Do I need life insurance? If so, how much?

For most young Americans life insurance is too confusing or scary to think about. I don’t blame them! The financial industry is notorious for making things overly complicated and leading the consumer to have paralysis by analysis. However, I’ve seen families be completely devastated when the income-earner unexpectedly dies, or on the flip side, being able to mourn their loved one without worrying about finances. I personally witnessed my 40-year-old uncle unexpectedly die in a car accident, leaving behind 3 children and a non-working spouse. This makes you wonder, what should I be doing to protect my family?

Do you need life insurance?

Life insurance is a great financial tool for Americans, but before diving into how to calculate how much you need, first, I want to address if you even need it to begin with. In my opinion, you only need life insurance if you have dependents that rely on your income. There are other reasons why people get life insurance that involve saving on estate taxes, but that topic is for another day. For this conversation, I’ll assume you’re considering life insurance for its primary purpose, which is to provide financial stability for those that rely on your income in the event of your unexpected death. If that’s the case, would you pay car insurance if you didn’t own a car? So why get life insurance if nobody depends on you financially? Allow me to share a situation I ran into when meeting with a friend for a financial planning session. He was sold life insurance, by a door-to-door salesman, when he was in his teenage years living with his parents. He was paying $100/month for a $100,000 whole life policy. I’m sure the insurance advisor (salesman) didn’t really ask himself, does this kid even need it? What if this teenager would’ve instead put that $100/month into an index fund via a Roth IRA? Those $100/month alone could compound into north of $500,000 tax-free at retirement for him (assuming a 7% annual return until age 67). My friend is now in his early 30s, still no kids, still no dependents. By now, that Roth would be roughly $38,000, already more than 1/3 of his death benefit. I tell you this story, so you don’t get emotionally convinced into a life insurance policy, simply because you have loved ones and a life that can be insured.

How much do I need?

Here's the way I think about insurance. I’m only going to pay for as much as I need, to protect myself and my family. Anything over that, I need to find another investment vehicle to put that money into, because otherwise I will start to incur opportunity cost. Opportunity cost is invisible to investors, but it’s very real. It’s basically the idea that you would’ve yielded better results if you would’ve chosen a different investment vehicle. So, insure yourself only up to the amount that you need to financially protect your dependents. If you want to leave your family with more, I’d suggest investing instead. This way you retain control of your investments, because there is also the possibility you will live into your 70s or 90s. So, bottom line, use insurance as insurance.

Everyone’s situation is different, you could have a dependent that is a sibling, child, or elderly parent. All those situations will require a different approach to your life insurance needs. A family member or elderly parent unable to work, will need income for the remainder of their life, once you die. A child on the other hand, is only financially vulnerable up until the age that they can work and start providing income for themselves. I will not go into the different types of life insurance policies. The main goal of this article is to provide you with a framework that you can use to start calculating your life insurance needs. A quick google search, or an insurance agent can easily explain to you the differences once you are closer to making a decision. For these examples, I will use term life insurance because it is the most straight forward and covers the basic needs of life insurance. Here are a couple examples to give you an idea on how this could play out.

Example #1

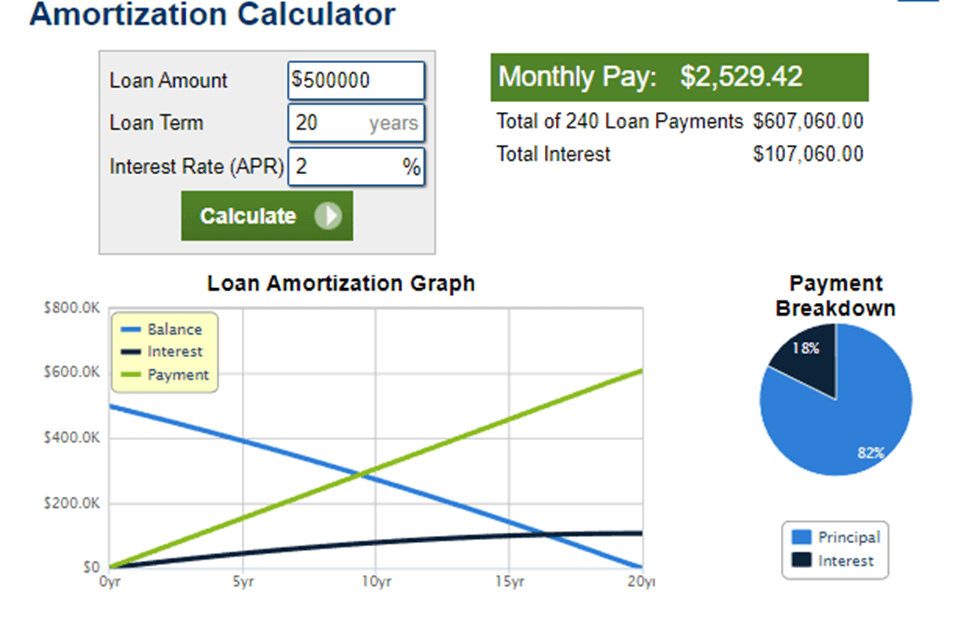

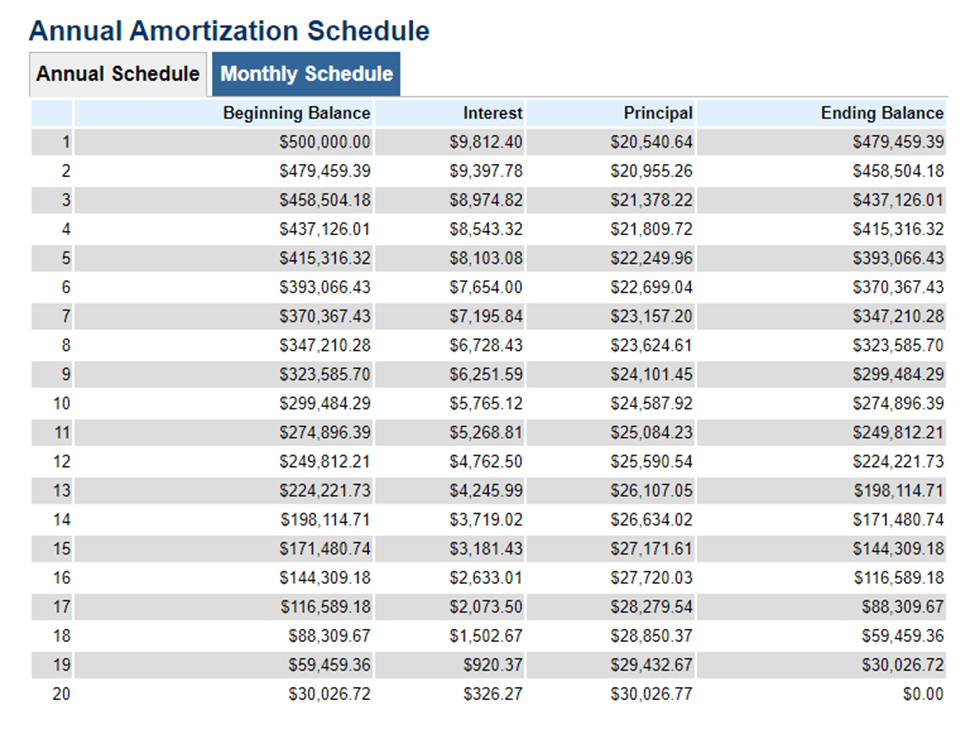

I’ll use myself as an example. My wife and I each got life insurance when our daughter was born. We got a 20-year term life policy for each of us. We assume she will be a productive, working adult by the time she is 20 years old. If we ever decide to have a second child, a new policy will be opened for that child, or if something changes that makes us believe we may need more time, then we can always open additional policies. We chose a $500,000 death benefit for each policy. How did we come up with that number? Well, the average (50th percentile) American household can be sustained with $60,000 annually, divided by 2 working parents, that means the death benefit of each policy needs to provide $30,000 in annual income for 20 years. If one of us would’ve died when she was born, this is how the amortization schedule (drawdown) would’ve played out, given that the death benefit was invested into a portfolio that produced 5% income minus a 3% loss to inflation and fees.

As you can see $2,529/month ($30,348/year) can be withdrawn to provide income for 20 years. That’s the basic idea of how life insurance should be viewed. Of course, you can make it more complicated, but once again, if this is new to you, then this example provides a basic framework for how it should work. If we don’t die within the 20 years, then we would’ve paid roughly $20/month per policy, which adds up to $4,800 in premium paid throughout the life of the policy, to protect us and provide that piece of mind. I used www.calculator.net to provide the calculations and amortization schedules.

Example #2

In this next example, you have a family member that is financially dependent on your income. In this case, you want to use their life expectancy to calculate the death benefit, but you want to use your life expectancy as the term of the policy. In this example, the beneficiary (your family member) is 30 years old, and you want this policy to provide income for them until they are 80 years old (their assumed life expectancy), and you, as their provider, are 40 years old. You would want to get an insurance policy with a death benefit of roughly $2M, so the money can last your dependent 50 years at a drawdown rate of roughly $60,000/year (using the same portfolio in example #1). The term of the policy needs to be 40 years (assuming your life expectancy is also 80). In comparison to example #1, this death benefit is much higher because the money is needed to last longer (50 years instead of 20), and all the income is reliant on one policy (rather than two). Expect this premium to also be much higher given that it’s twice the term, and the insured is older. In finance there is “no free lunch”, so as the risk of having to payout the death benefit increases for the insurance company, so does the premium they will require. Below is the amortization schedule for this example.

Final Thoughts

Once you’ve calculated your personal insurance needs, I recommend you consult with an insurance or financial advisor before making a decision. Get informed about the different kinds of life insurance policies so you can pick the right one for you. And finally, I suggest you look into making a will that appoints an executor (a person that will execute your wishes after your death), who will set up a trust and invest the death benefit (money) appropriately, so it provides the desired income for the beneficiary (your dependent). The last thing you want is your loved one to not be protected over something crazy, such as nobody claiming the money or them not knowing what to do with it. Once again, this is for educational purposes only, it’s neither legal nor financial advice. I hope this provided a good starting point for calculating your life insurance needs. My goal here is to provide you with educational, yet applicable information, that can serve as tools in your personal finances. At times it might seem overly complicated or overly simplified, however, know that I will always try my best to find the beautiful equilibrium. Thanks for reading, until next time.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.