Humanoids Are Coming And This Overlooked Stock Could Be Their Nvidia

Opportunity

The future has two arms, two legs, and an AI brain. Humanoid robots – advanced machines that are capable of human reasoning, movements, and work – are poised to become the next big thing. Now, it’s often the case that the supply chain is where you can find lucrative investing ideas on the cusp of any big trend’s boom. And that’s where I found Harmonic Drive Systems, an under-the-radar, small-cap stock with a near-monopoly in a key humanoid robot component.

Thesis

- In many industries, humanoid robots are the future of work. These programmable AI machines mimic us (the humans) in appearance and can imitate the work we do.

- Humanoid manufacturing is predicted to grow from just 3,500 robots this year to 1.4 million by 2035. By then, the industry’s market size is expected to top $38 billion – on its way to hitting the $3 trillion mark.

- Japan-based Harmonic Drive System Inc. (HDSI) is the market leader in high-end harmonic drives, which are essential in high-spec robots.

- Sales and profits at HDSI look set to rocket higher, with as many as 44 harmonic drives needed in each high-spec two-armed humanoid unit.

- HDSI’s stock could see a 50% jump in the next 12 months if analyst targets are to be believed, but the humanoid revolution could push it a whole lot higher over the next decade.

Risks

- Increasing competition in high-end harmonic drives could eventually dent HDSI’s profitability. The top Chinese competitor in this niche, LeaderDrive, is racing to try to improve its products to match HDSI’s quality and durability.

- A delay in humanoid robot production acceleration could slam the brakes on profits for the firm.

- A sharp economic slowdown that impacts global manufacturing and capital investment could lead to more trouble for sales and profits.

- Tesla is likely to be one of the humanoid population’s biggest manufacturers and it could build harmonic drives in-house. That kind of vertically integrated, all-under-one-roof production is Elon Musk’s preferred M.O.

Introduction

Elon Musk recently yanked the tarps off of Tesla's robotaxis, declaring that its autonomous vehicles would soon take the world by storm. And investors, well, they were pretty underwhelmed. But another part of the robotics industry is poised to raise their eyebrows good and high: humanoids. These person-sized, person-shaped robots are set to upend everything. And one under-the-radar and in-the-supply-chain company could become one of the trend’s hottest stars.

PART 1: HUMANOID ROBOTS

In terms we can all understand: they’re like C-3PO or the Terminator. Androids, if you will. Humanoids are programmable AI machines that are designed to look like people and imitate the work they do.

Humanoid robots are what’s called “embodied AI” or “physical AI” – with bodies built to contain sensors, cameras, actuators, harmonic drives, and batteries. They’ve got built-in motion control systems that receive instructions from an AI chip and manipulate humanoid joints that make the whole thing mobile. And with recent advancements in AI, they’re also capable of some complex decision-making and problem-solving.

You can think of a modern humanoid robot as having two parts – the brain and the body. And, like a human, those interconnect. An AI chip powers its brain, which then sends signals to the rest of its body. Rapid advancements in generative AI have boosted humanoid robots’ brain function, making them “smarter” by improving their learning speed. Meanwhile, new top-of-the-line materials make their physiques lighter and more durable – which takes less of a toll on battery life and lowers production costs.

The number and type of components needed varies depending on the design and intended use of the machines. Until recently, robots were mostly given only repetitive tasks – like moving stuff from point A to point B on production lines or in warehouses. That might still be the case, at least for a while. But eventually, as their skills improve, they’ll be promoted to more complicated jobs. The idea is eventually to use them to solve labor shortages, especially in social care and healthcare facilities, where demand has been increasing as populations age.

Why do humanoid robots look like humans?

Nvidia CEO Jensen Huang says there are two good reasons why the robots of the near future resemble the same two-legged, two-armed, one-headed human model you’re sitting in now. First and foremost, it’s because we built the world (especially the working world) for ourselves. If humanoid robots have a similar, human-ish body form, companies won’t have to completely redesign their factories and workplaces. It’s just more efficient.

Second, to teach a robot anything – for example, how to be productive in a task – you need tons of data. And right now, that data and most of what can be observed about productivity is based on a human form and its movements. See, robots learn by recording and imitating behaviors in both the physical and virtual worlds. They collect the data points and then use generative AI and data centers to help process, interpret, and respond.

PART 2: THE MARKET

It’s everywhere, across industries, in many of the places where people work. And, according to experts, it’s ready to take off.

Goldman Sachs is predicting that there will be 3,500 humanoid units shipped from factories this year, 20,000 next year, and up to 1.4 million by 2035. That’s a stunning, 70% compound annual growth rate.

The investment bank is also forecasting a market size (that is, a total addressable market, or TAM) of $38 billion by 2035 – and it expects around $22 billion of that to be the high-spec variety – i.e., the ones with a functioning thumb and fingers on each hand. Morgan Stanley, meanwhile, set its viewfinder further out and said it expects the TAM to hit $3 trillion eventually.

Two of tech’s biggest founders are at the center of this boom. Nvidia’s Huang – one of the most important figures in AI – has said humanoid robots are the next big thing in artificial intelligence and predicted that all factories will eventually be entirely robotic and human-free. In his view: robots will build robotic products as robots interact with robots.

Tesla’s Musk has predicted that there will be over one billion humanoid robots in operation by the 2040s. He said that over time, they’ll outnumber humans by two-to-one, and then by more. He estimates that his company’s Optimus humanoid will eventually be priced somewhere between $25,000 and $50,000 – low compared to what it costs to hire a human worker for an automotive production line or a warehouse (even before you factor in healthcare, retirement benefits, and so on). And when you look at it that way, it’s no surprise that folks are so bullish. And, it’s also not shocking that automakers – BMW, Toyota, Hyundai, Mercedes-Benz, Dongfeng, Xiaomi, and of course Tesla – are already working closely with humanoid developers.

PART 3: THE BIG PLAYERS

Some of the names are well-known: Tesla’s humanoid robot has already made some splashy headlines. But there are also some promising upstarts in this space, and some crucial firms all along the supply chain.

The humanoid creators

Tesla is the obvious one. Its Optimus 2 model launched earlier this year and Musk has plans to start production for the EV maker’s own use next year. He sees production ramping up for external sales in 2026.

Agility Robotics secured new fundraising earlier this year at a $1.2 billion valuation. Amazon has invested in Agility through its Industrial Innovation Fund and is testing “Digit”, its bipedal, paddle-handed robot. In June, Digit began working alongside Amazon’s human workers in the material handling division.

Figure AI was founded in 2022 and recently valued at a staggering $2.6 billion. It’s fast becoming a challenger to the rest of the field. Its second-generation humanoid robot, Figure 02, was released in August and is the most advanced humanoid robot on the market. Cutting-edge artificial intelligence, thanks to integration with OpenAI, allows for speech-to-speech conversations with humans. The firm recently announced a collaboration that will put its humanoid robots in BMW’s US headquarters.

Boston Dynamics was founded in 1992 as a corporate spinoff from MIT. Hyundai then purchased its 80% stake from Softbank Group in 2021 for $1.1 billion. The firm now builds humanoid machines that aim to reduce work-related risks and perform boring, repetitive, and dangerous tasks.

Other companies at the forefront of humanoid development include Toyota Research, 1X Technologies, Apptronik, Fourier Intelligence, Sanctuary AI, XPENG, Xiaomi, Ubtech Robotics, Engineered Arts, and Naver.

The brains

Boston Dynamics, Agility Robotics, and Figure AI all use Nvidia’s suite of AI services to develop, train, and build its humanoid robotics. Makes sense: Nvidia launched a new general-purpose foundational AI model project called Generalist Robot 00 Technology (GR00T), designed specifically for advancing breakthroughs in humanoid robotics. It allows robots to train in a simulated version of reality called the “Omniverse”.

Jensen describes it as a “gym where the robot learns how to be a robot”. GR00T may not be the only model used in robotics research and development (R&D), but it is a key partner with a lot of the top players – and that’s helping cement Nvidia’s position at the forefront of the wider trend.

The brawn

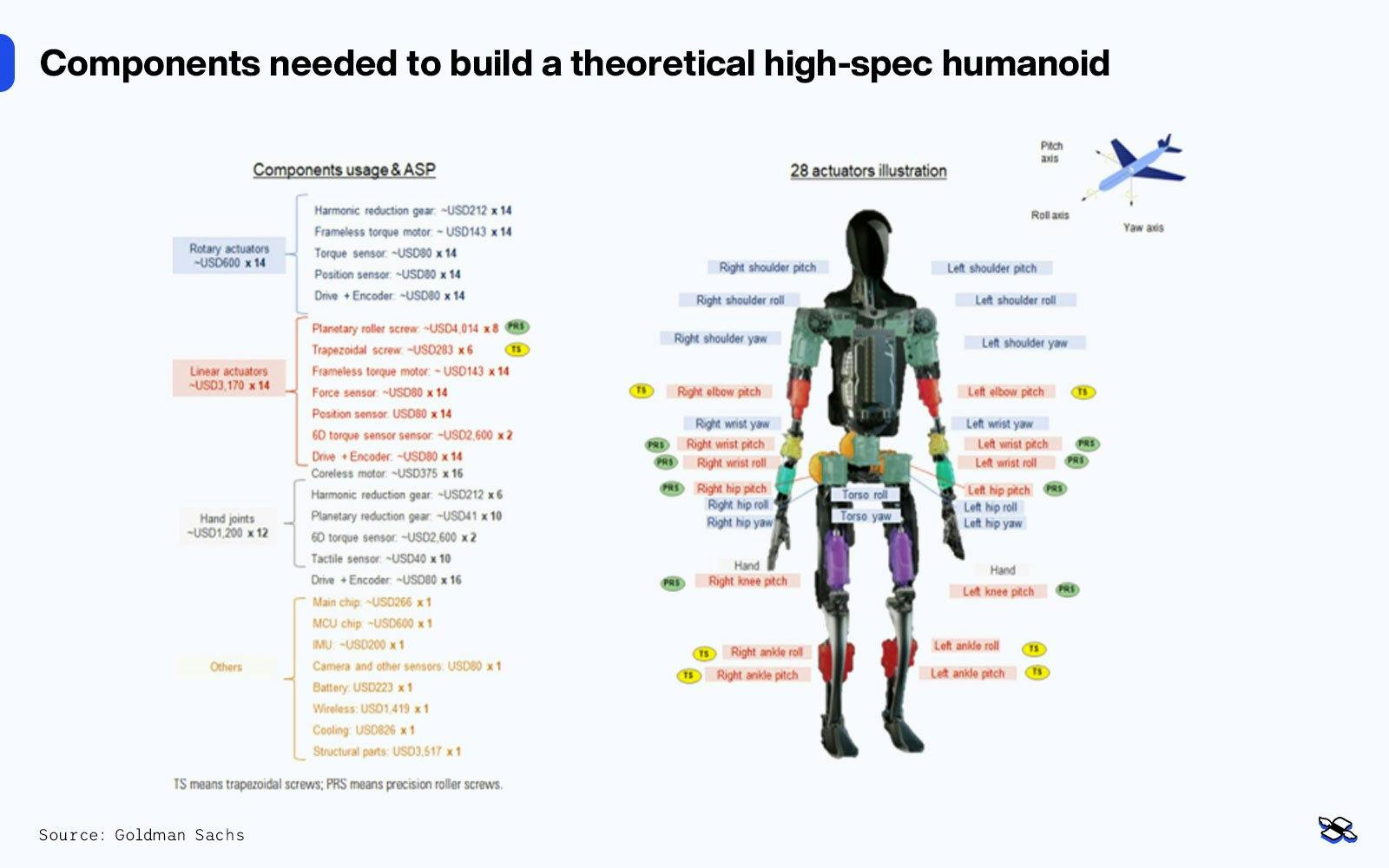

Humanoid robots have different specs depending on the job they’re designed for. Higher-spec models will need more components and be more expensive (and trickier) to construct. The chart below shows what kind of components it would take to build a theoretical high-spec robot.

Actuators – which are made up of screws, harmonic reducers, motors sensors, bearings, and encoders – are core to performing human-like motions. They act as the robotic equivalent of human joints and muscles, enabling movement in rotational and linear directions. The more freedom of movement that’s required, the more actuators you’ll need. A human hand has 27 degrees of freedom – so it's one of the most challenging areas for robotic engineers. But in some cases, it’s essential for – ahem – the task at hand, and for achieving the necessary levels of manual dexterity, precision, and responsiveness. In other cases, it’s not so important, and simpler mechanisms can be used.

Figure AI’s launch of Figure 02 showed real progress in this area, with robot hands that have 16 degrees of freedom. They closely mimic human dexterity – from making delicate manipulations to handling heavier objects. Tesla’s Optimus 2 has only 11 degrees, but Musk has said the next upgrade will have 22 degrees. The race to the finish on hand dexterity will be over in a snap – it has to be if humanoids are going to hold human jobs in the workplace.

PART 4: THE OPPORTUNITIES

Sure, there are the Big Tech superstar stocks, and they’re likely to see some benefits of the humanoid revolution. But there’s also a little-known potential gem in the supply chain: Harmonic Drive Systems Inc.

Most pure-play companies in the humanoid field are privately owned, and that means there aren’t a lot of portfolio opportunities for the average investor. Mind you, there’s mega-cap tech. Nvidia, for one, is likely to benefit from the humanoids’ rise. Tesla, for another: it’s one of the leaders in this space and can use what it knows about robotaxis to teach its Optimus models. And then there’s Amazon, which will become one of the key users, improving its productivity by employing more machine workers and fewer human ones in their fulfillment centers.

But that’s a short list of stocks that – let’s face it – are already pretty crowded. So to find shares that aren’t already on everyone’s list, I decided to zoom in on the humanoid component supply chain. Now, a few of the companies I turned up are listed in China, and I’ve left those off the list, simply because it’s so difficult for individual investors outside of the country to buy them.

Until now, the chip producers have been the focus of all the investor AI love. But there’s another category that stands out for me: harmonic reducers. The little devices are tucked inside the “actuators” in humanoid arms and hands – which is what gives them some degree of agility. Every high-spec humanoid robot will have them, and, outside of China, one company – Harmonic Drive Systems Inc. (HDSI) – has a near monopoly on those. Once production volumes on humanoids really start to take off, that firm’s total profits should rocket.

What exactly do these things do?

A harmonic reducer (also known as a harmonic drive) uses a set of three gears to produce rotational motion, which allows the motor to run at the precise speed needed for each part of the robot. It consists of three core components: the flexspline (flexible wheel), the circular spine (rigid wheel), and the wave generator. Human movements are complex: these things help make that happen.

For humanoid hands to achieve a high degree of freedom, they need as many as 15 harmonic drives in each hand. An entire, high-spec two-armed robot, meanwhile, could need as many as 44.

It’s no wonder global harmonic drive demand is expected to increase sharply, in line with the growth in humanoid production. India-based research firm Congruence Market Insights predicts that the humanoid demand for global harmonic drives will surge from $146 million in 2022 to $2.5 billion by 2030 – a rate of roughly 43% per year.

HDSI is a small company: it’s got a market cap of just 286 billion yen ($1.9 billion). But it has a near monopoly on harmonic reducers outside of China – I’ve seen estimates of 90% and higher. In China, however, domestic companies dominate the lower end and middle of this market, since they can undercut HDSI on price. Problem is, their reducers aren’t stable, so that leaves HDSI in a prime position to benefit from the growth in high-spec humanoids – even those made in China.

HDSI’s current customers are spread across industries – with robotics, automotive, semiconductor equipment, and aerospace among the biggest. The US and Europe account for around 50% of its sales.

HDSI’s recent performance

It’s not the most glittery picture, I grant you. The company’s orders, sales, and profits have all fallen in the past couple of years, thanks to a global manufacturing slowdown and some excess inventory among a few of its customers. China’s economic troubles also took a chunk out of its industrial robot sales. What’s more, semiconductor manufacturing equipment sales also took a hit until recently, even as investment in data centers and generative AI applications grew. One bright spot has been sales for advanced medical applications – for example, surgical robots.

With sluggish orders and sales, the firm’s factories have been forced to operate at a lower output rate, and that’s hurt profitability and the share price. That explains why its operating margin (the profit it makes for each dollar of sales after costs) has fallen so sharply. Plus, that deteriorating environment led the firm to take a chunky impairment loss of around 28 billion yen ($190 million) on its German-based subsidiary. No wonder then that the company posted a net loss last year.

HDSI’s outlook and valuations

At its quarterly update in August, the company noted signs of a pickup in orders for semiconductor production equipment and – importantly – humanoid-related items. It also said excess inventory was heading back toward normal levels, but is still a sticky issue for some industrial robot customers. Still, when demand levels out for these products, the firm’s targeted 20%-plus profit margin goals should be achievable.

The company expects humanoid robot-related revenue to be around three billion yen ($20 million) in the fiscal year ending in March 2025 – up from virtually zero in the year before. And it sees that figure growing to over ten billion yen in the year ending in March 2027. That would be a nearly 100% annualized growth rate and constitute around 12% of its total sales, which consensus estimates expect to be around 82 billion yen ($566 million) – below the company’s 90 billion yen plan. But, remember, as humanoid-related sales accelerate, they’ll have a rising impact on the company’s sales and profits.

In other words, the company is widely expected to grow – and that growing army of humanoid robots is a big part of the reason why. HDSI has said it's confident about the humanoid order books for this fiscal year. And with recent progress in the field – with Figure AI’s new robot launch and Tesla’s plans for the next Optimus upgrade – there are reasons to be optimistic about the outlook.

Still, you can’t ignore the fact that the firm’s been in a rough patch. Disappointing earnings results have seen the share price plunge, falling from a high above 9,000 yen ($60) in 2021 to just below 3,000 yen ($20) today, where it’s flirting with a five-year low.

Meanwhile, its strong growth potential means the stock has traded at a pricey valuation multiple for some time. Based on consensus estimates for the year ending in March 2027, it’s trading near a 30x price-to-earnings ratio. And while that may look expensive (and is), that’s the lower end of the ten-year range. Goldman Sachs has an earnings-per-share estimate for the firm that’s much higher than the rest of the pack, and based on that forecast, the stock’s currently trading at an 18.3x price-to-earnings ratio.

With much of the market still a bit sluggish, the company hasn’t been running at full capacity. But it’s planning to ramp things up to meet the expected surge in humanoid-related orders. Sure, that might squeeze their margins for a little while, but the firm is predicting a big bounce in the long run. I mean, look, if Musk is right and a billion humanoid robots will be in operation by the 2040s, that will mean tens of billions of harmonic reducers will be needed.

Still, it's difficult to accurately predict sales and profit two years ahead for companies that sit at a key inflection point – let alone five or ten years ahead. Too many variables can impact the accuracy of these forecasts – new competition, market share, pricing, demand, and so on. And when you’re investing, it’s important to keep your eye on the forecasts and one on the here and now.

The next big stock mover for HDSI is probably its half-year earnings: so mark your calendar for November 12th. And, keep in mind, the results aren’t likely to show signs of a huge recovery, since the global manufacturing picture is still a tad dreary. But if the company does indicate an improvement in humanoid-related order outlook, that could give its share price a boost. After all, orders pave the way for sales and profit.

In the meantime, it’s worth noting that there aren’t a lot of red flags on HDSI’s balance sheet. The company is stable and forecasted to be in a “net cash” position in a couple of years. It owns a cross-shareholding in Japanese engineering company Nabtesco worth $55 million, and in line with improved corporate governance in Japan, there’s talk that it will try to sell its stake. And, yep, it could use the proceeds for a share buyback, but I think it’s more likely to use some or all of the money to finance some big capital investments, like new equipment or facilities.

Finally, the investment potential

HDSI (ticker: 6324 JT) is clearly an interesting long-term investment idea. Its weak operating environment will probably require a bit of patience, so – depending on your risk appetite – you might want to wait for more visibility on the humanoid order books before you step in. On the other hand, you could consider buying just a quarter of your position size to get started, and look to add once those orders start to flow. After all, the stock may move higher once more positive news about orders is released.

On the Japanese market, the trading lot size is 100 shares – not one. So, at today’s price of 2,970 yen ($20), that’ll set you back around 297,000 yen ($2,000). The company also has an over-the-counter listing (i.e. not a public stock exchange) that goes by HSYDF, which is equivalent to one ordinary share, but be careful about how much you pay: its price is prone to jumping around as it hardly ever trades.

If making long bets is more your style, you could consider opening a small long position on your trading platform. The stock has fallen to levels not seen since 2018, so the idea would seem to have a reasonable risk/reward. You could also set a stop level just below the stock’s 2018 lows, to limit your risk even more.

In my research, I found just ten bank analysts who have rated the stock. (As I said, it’s small and mostly under-the-radar.) Six of them gave it a “buy”, three gave it a “hold”, and one called it a “sell”. Their average target price among the ten is 4,628 yen ($31) – roughly 56% above where it sits now. Most analysts said they like the stock because of its strong potential growth – but it’s worth pointing out that most of them underestimated the impact of the current slowdown. Still, I suspect its weak share price now creates an opportunity. Humanoids are coming – it’s just a question of time.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.

More from Trading Terminal

October 17, 2024

October 17, 2024Humanoids Are Coming And This Overlooked Stock Could Be Their Nvidia

October 16, 2024

October 16, 2024Hurricane Milton Threw A Spotlight Onto Catastrophe Bonds

October 15, 2024

October 15, 2024Intel May Be Too Important To Fail – And Too Cheap To Pass Up

October 11, 2024

October 11, 2024