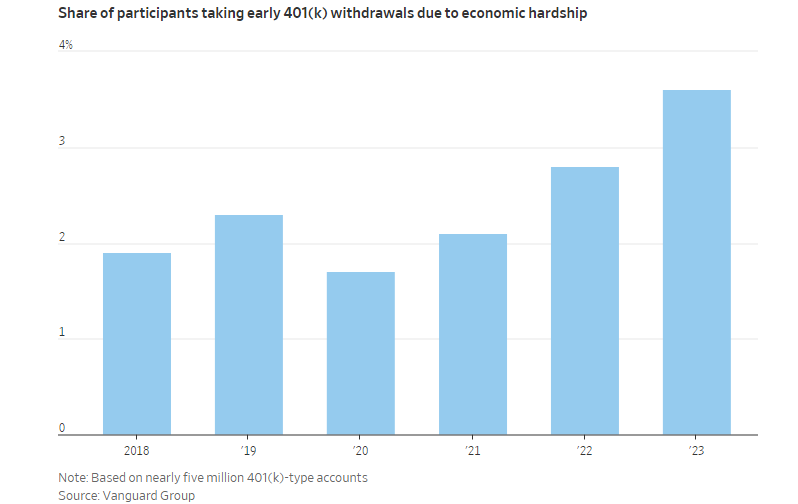

Americans Are Plundering Their Retirement Savings In Record Numbers – Long Before It’s Time

Typically, people use retirement accounts – like America’s 401(k) – to lock away their savings until later in life. But more and more people have been bypassing those locks. Last year, a record share of 401(k) holders dipped into their funds early – despite the taxes and penalties they’d face from such a move.

That could mean two things.

On the upside, it suggests that the strong stock market has plumped up these accounts so much that folks feel okay pulling out some cash. That’s what happens when investors experience the “wealth effect”: that is, when soaring asset values – in, say, stocks or real estate – make people feel richer and more comfortable spending.

On the flip side, though, it suggests that rising costs are cutting deeper into people’s bottom lines. Let’s face it, the fact that more people than ever are willing to tap into their future savings for immediate relief – and suffer the tax hits and penalties for early withdrawal – shows how unmanageably tight things have become for some. And that notion is certainly consistent with the recent surge in credit card defaults among the country’s less well-off.

While the US economy continues to look solid and consumer spending remains strong, there are clear signs of stress brewing beneath the surface. It may be contained for now, but it could build and spread to more areas, so keep your eyes peeled.