Netflix: Your Three-Minute Analysis Ahead Of Earnings

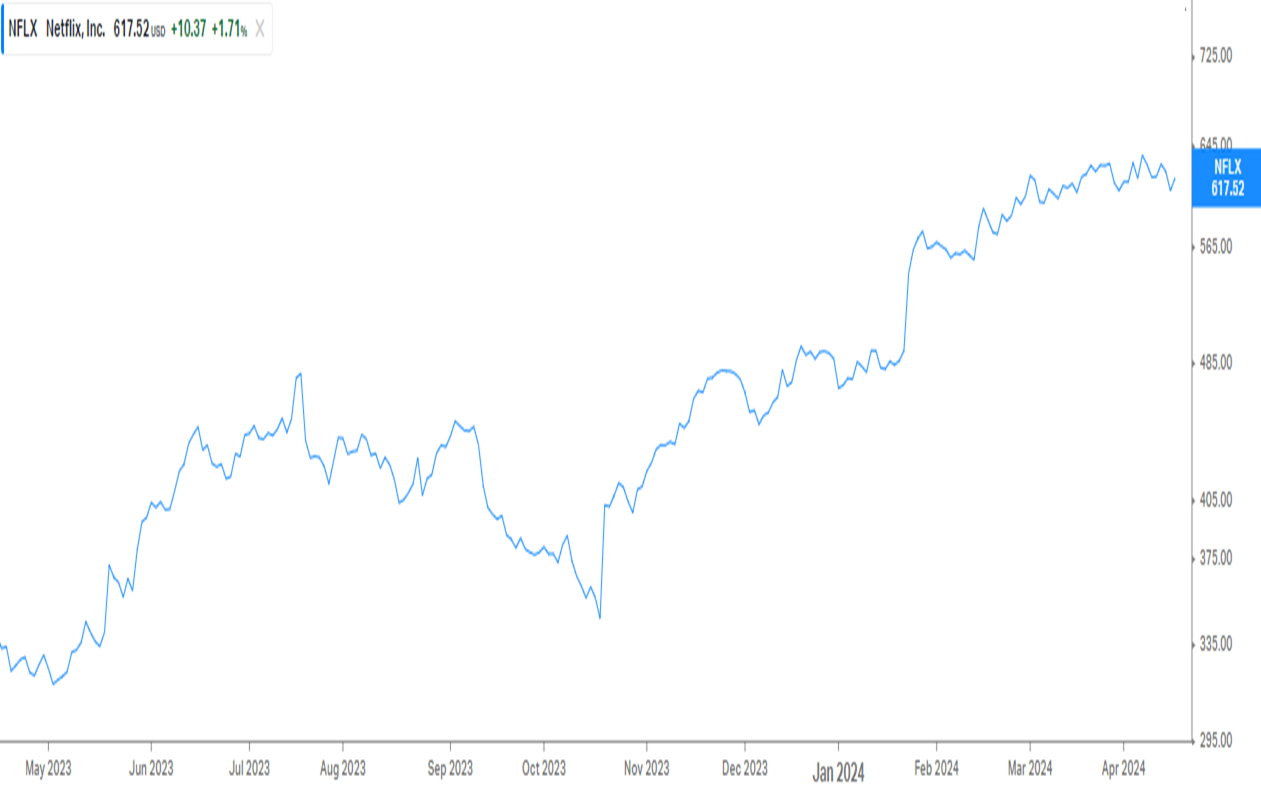

Investors have been binging on Netflix stock this year – so there’s been a suspenseful buildup ahead of the streamer’s latest earnings update, which is set for release after the market’s close on Thursday. Here’s what to watch when that quarterly update is released and a closer look at the stock – courtesy of the markets tab in your Finimize app.

First, what to watch.

Netflix has an all-star cast of reasons to tune into its quarterly results. The streamer has been winning a ton of new subscribers lately – thanks to a password-sharing crackdown that has forced freeloaders to get their own accounts. And its new advertising efforts are reportedly bringing in a healthy flow of fresh money, including via a partnership deal with Expedia. What’s more, the company is also beginning an expansion into live sports, which could bring in even more cash.

But every good drama needs an antagonist and Netflix’s is the already high expectations for its earnings release. Investors like to see their stocks outdistance the forecasts – and that won’t be easy for Netflix. Analysts broadly estimate that the firm will report revenues of about $9.3 billion and earnings per share (EPS) of $4.54.

But a key point to watch is subscriber numbers. Goldman Sachs is forecasting an increase of 7 million new customers for the quarter and Morgan Stanley expects 7.5 million, so anything above those figures will be the feel-good hit of the season for investors. Anything below 7 million, however, will be seen as a flop.

Advertising margins are also on the watch list, and the company has said it expects to see them above 50%, which is impressive. But for now, this segment is still just a bit player in its overall revenue and profits, so it’s not likely to be a major mover.

Next, a markets tab view of the stock.

Value check: Is Netflix cheap or expensive?

The Finimize markets tab summarizes a stock across four separate categories. The first is value: it tells you whether the stock is cheap or expensive. Netflix trades at an enterprise-value-to-sales (EV/sales) ratio – which compares its worth against the past year of sales – of 7.2x, considerably higher than the median S&P 500 stock, which sits at 4x. And with a forward price-to-earnings (P/E) ratio of 34x, Netflix is also well higher than the index’s median 20x.

So its valuation multiples appear pretty rich, but those premium levels might be justified. Let’s dig a little deeper, starting with a quick look at its stock.

Quality check: Does Netflix have strong fundamentals?

Netflix has posted annual sales growth of 16% over the past five years – a hefty amount when you compare it to the market’s 7%. And it’s maintained an operating margin (that is, the amount it makes relative to sales) of 20.6% – comfortably higher than the market’s 18.4%. Its return on invested capital – which measures a company’s use of investor money – stands at 16.5%, which is also a fair bit loftier than the market’s 12.1%.

So the answer would seem to be yes: Netflix’s high growth, margins, and returns do help justify those higher multiples.

Risk check: How risky is Netflix?

Netflix’s “beta” is 1.5 – so the stock generally moves 50% more than the overall index – and that’s quite high. And its volatility sits at 32%, versus the market’s median of 25%.

It does have a small amount of net debt on its balance sheet, but it’s at a modest level, so not overly worrisome.

So it’s clear that Netflix is a high-growth company, and that its shares are high beta and volatile. And because of that, its share price is bound to see sharp and fast moves.

Sentiment check: What do investors think about Netflix?

Most (but not all) analysts rate Netflix as a buy. Its share price is trading marginally above its 50-day moving average, which is positive – it suggests the stock has upward momentum. That said, high valuations can make some analysts cautious. After all, the higher it is, the further it can fall.