Trading Loss, Fed's Rate Hike, and Market Sell Off

Dear Traders,

Today, I unfortunately suffered another big trading loss while also missing the Open. Thor and Brian had some amazing trades at the Open, with shorts on 3M and Coinbase, but since I missed about 30 minutes of the Open, my trading day went really bad. You can watch our recap here.

Two important announcements before I make a point about the Fed. One is that we are holding a half-day seminar outside LA on August 20. Brian, Ardi, Mike, Megan, and I will be heading up the presentations. You can RSVP here.

Second, I am presenting this Thursday at the MoneyShow Virtual Expo. My topic is on trading in a bear market. I would appreciate it if you all can support my presentation by signing up here.

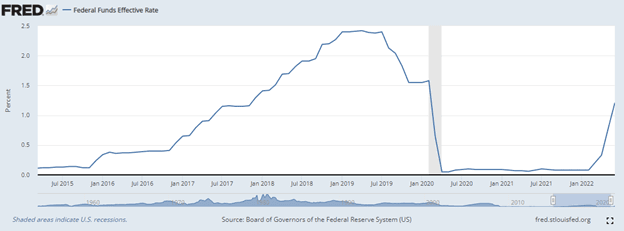

This week, the Federal Reserve, the US central banking system, is increasing the interest rate, and most traders have priced in a 0.75% increase. This will bring the Fed's effective rate to 2.5%, which is the level it was at in 2019 before the pandemic hit. Some people have asked me why increasing the rate causes the market to drop.

The answer to this question is really twofold. Yes, the higher the interest rate, the more the impact on future discounted cash flow, valuations of companies and their future revenue, and so on (and especially with technology companies). But the real reason is: Who cares if the Fed’s rate is at 2.5% or 1.75% or 5.5%? During the dot-com bubble, the Fed’s effective rate was 5.5%, yet we still saw some unbelievable runs. During the 2004 housing bull market, the Fed increased the rate aggressively from 1% in June 2004 to 5.5% in December 2006, yet we still saw housing prices skyrocketing.

The real answer relates back to the confidence that investors have in the financial markets. At the moment, inflation is out of control and obviously not transitory. The Fed has clearly stated that they will do everything they can to bring down inflation, even if that means risking the growth of the economy and taking the US into a recession. They just don't want it to become a depression.

Business cycles are part of the fundamentals of capitalism. Under a capitalist system, it is impossible to have consistent growth. The economy has to go through cycles of boom and bust. Usually, approximately every 5 to 10 years, a period of prosperity and growth is followed by a period of contraction that causes some businesses to shut down and some people to lose their jobs. This is then followed by another period of growth. This quite simply is the fundamentals of capitalism.

What surprised me, as a relatively young investor, is that I didn't think that business cycles, which have usually been 5 to 10 years in length, could become so short. After the boom of 2020 and 2021, no one really expected that 2022 (and most likely 2023) would be a time of recession. The difference is only 1 to 2 years. The reason for this is something that most people didn't think about, and that is inflation. The US economy has never before seen such out of control inflation and that has caused business cycles to become shorter in length than usual. If inflation does not come down, then the US economy will have to go into a deeper recession, businesses will go belly up, and people will lose their jobs, until the Fed starts eating again.

Based on this, no investor wants to take on any risk at the moment. It is not about interest rates as much as it is about losing confidence in the markets. Reports have shown that an astonishing level of assets on Wall Street are now in cash, instead of in bonds, stocks, or other asset class. The figure is 35%! And that is something that has never before happened. It means that until inflation comes down and there is a path to growth once again, investors are preferring cash over any other asset class.

To your success,

Andrew

PS: Although it is still in a beta version, you can visit tradingterminal.com to do research on stocks you're interested in. While we have not perfected it completely yet, it is a great place to not only research stocks, but also crypto and forex, as well as catch up on the latest news. There’s even an earnings calendar to assist you in making trading decisions.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.