Dear Traders,

Today’s focus on the trading front was Amazon and Apple…and they did not disappoint! We had an amazing and profitable trading day in the community. I personally had one of my most exceptional days trading this year. You can watch the recap that Brian and I posted here.

Last night, we had a very informative talk with former Lehman Brothers head of ETF trading, Jared Dillian, and we also saw some nice moves on Amazon and Apple’s earnings. Amazon went up over 14% following the company’s better-than-expected revenue and strong guidance. Investors were concerned about slowdowns in advertising revenue and retail spending, as well as rising costs from other companies in its space. However, despite those headwinds, Amazon’s core businesses appeared to hold up better than many expected, giving the stock room to run to the upside today.

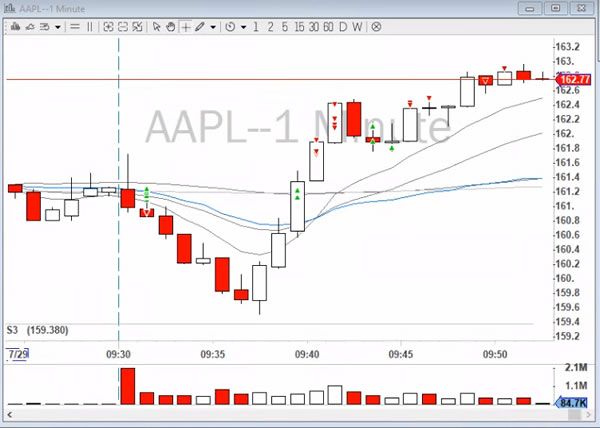

Apple beat revenue and profit expectations but showed slowing growth overall. The stock was up about 3% after hours and traded higher today. The slowdown was largely expected given the earnings and guidance news from chipmakers and other smartphone/PC makers. Additionally, although cost pressures remain high, the company’s gross margin exceeded the 42%-43% range it outlined earlier in the year (43.26% actual). Apple did not give formal guidance for its upcoming quarter but expects revenue to accelerate despite some pockets of softness.

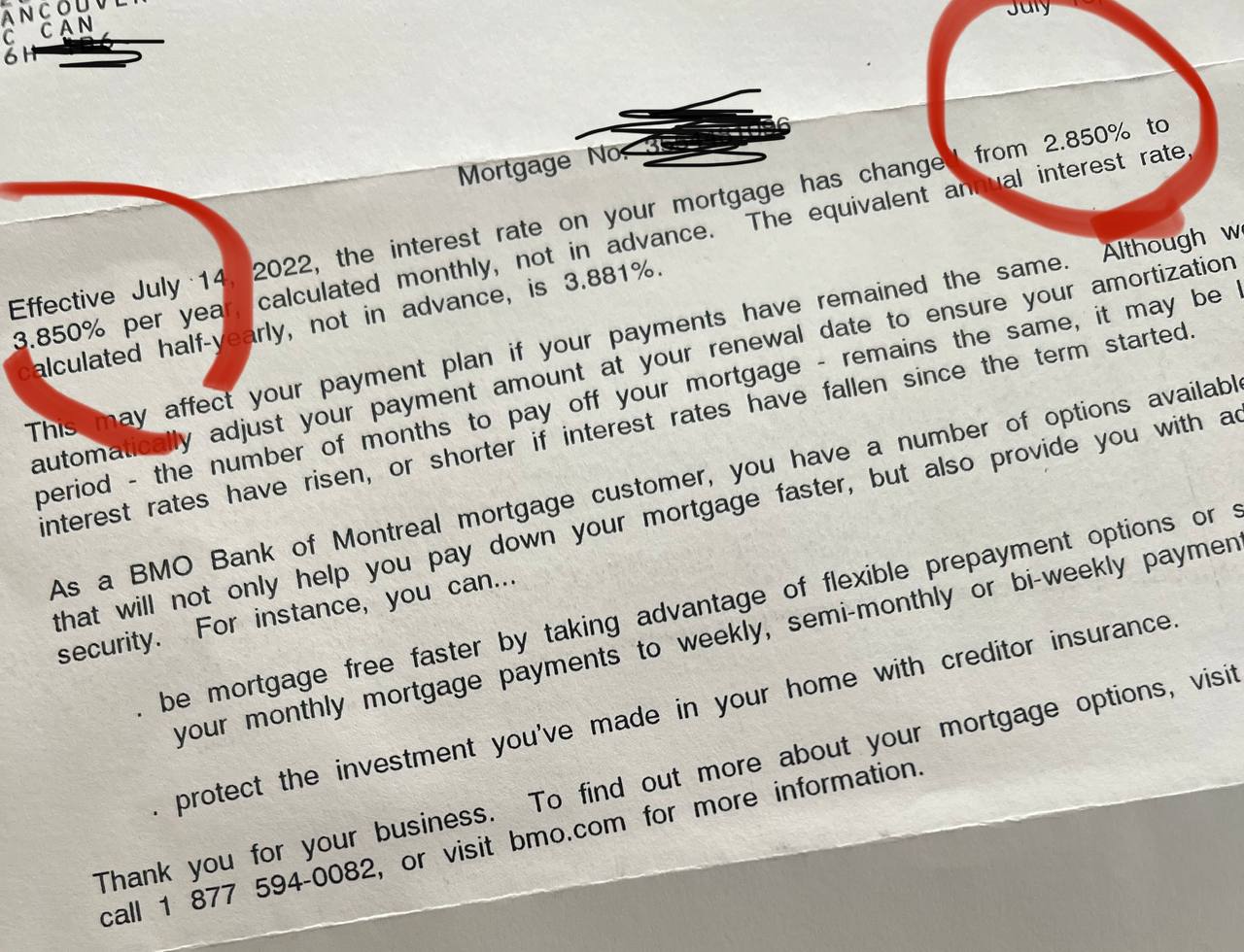

Last night, I received an email from my bank that the interest rate on the mortgage I have on one of my properties is now up to 3.85% from the previous 2.85%. That means my payments are going higher. That worries me. What will be the next step for the Bank of Canada and also the US Federal Reserve? Yet another interest rate hike? Will I have to pay even more on my mortgages?

Do central banks around the world need to be even more aggressive?

The answer is in the biggest asset class market: the bond market. While we are all crazy about the stock market, the bond market is actually the largest market. So, what do we see there? As Ardi always talks about on our show, the bond market is more sensitive toward interest rates than the stock market is. Looking at what the bond market is doing, it seems they are affirming that we are nearing the peak of both inflation and the Fed’s aggressive tightening. Global bonds are set for their best monthly gain since 2020, bouncing back from a record slump in the first half of 2022. The bond market rally shows that the Fed will be able to get cost pressures under control and stop such aggressive tightening.

All around the world, bond investors are very confident that inflation will be coming down sometime soon, and that will allow the Fed and other major central banks to ease off on the pace of tightening.

What do you think? When do you believe we will hit the peak of inflation? I sense it will be December 2022 or January 2023. Please let me know your opinion by replying to this email.

To your success,

Andrew

PS1: If you have not already, I encourage you to try out our free web-based trading simulator at stocktradingsimulator.com. It’s conveniently available 24/7, whenever you have time to practice honing your trading skills.

PS2: Although it is still in a beta version, you can visit tradingterminal.com to do research on stocks you're interested in. While we have not perfected it completely yet, it is a great place to not only research stocks, but also crypto and forex, as well as catch up on the latest news. There’s even an earnings calendar to assist you in making trading decisions.

Disclaimer: The content and materials available on this site are not intended to serve as financial, investment, trading, or any other form of advice or recommendation from Trading Terminal.