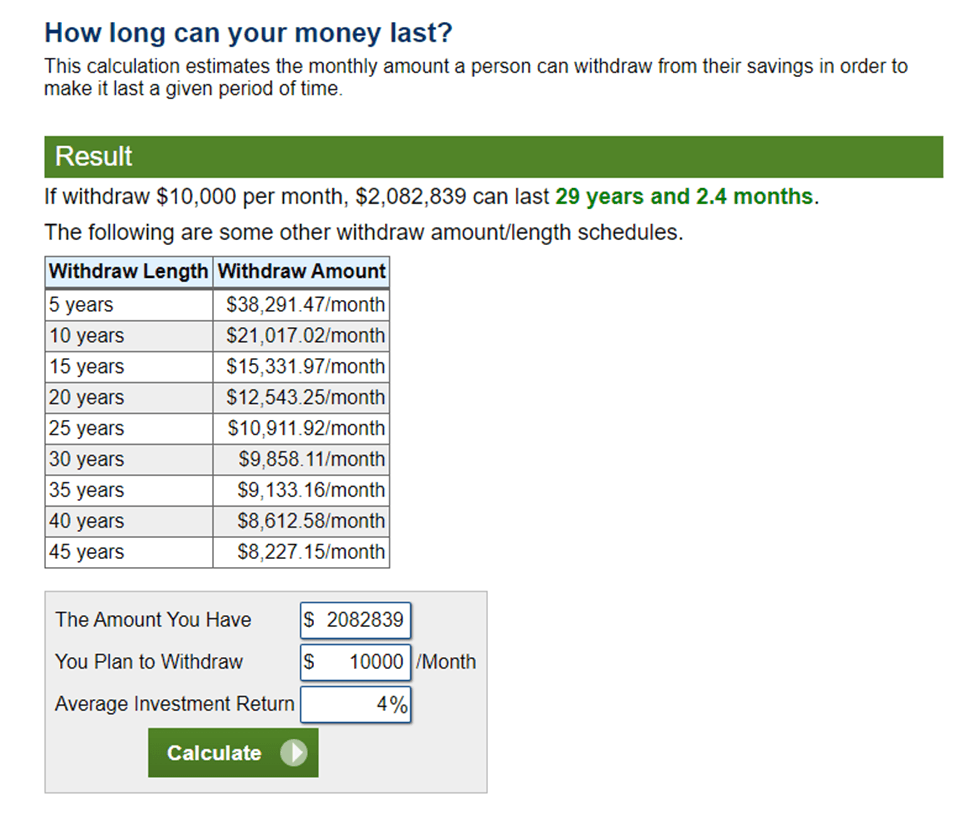

Below is the hypothetical drawdown for this scenario at retirement. $2,082,000 is the joint target balance, and $10,000/month is the inflation adjusted equivalent of $5,000/month (using roughly a 2% inflation rate).

You will obviously need to adjust the contribution for your specific situation. If your employer offers less than the 5% I used, or perhaps they don’t match, then you will need to make up the difference in either a Roth or traditional IRA.

Conclusion & final thoughts

Hopefully all those numbers made sense and didn’t give you a headache! Though not fun for many, I believe it is critically important that you run some version of these numbers for your personal life so you can act and take control of your retirement. Most financial advisors will not do this for you because it’s your life! Trust me, I come from the banking and advising world! They only run these kinds of numbers once you show up with a multi-million-dollar portfolio (for decumulation), but none will run numbers for you in your early (accumulation) years. Why? Because they don’t get paid for that, they get paid to bring in and retain AUM. It’s your responsibility to take care of yourself and your family!

Plug in numbers for your situation and if you find yourself with less time for your portfolio to compound, remember you can make additional contributions to an IRA to make some of that up. And once again, I would highly suggest you consider the expat life, as it could require a fraction of the balance in this scenario! Simply cut it in half for a $30k/year lifestyle in Argentina, Portugal, or Japan. Or why not experience them all?

I hope this can serve as a template to empower you in your retirement planning journey. Remember nothing is guaranteed, these are hypothetical numbers for educational purposes only, and not financial advice. Always consult with a financial advisor and tax advisor. Till next time!

Sources:

https://blogs.chapman.edu/wilkinson/2022/10/14/the-top-10-fears-in-america-2022/

https://www.bls.gov/charts/usual-weekly-earnings/usual-weekly-earnings-current-quarter-by-age.htm

https://wid.world/income-comparator/

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.