The Weekly Chartpack

This week’s chartpack revs up with Ferrari versus Dollar General, and cruises along from there. Here's the full speedy rundown.

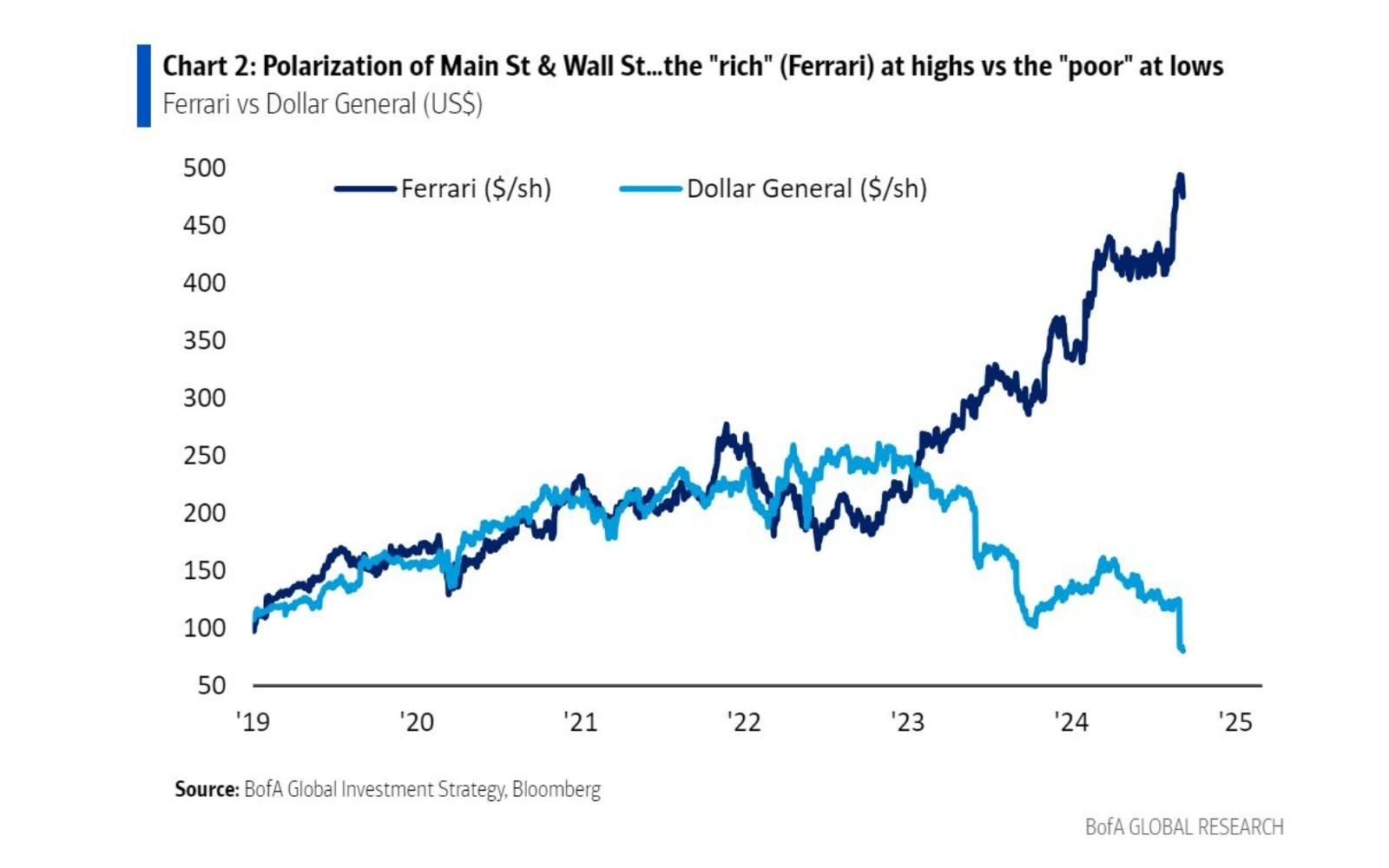

Ferrari Has Been Crushing Dollar General: Here’s What That Tells You

The pandemic and inflation have created a two-speed economy: the well-off are surging ahead with booming portfolios and savings, while other folks struggle with rising costs and debt payments. Just look at how Ferrari has been crushing Dollar General: the luxury sports car brand has hit record highs, while the US discount retail chain continues a prolonged slide. So far, the “haves” have been holding up the economy, but this strength is fragile, like thin ice that could crack under pressure. In fact, “aspirational” luxury brands like Gucci, Burberry, and Hugo have already started to feel the pressure.

Read more about it here.

The UK Economy Flatlined For A Second Straight Month

After slipping into a short, mild recession at the end of last year, the British economy sprinted back with a 1.3% growth in the first half of 2024 – actually outpacing its big Group of Seven (G7) peers. But then it appeared to get a bit winded. The UK economy stood still in July for the second month in a row. But two months do not make a trend, and monthly growth reports are notoriously volatile – more noise than signal. What’s more, the broader trend in the UK remains solid, with economic growth clocking in at 1.2% on a year-over-year basis, and 0.5% on a three-month-over-three-month basis. Still, the economy likely will slow compared to the strong first half of the year, as the government tightens its spending belt and as the Bank of England continues its go-slow approach to cutting interest rates.

Read more about it here.

Close Is For Horseshoes And Hand Grenades – And Inflation

Investors have been looking for confirmation that the US Federal Reserve (Fed) has tamed the country’s inflation beast with its aggressive barrage of interest rate hikes – and the consumer price index (CPI) for August wasn’t it. When you strip away more volatile items – like energy and food – and look at “core” inflation, the yearly rise was a bit faster than the month before. And if you look at what’s driving the core inflation, you’ll see that the call (as they say in the old horror films) is coming from inside the house. Shelter inflation has been downright scary, with rents rising faster than economists were hoping for (to say nothing of renters). By comparison, the trend in core goods prices has been pretty steady, falling again just a bit in August. In fact, ever since its brief blip higher early this year, inflation has been trending lower in core goods – which is what the Fed had in mind. No surprise then that the Fed is still widely expected to trim interest rates on Wednesday – but likely by just 0.25 percentage points.

Read more about it here.

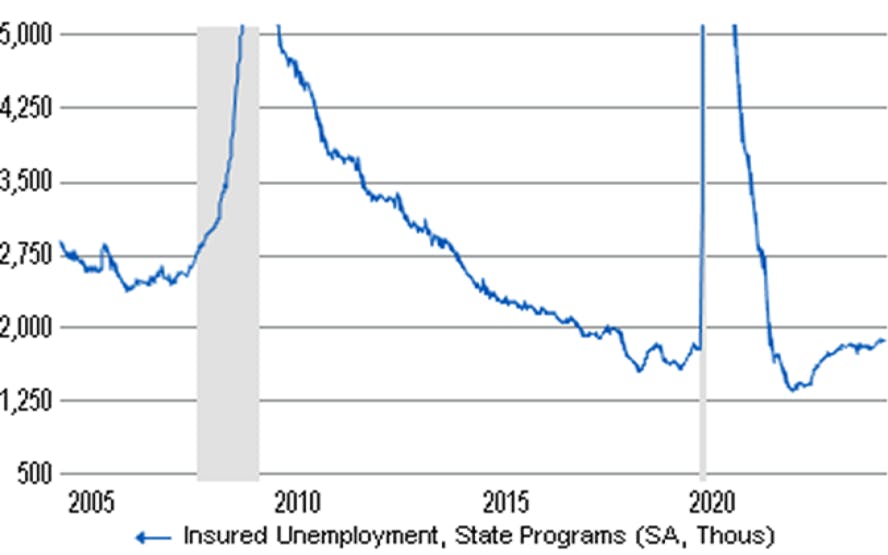

What Investors Expect Now From Wednesday's Fed Decision

US consumer price data suggests that the Federal Reserve (Fed) has all but won its battle against hot inflation. And US jobs data suggests that there are only a few outright signs of stress in the labor market, even as it cools. It’s good news for the Fed: in recent years, it has aggressively hiked interest rates, aiming to cool the economy enough to bring down inflation without triggering a recession. Now, with inflation mostly in check and the job market showing signs of softening, the Fed is widely expected to begin lowering interest rates. The question is how aggressive it will be: whether it will announce a 0.25 or 0.5 percentage point cut when it meets Wednesday. And if the market can’t seem to agree about how deep that cut might be, that may be because the Fed can’t either. News reports this week suggested that the decision to go big or small on the first cut is a serious “dilemma” for policymakers.

Read more about it here.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

More from Trading Terminal

September 18, 2024

September 18, 2024The “Big Five” Portfolio Built For Growth In The Economic Wild

September 18, 2024

September 18, 2024Pressure Is Mounting On The Federal Reserve, Despite Stronger Than Expected Retail Sales

September 17, 2024

September 17, 2024How The Pros Are Investing Ahead of The US Election

September 17, 2024

September 17, 2024