ASSUME THE POSITION

You might wonder why I maintain a Twitter presence since I have people calling me an idiot all the time. I don’t mind. I block the mean-spirited ones, but the rest are useful information.

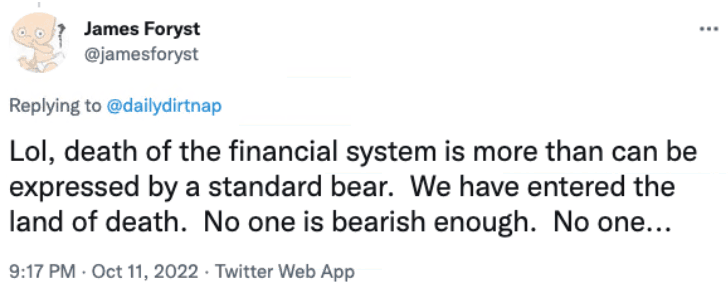

This reply should give you an idea of where sentiment is:

This is a bubble. It is a bubble in bearish sentiment, although we don’t really have a word for that in our vocabulary. A bubble is an excess of bullish sentiment, but what is the word for an excess of bearish sentiment? A bear bubble? The word doesn’t exist. We will have to make one up. Entertaining any candidates.

As I write, the stock market is slightly higher on the idea that PPI was not horrible enough. Not much to hang your hat on. People have been surreptitiously passing me research reports with all sorts of indicators of inflation falling. Out of respect for copyright, I can’t include them here, but it’s the real deal.

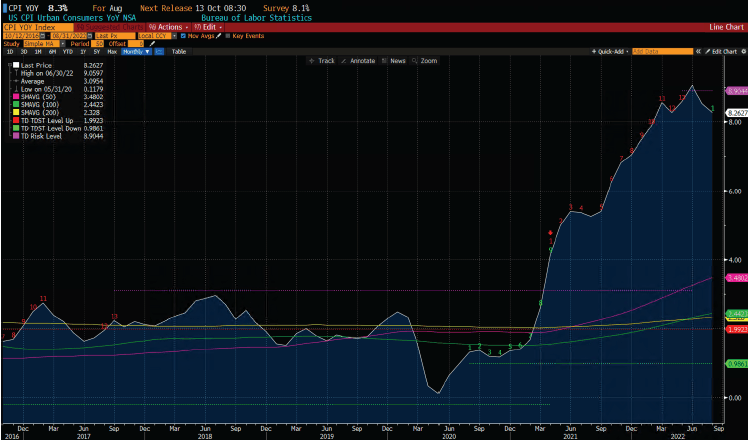

It’s chart time. My methodology is as follows, though you already know it. Wait for sentiment to get to an extreme. Make sure it lines up with the charts. We are there. I’m going to present you with a series of charts so you can see what I’m talking about.

First, a Demark chart of CPI. The next print will be lower. How much, we don’t know.

I know you will have trouble seeing it but that’s a red 13 followed by a green 1 on the setup on the way down.

In the SPX, here’s a red 13 two weeks ago followed by a retest. The stop-out is around 3500. Below there is hell. There is also a MACD divergence, and some of the most powerful setups are when you get the red 13 on Demark with a MACD divergence.

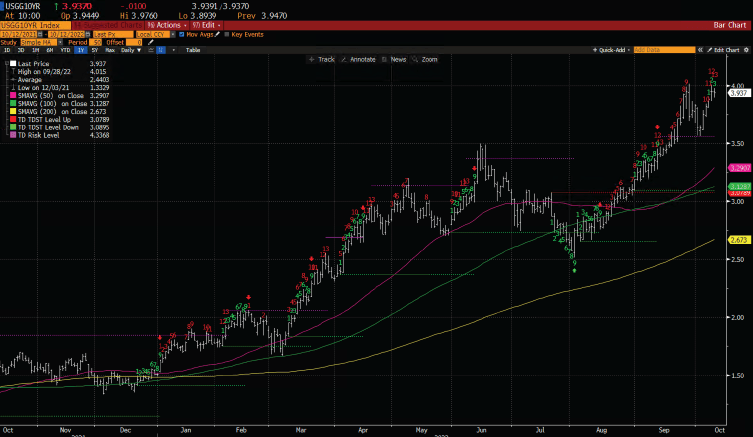

We should check in on the bond market. We’re getting setups there as well. Here’s a chart of 10yr yields with Demark. Red 13 as of yesterday. Waiting for the price flip. Also a MACD divergence.

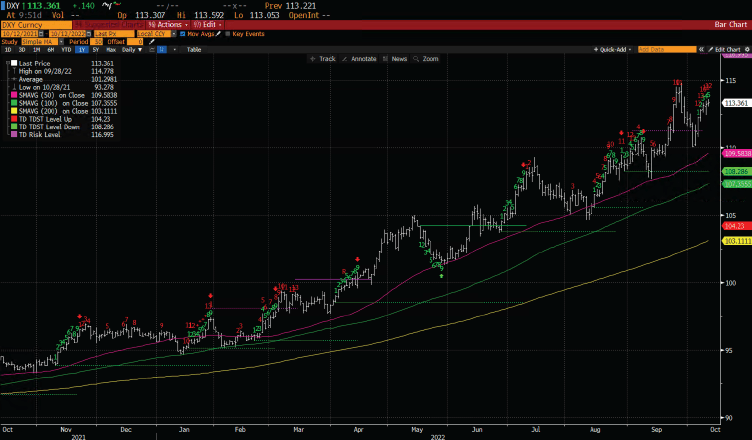

What about the dollar? I’m glad you asked. Red 12 as of yesterday, to go along with two fantastic magazine covers.

I could keep baffling you with BS, but I will cut it short there.

Now, these charts aren’t foolproof. It is possible that they will all fail. And if they fail, it will give us a signal—being short will work for a

while, probably at least another month. But it’s kind of an interesting coincidence that all these charts and sentiment are lining up right for a CPI report. It always seems to work out that way.

Something I tweeted yesterday:

There are situations where the herd is right, for sure. Usually in FX, because there are natural flows on the other side. Not in stocks. Maybe we need to see capitulation. Maybe we are already there. Maybe we need another 17% faceripping rally to restore technical

health to the market. Maybe this is actually the bottom. Maybe it’s not. My job is to point out the extremes in charts and sentiment. I gave you the information. You can do whatever you want with it.

You may think it hinges on the CPI print—probably not, actually. In my experience, when things are this onesided, even if you have a bad outcome, the market rallies anyway. Shorts have to cover.

The constant feedback that I keep getting is that we haven’t taken “enough” pain, whatever that means. I assure you that we have already taken a lot of pain. Stocks aren’t down 57%, but unlike 2008, there is a lot of pain in the rates markets, which really are on the brink. I would say that there is at least as much pain as 2011, when the European debt crisis threatened to blow up the world, and then it was resolved, deus ex machina-style by Draghi. Is there such a solution this time around? Absolutely there is: one comment out of Powell that turns everything around. I get the bear case, but the bear case is always most compelling on the lows. A single word can send markets higher. Better grow eyes in the back of your head.

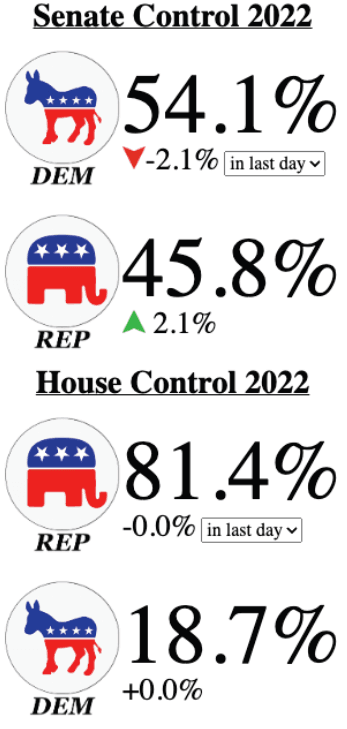

Election Betting Odds

The latest from electionbettingodds.com:

I actually haven’t been following this very closely, but it looks like Oz has a decent shot in Pennsylvania, owing to Fetterman’s stroke difficulties. Looks like Herschel Walker is at a dead end, but you never know.

If you’re wondering why you haven’theard much about this in recent weeks, it’s because more gridlock is the most likely outcome. If anyone thought thatthe House had a reasonable chance to fall into Democratic hands, then you’d see a lot more freaking out about this.

The word nothingburger comes to mind. Immediately after this is over, people will start speculating about 2024, and I noticed that Gavin Newsom has gone from about one percent to 4.5 percent in the betting odds. I told you so.

The Reason I am in Atlanta

So the main purpose of going to Atlantais to get two more tattoos. My favorite tattoo artist, Desiree Mancia, is closing up shop and moving toPennsylvania. I wanted to catch her before she leaves.

I’m getting “stuvwxy” tattooed on some open space at my right arm...for my cats. I’m also getting a silhouetted black cat tattooed on my back in honorof my cat Otto, who passed away in 2014. Yes, I am getting cat tattoos. I’ll take a picture and show you.

But it will be great to meet up with TDD subscribers. Again, if you’re in the area, I’ll be in the bar at the Four Seasons at 5pm on Friday, after completing a six-hour drive. I plan to take the Corvette.

See you there.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.