Strategies Update December 2024: After A Strong Month, Time To Shake Things Up

Yep: it’s a brand-new month, so it’s time to take a look back at our three simple, easy-to-replicate investing approaches. And that means the Easy Rider Portfolio, our diversified investing mix that can serve as your core allocation; the active Momentum Rider Portfolio, which targets top-performing assets; and the nimble Sector Momentum Edge Strategy, which rides the best-performing US sectors.

Here’s how they performed in November and how they’re positioned for December.

PART I: THE SECTOR MOMENTUM EDGE

First, a quick review of the strategy.

The Finimize Sector Momentum Edge is built with two key goals in mind: catching the wave of the top-performing sectors and shielding your cash when markets get rough.

Here's a reminder of how it works: every month, you check out all 11 US stock sectors and find the three that have been delivering the best returns over the past three, six, nine, and 12 months (excluding the most recent month’s returns) and you split your investment evenly among them. But there’s a catch – you only dive in if these sectors are outperforming cash returns. If they’re not, that means they’re in a downtrend – so, in that case, you’d play it safe and park your money somewhere safer: bonds.

Next, a look at November’s results.

November delivered a solid 5% return for the strategy – just shy of the S&P 500's exceptional 5.9% performance. All three sectors – utilities, real estate, and communications – pulled their weight.

There was a slight sting in leaving financials out last month: the sector rallied hard after the US election. But hey, that’s the game – the model sticks to its rules, and we trust its long-term value. And really, it hasn’t disappointed, with the strategy up a respectable 25.8% so far this year.

Finally, December’s new lineup.

The Sector Momentum Edge strategy has reshuffled its portfolio for December. The model just ousted real estate and welcomed financials back into the fold, signaling a shift in sector leadership.

So for the month ahead, the portfolio will be equally weighted across three sectors: 33.3% in our preferred utilities ETF (XLU), 33.3% in a communication services ETF (XLC), and 33.3% in a financials ETF (XLF).

PART II: THE FINIMIZE EASY RIDER PORTFOLIO

First, a little refresher on its strategy.

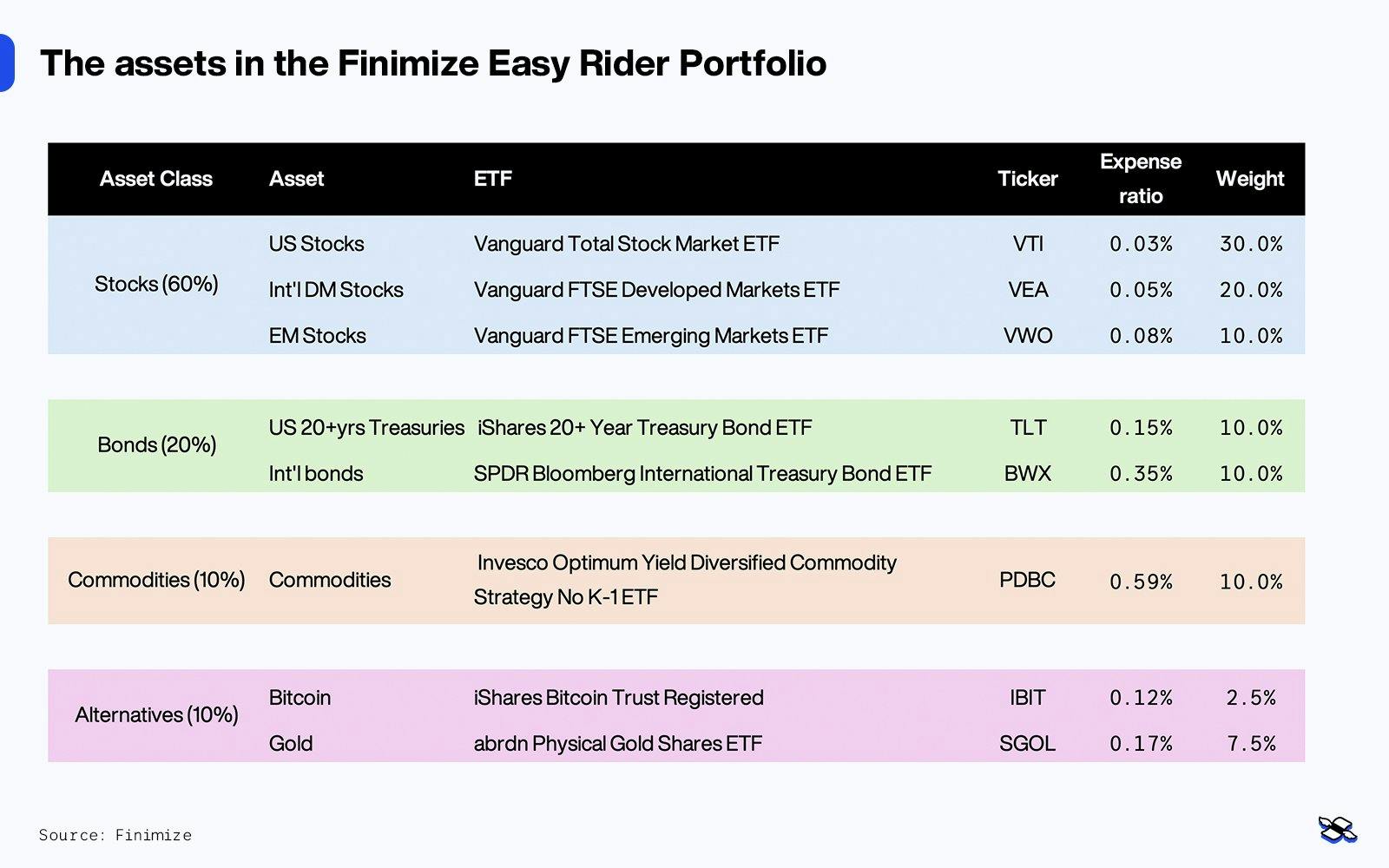

The Easy Rider Portfolio aims to deliver steady returns of 4% to 8% per year over the next decade while minimizing the risk of big losses along the way. It’s a diversified combination: 60% global stocks for growth, 20% bonds for stability, 10% commodities to hedge against inflation, and smaller doses of gold (7.5%) and bitcoin (2.5%) for extra protection. This blend helps balance your investments, boosting your chances of reaching your financial goals, while reducing your risk compared to an all-stock or 60/40 (stocks/bonds) portfolio.

Next, a look at November’s results.

The Easy Rider Portfolio climbed 2.7% in November, thanks to a very strong 6.7% gain from its US stocks ETF and a standout 38% surge in bitcoin. That small 2.5% bitcoin allocation really held its own: it proved big enough to make a noticeable impact, but not so huge that it dominated the portfolio's overall performance.

Gold, emerging markets stocks, and commodities dragged down the overall performance, while US Treasuries provided a modest boost, helping to balance the portfolio’s overall returns.

Year-to-date, the Easy Rider Portfolio is up 15.6%. And, sure, that trails the 20% gains for global stocks – which have benefitted from their 60% exposure to this year’s top performer, US stocks. But for a diversified approach, it’s still an impressive return. Most importantly, it’s well above our target range of 4% to 8% in annual returns.

PART III: THE FINIMIZE MOMENTUM RIDER PORTFOLIO

First, a speedy recap of its strategy.

The Momentum Rider Portfolio shares the same goals and investment universe as the Easy Rider Portfolio but takes a more active approach. Its mission: invest in only the top-performing assets while shielding your portfolio during market downturns.

Here’s how it works: each month, the portfolio selects the four best-performing assets from a diversified mix – US stocks, developed market stocks, emerging market stocks, bonds, commodities, and gold – based on their momentum over the past three, six, nine, and 12 months. Each chosen asset gets a 24% allocation. If bitcoin ranks among the top performers and beats cash, it gets a 4% slice, too. To manage risk, the portfolio invests only in assets that have been outperforming cash. If a top pick is in a downtrend, its allocation shifts to bonds for safety.

Now, a look at November’s results.

Momentum Rider added 2% in November, with US stocks (VTI) and bitcoin leading the charge. On the flip side, emerging markets and gold held it back.

The Momentum Rider Portfolio is up 20.7% so far this year, on par with global stocks.

After recalculating the momentum numbers, you’d keep December’s lineup the same. US stocks, developed market stocks, emerging market stocks, gold, and bitcoin all still top the momentum charts, so for the ninth successive month, the portfolio would see no changes to its weights. And international government bonds, long-term Treasury bonds, commodities are still out of the mix.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.