Market Pulse: Market Breadth and Inflation

Hello Traders,

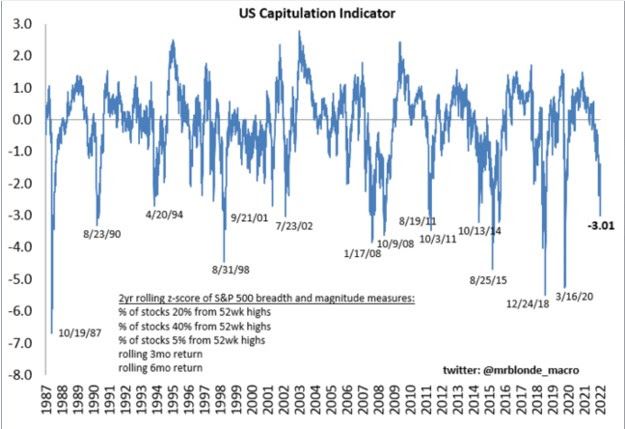

Welcome to this week’s newsletter. The market is now in a rally mode after one of the worst weeks in history. This short-term rally could have been expected as market internals were demonstrating an oversold condition. This incredible chart by MrBlonde shows precisely what we experienced last week – three standard deviations away from the mean – and that signals an extremely oversold condition.

The Big Picture

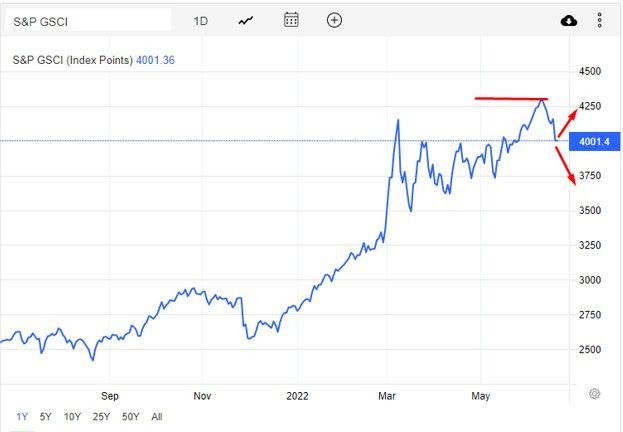

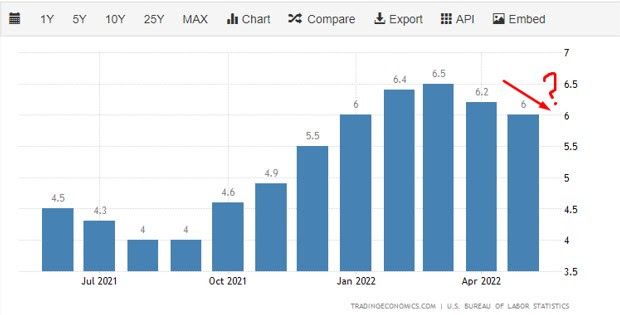

The markets remain choppy and thus hard to predict. Two significant worries on the minds of investors and traders are inflation and growth. Last week, I discussed how growth would impact SPX, and this week I would like to share with you some findings on inflation. Firstly, all the talk about a recession has led to a decline in commodity prices. From oil to copper, all major commodities are well below their 52-week highs.

Secondly, the inventory buildup for many retailers such as Target and Walmart will act as a deflationary force. Based on the data we have so far, it seems to me that core inflation might be on its way down.

Option Trades for the Week

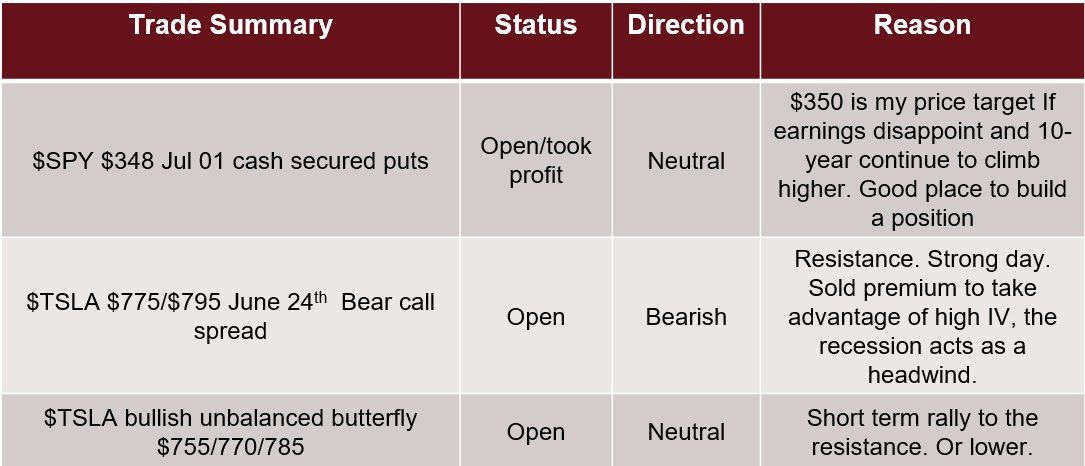

It’s a shorter trading week and my bias for this week is mostly choppy and bullish due to the oversold conditions in the market. I’m currently in three trades involving SPY and Tesla. I have a bullish unbalanced butterfly on Tesla plus the puts I sold on SPY.

As the week progresses, I might look into taking a long position in 10-year Treasuries. If inflation is in fact peaking, this could be good news for longer duration assets such as 10-year Treasuries and some of the beaten down growth stocks. I have not pulled a trigger on this trade yet as I’m waiting for more data and a better risk to reward. I will also use some leveraged bond products for a short-term trade such as on $TYD or $TMF.

My trade log as of today follows along with some comments regarding my reasoning:

Tweet of the Week

My tweet of the week goes to Jared Dillian, an ex-Lehman trader and macro-focused person. In response to a question on whether people prefer more returns or less drawdowns, he replied:

Everyone is talking about amazing returns, but amazing returns mean having the stomach to accept drawdowns. No reward in the market is without risk. Most people argue that they want high returns, but what they really want are minimal drawdowns.

One Last Thing: The Best Trade of the Decade?

Over the weekend, I wrote a piece on my blog about what could be the best trade of the next few years. If you have some time today, feel free to check out this piece HERE!

To your success,

Ardi

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.