Nothing Stays On Top Forever. Here’s How To Deal With That.

The biggest companies by market value won’t hold their crowns forever: that exclusive club has a revolving door. Innovation, disruption, and competition keep it spinning, with some firms on the way in and others on the way out. And, sure, you could spend hours trying to predict which businesses will occupy the world’s top ten spots a decade from now and still get it wrong. Or you could adopt a simple investing approach that keeps you winning no matter how the group changes.

What does the club look like now?

These days, it’s a tech-heavy crew, led by Apple and Microsoft – as the Magnificent Seven dominate the market, thanks to the rise of technology and AI – with firms like Nvidia and TSMC charging up the rankings.

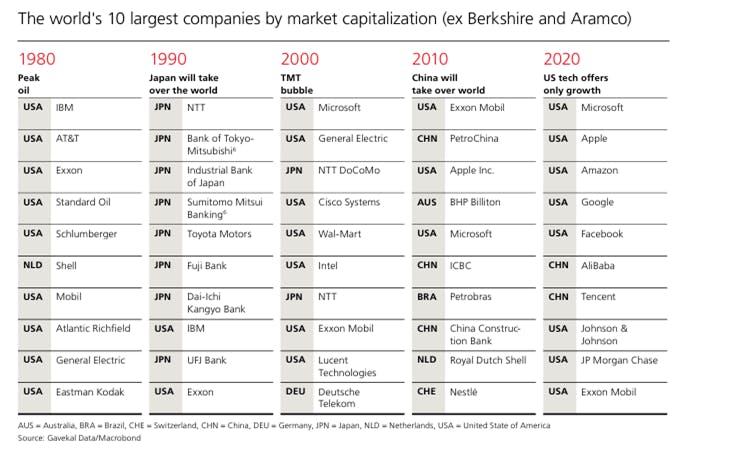

And that global market leadership is constantly changing. None of the heftiest companies from 1980 still hold a spot in the top ten.

In 1980, energy-related companies topped the list, with “peak oil” – the notion that world reserves were nearing their peak and would soon start to decline – being the prevailing view. And eventually, it proved to be wrong.

By 1990, Japanese companies accounted for eight of the top ten – and the prevailing thought was that the country would soon “take over the world”. Again wrong.

By 2000, the tech, media, and telecom (TMT) bubble had arrived, and Microsoft made the list, along with Intel. By 2010, Chinese companies had surged in popularity as investors and the new refrain was that China was ready to “take over the world” – again wrong. Apple also made the cut for the elite crowd for the first time that year. And by 2020, US tech stocks held the top five positions – each with stunningly high market values (or market capitalization).

And what are their stock valuations like?

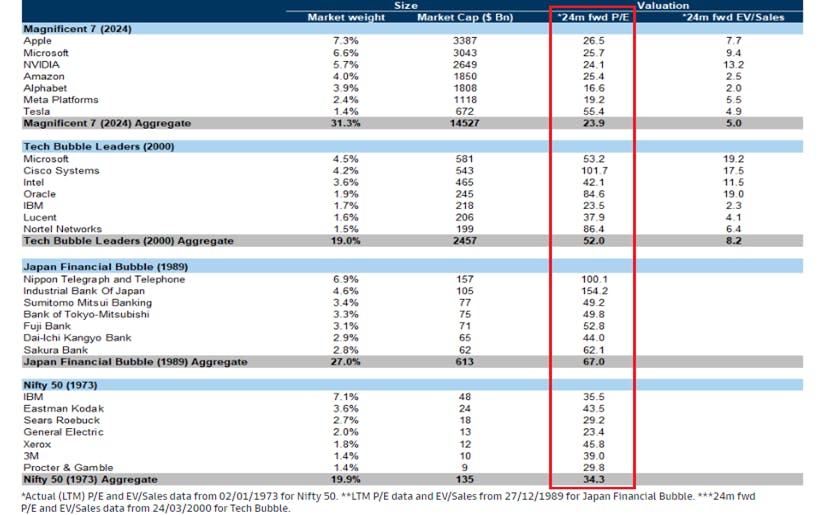

With their high market caps, it’d be easy to assume that the big guys’ stock valuations would be in the nosebleeds too. But, actually, today’s dominant companies trade at far lower price-to-earnings (P/E) ratios than their predecessors did in their day. The average two-year forward P/E ratio for the Magnificent Seven stocks is just 23x, compared to 52x for the market’s leaders in 2000, or 67x for the leaders in the late 1980s. (The ratio compares the current share price to the company’s estimated earnings per share in two years.)

Okay, so what moves a company up or down that list?

This is the tricky part: it’s impossible to perfectly anticipate the changes before they happen. They tend to come along because of some new threat or disruption that people didn’t see coming. In the case of Japan and China, for example, an imploding economy undermined their presumed dominance.

Companies can seem invincible but disruption and competition can change the market dynamics. Legendary economist Joseph Schumpeter famously said innovation and technological change come from entrepreneurs or wild spirits. (Think Elon Musk and Jensen Huang).

And those changes do more than shrink the earnings for those leading firms – they can shake their foundations and threaten their very existence. Almost 100 years ago, Schumpeter argued that behemoth companies have the money to invest in researching and developing new products and services, and scope to deliver them to customers more cheaply – and that’s what’s needed to stay on top.

Now, I’m pretty sure he didn’t anticipate the likes of Microsoft and Apple, with their $3-trillion-plus market values – the laptop and cellphone hadn’t been invented – but his age-old view holds water nonetheless.

His observations help to explain the seeming invincibility of Big Tech and the Magnificent Seven. Their massive size (and huge profits) have enabled them to invest hundreds of billions of dollars in research and development, building their infrastructure, strengthening their market positioning, and keeping potential rivals at a distance (i.e., widening their economic moat). Right now, it's nearly impossible to imagine new competitors making a serious dent in their market shares – and investors believe that’s going to be the case for a long time. But folks said similar things about IBM and ExxonMobil, and both lost their spots at the top.

Innovations have a way of changing things. Before ChatGPT sparked the AI frenzy, few saw the potential for Nvidia to join the $3 trillion club. And pharma giants Novo Nordisk and Eli Lilly were a lot less giant before the release of their wildly successful obesity drugs.

What’s the opportunity here?

Passive investing could be the key if you want to keep your portfolio up-to-date with the latest changes in the big-stocks hierarchy without doing too much. You could consider owning the SPDR S&P 500 ETF (ticker: SPY; expense ratio: 0.09%), that tracks the S&P 500. But for those supersized companies outside of the US, the Vanguard Total International Stock ETF (VXUS; 0.08%) could fit the bill. Its top holdings are TSMC, Novo Nordisk, ASML, Samsung Electronics, Tencent, Nestle, and AstraZeneca – so it’s got plenty of exposure to the AI and weight-loss trends. The ETF’s holdings are adjusted twice a year, so when a company’s stature rises, it buys more. Likewise, when a company proves to be a fad and its market value drops away, it shrinks its holding – so you don’t get left with a big position in a loser.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.